IN THIS PAPER

Different ‘sustainable’ infrastructure investment approaches: An examination of ‘Transition,’ ‘Thematic’ and ‘Solutions’ asset types.

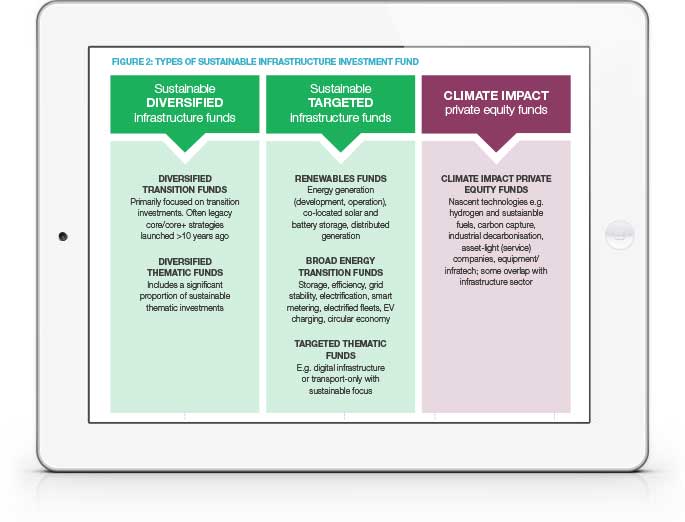

What are the main categories of sustainable infrastructure strategy available now? More than 100 funds are currently in the market for capital, spanning both diversified and targeted offerings. This figure does not include climate impact private equity funds: the lines between infrastructure and private equity are increasingly blurred.

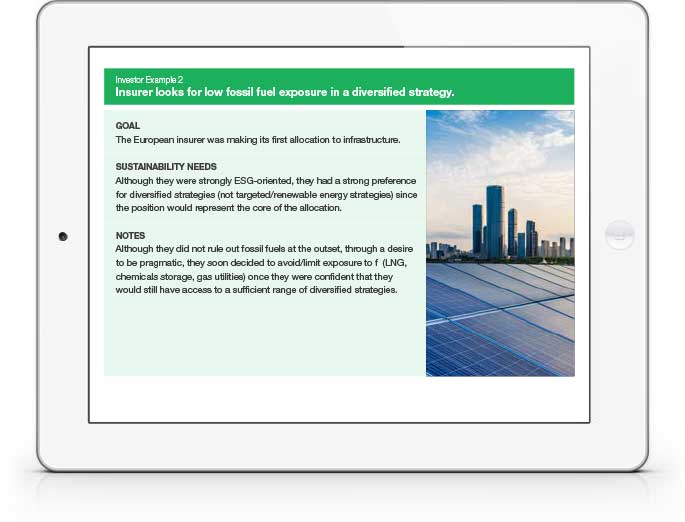

What should investors look out for? Asset owners’ very different needs and approaches to this asset class are illustrated in a sequence of four case studies. Not all sustainable strategies are created equal: fund managers are taking very different approaches on biodiversity, climate risk, community engagement, carbon/impact reporting and supply chain management.

WHY DOWNLOAD?

Infrastructure has long been an area of focus for sustainability-minded investors due, in part, to the explicit role of renewable energy production and associated infrastructure in the transition. Today, investors can approach ‘sustainability’ in this asset class in a variety of different ways that extend well beyond one sector. We can also access a plethora of funds and strategies—many of them new—that take different approaches to the subject.

Yet how should investors evaluate the different approaches to the subject of sustainability in this asset class, and how credible are the available offerings? A strong clean energy focus should not, in itself, give an asset manager a ‘free pass’ on ESG or impact. Indeed, broader ESG factors are particularly material in this asset class, with its long-term investment horizons and the significant environmental damage associated with the construction and management of infrastructure assets. Meanwhile, we would encourage investors not to disengage too readily from essential infrastructure and services that involve high emissions in the near term.

This implementation-focused overview of sectors and strategy types is designed to support institutional investors in navigating a rapidly evolving asset class.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  French (Canada)

French (Canada)