IN THIS PAPER

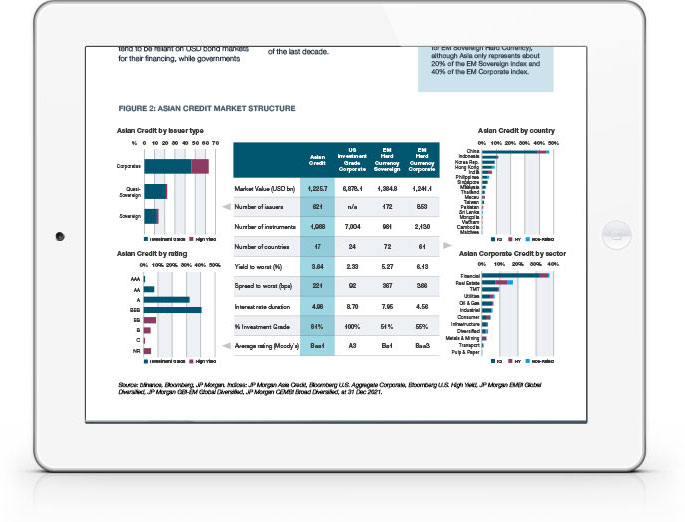

Market overview: Key facts and figures on market structure, composition, risk/return history, correlation and a review of the three key factors contributing to a positive spread differential.

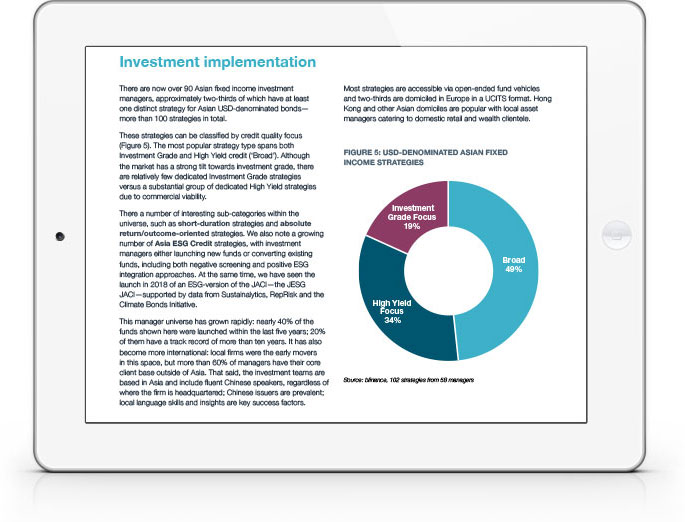

Investment implementation: A closer look at the 100+ Asian USD bond strategies available now with a focus on strategy type, return objectives, ESG integration and more.

Manager performance: Strategies have historically outperformed benchmarks, particularly in up-markets, but there are notable challenges that investors face when examining track records in this sector.

WHY DOWNLOAD?

With fixed income investors now looking towards ongoing rises in interest rates, Asian USD bonds are drawing focus. The asset class has provided slightly lower returns than EM sovereign debt, but much lower volatility over three, five and ten years, producing an outstanding Sharpe Ratio of 1.0–1.2.

There are now more than 100 active strategies, nearly 40% of which have been launched within the last five years. While many of the earliest strategies were established by regional firms, recent years have seen an increasingly large proportion of international managers—with predominantly non-Asian clients—joining the fray via local investment teams.

This brief paper—part of our educational ‘Sector in Brief’ series—is intended to support investors that seek a rapid overview of the asset class, with a market summary followed by manager research considerations.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (Canada)

English (Canada)  French (Canada)

French (Canada)