IN THIS PAPER

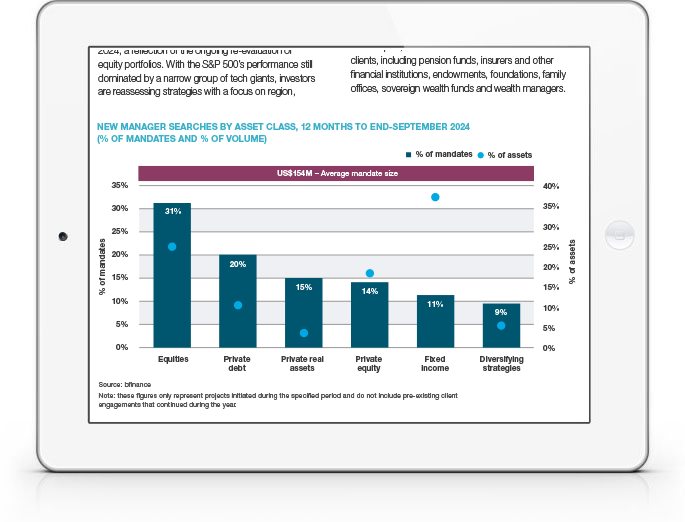

We note a sustained increase in equity manager search activity, which accounted for 31% of all new mandates over the 12 months to September 2024, up from 21% and 14% in the two preceding years. This uptick reflects strategic re-evaluations by investors who are seeking to improve diversification across regions, styles, and market caps in light of heightened market concentration.

Active equity managers saw their relative returns improve in the altered market conditions of Q3: 50% of Developed Markets active manager outperformed their benchmarks net of fees in the third quarter, thanks to a shift in style drivers. Active equity managers have struggled to deliver excess returns through a period when an exceptionally narrow group of (large technology) stocks have dominated market performance.

In contrast, active fixed income managers have delivered strong relative returns over the past five years; US Investment Grade managers, for example, delivered outperformed by 40bps net of fees over the five-year period, and Euro Investment Grade managers outperformed by 30bps net of fees.

Fixed income manager search activity among bfinance clients has reverted to normal levels through the course of 2024, after a spike in Investment Grade mandates (corporate, sovereign and both) in 2023. That being said, recent months have brought a modest resurgence in Emerging Market Debt search activity, with investors alert to spread compression in other credit markets and seeking a measured approach.

WHY DOWNLOAD?

Each quarter, bfinance publishes information on investor activity, key market trends and manager performance. A quarterly snapshot of the key developments within equity, fixed income and alternative investments, including analysis of which asset manager groups performed well and which didn't.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (Canada)

English (Canada)  French (Canada)

French (Canada)