IN THIS PAPER

Revisiting the sector. LRA as a sector has evolved significantly in recent years and, as the time has gone by, the market has expanded to provide greater opportunities in emerging and non-core sectors, as well as ‘green’ strategies and Shariah-compliant REITs, to name a few developments.

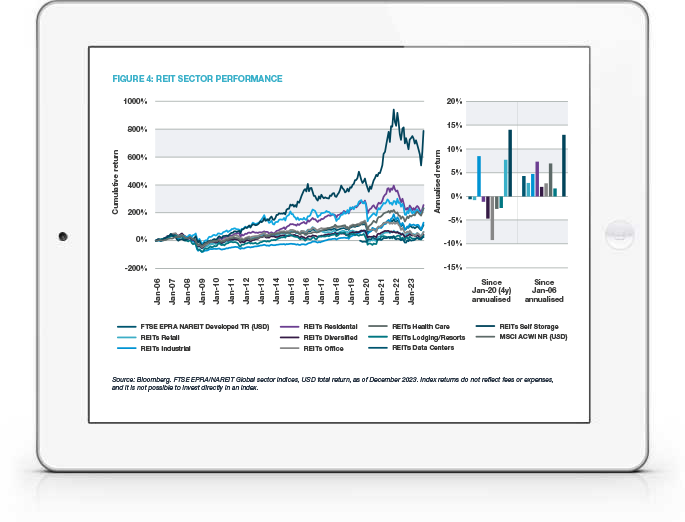

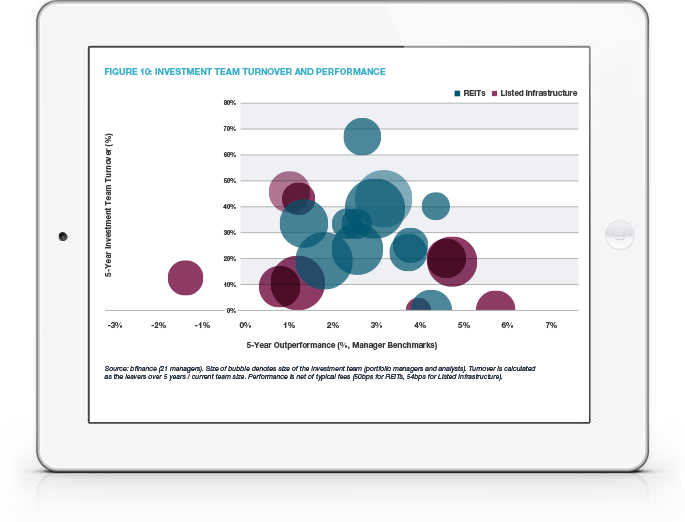

Assessing performance. Despite the poor returns for LRA in 2022-3 overall, closer examination reveals a more nuanced picture, there have been pockets of very strong performance in particular sectors and geographies, which has contributed towards high manager performance dispersion.

Incorporating LRA in a portfolio. While the results of the past few years may well affect the case for including LRA in portfolios, we still observe strong arguments in favour of doing so. For example, for investors that prioritise liquidity, LRA offers an opportunity to gain exposure to some fundamental characteristics of the underlying asset classes.

WHY DOWNLOAD?

The past decade has seen remarkable developments in the LRA sector: listed infrastructure strategies caught hold (as did debates regarding their validity); hybrid Listed Real Asset products appeared, bringing REITS and Listed Infrastructure together (with several more recent launches even including energy/commodity/natural resource exposure); funds blending private and public real assets in one vehicle have also become more prominent.

Indeed, investor demand for liquid or semi-liquid access to ‘real assets’ has arguably never been higher, whether this is expressed through LRA, open-end funds or other relevant approaches. Appetite has been supported by the growth of the Defined Contribution and Wealth sectors, for whom continual flexibility on inflows and outflows is often required.

At this interesting juncture, it may be useful to consider: what are the main reasons for incorporating listed real assets in portfolios, and do they still hold? Which subsectors have driven recent poor performance, and which have done well? Why have active managers been able to outperform benchmarks over the past three years? This report seeks to address timely questions with up-to-date analysis.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (Canada)

English (Canada)  French (Canada)

French (Canada)