IN THIS PAPER

A changing landscape of multi-manager strategies for illiquid and liquid alternative investment. Recent years have seen a transformation in the variety of multi-manager or fund-of-fund (FoF) strategies available to investors. Notable shifts include a move from commingled to highly customised strategies, the emergence of ‘multi-asset private markets’ and a proliferation of in-house (or ‘umbrella’) fund-of-funds. The types of firm offering these products have also changed, with asset management firms becoming increasingly diverse while investment consultants have launched vehicles of their own.

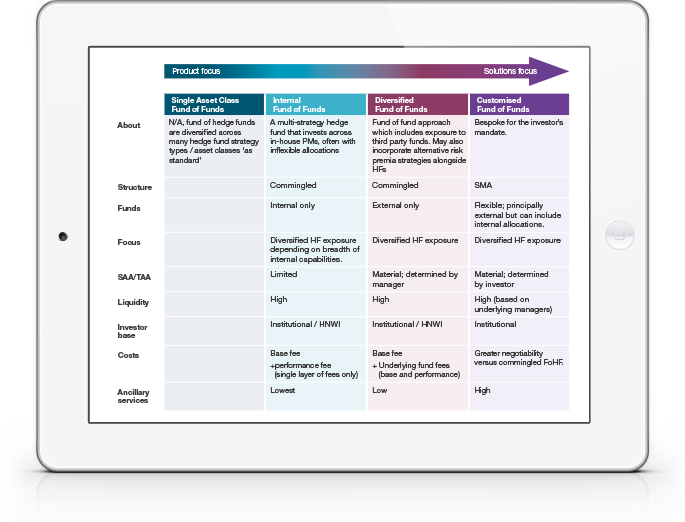

Identifying four multi-manager fund types. The universe of options can be roughly categorised into four groups, each with distinct advantages and drawbacks: the single asset class FoF, the diversified FoF, the customised FoF and the internal FoF.

Challenges in multi-manager investing. Investors in this area must tackle complexity, cost, conflicts of interest and the difficulty of identifying appropriate partners. The report closes with a selection of case studies showing how real-life institutional investors have approached this space.

WHY DOWNLOAD?

Investors now seek exposure to an increasingly long list of non-traditional asset classes, sectors and geographies. The investor base for alternative investment strategies is also evolving: a more diverse roster of institutional and non-institutional clients with different needs are now seeking access to illiquid and/or liquid alternative asset classes.

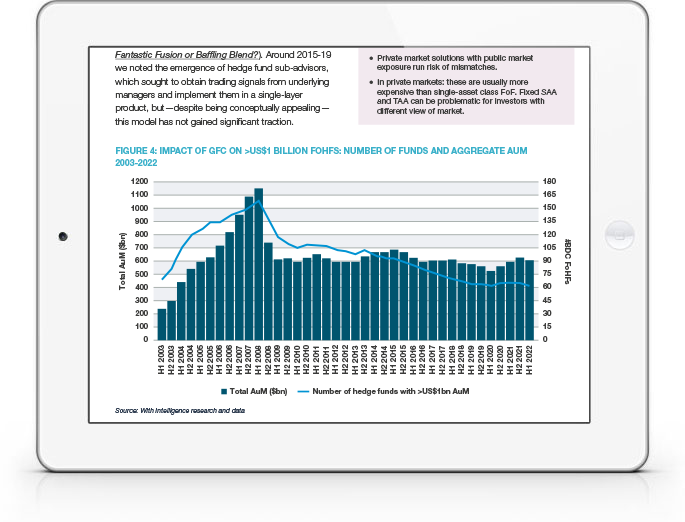

Within this climate, multi-manager strategies—using external funds, internal funds, direct/co-investments or a combination of all of the above—are more popular than ever before. The path has not been a smooth one. So-called ‘fund of fund’ (FoF) or multi-manager strategies in sectors such as hedge funds and private equity fell out of fashion dramatically in 2008, with weak performance, risk management problems and liquidity issues provoking dissatisfaction and outflows. Yet the FoF model has survived and evolved.

We hope that this overview helps investors that are implementing alternative investment portfolios within their own organisations. More broadly, we encourage investors to undertake routine re-evaluation of their operating model for investment outsourcing, including the appropriateness of direct versus fund versus multi-manager investing across single or multiple asset classes. Conclusions of these reviews may change as both the investor and the industry/products evolve.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  French (Canada)

French (Canada)