bfinance insight from:

Kathryn Saklatvala

Senior Director, Head of Investment Content

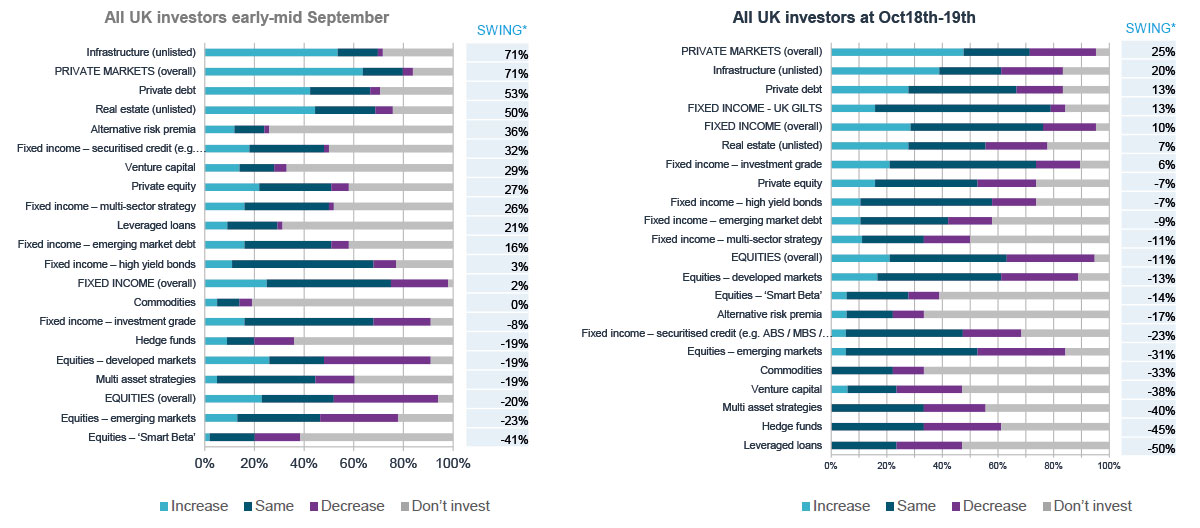

An early survey of UK Asset Owners (pension funds, insurers, endowments and others) is now pointing towards what may be a significant shift in investor appetite for private market and fixed income strategies over the coming year. The findings of the 'snap poll' conducted on October 18-19 contrast with the UK-only results of the bfinance 2022 Global Asset Owner Survey, which was carried out a month prior (from end-August to September 20th 2022); global data will be published in early November.

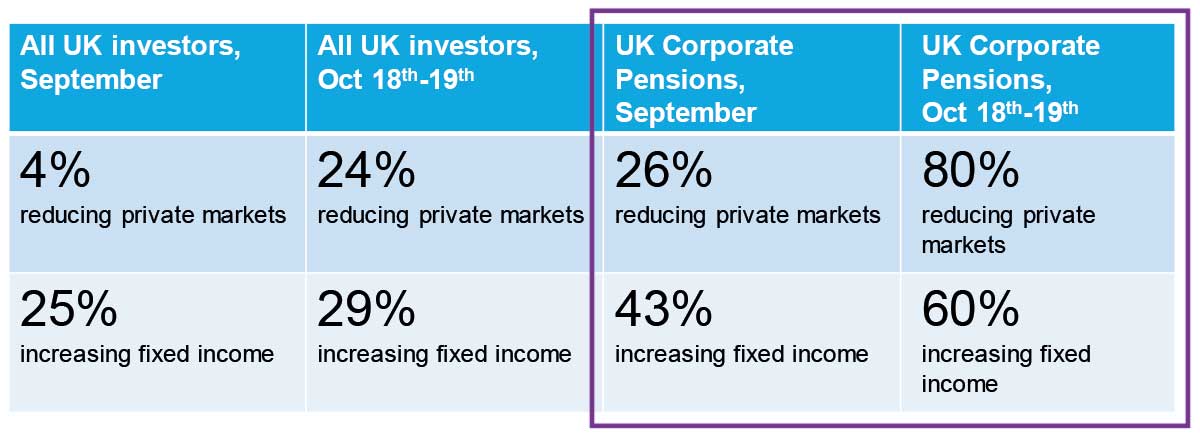

According to the new results, we are still seeing a positive overall trend in favour of boosting exposures to illiquid strategies such as infrastructure and private debt, with nearly half of investors expecting a higher allocation to 'private markets' in real terms over the next 18 months. Yet 24% of UK investor respondents are now planning to decrease their exposures over that period, up from just 4% a month prior.

“How do you think your exposure to these sectors/asset classes may change over the next 18 months? (as a % of the portfolio)”

Source: bfinance investor research; data from 65+ UK asset owners."

UK corporate pension funds, who have been particularly affected by the upheaval in the UK government bond market and heavily selling liquid assets in order to fund margin calls on their hedges, are leading the trend. Here, 80% of respondents expect to cut their exposure to private markets in the next 18 months, up from 26% the previous month. The main asset class beneficiary, sentiment-wise, is likely to be fixed income: 60% of UK corporate pension funds will be increasing exposure (up from 43%), versus 29% of all investors.

“How do you think your exposure to these sectors/asset classes may change over the next 18 months? (as a % of the portfolio)” - selected data

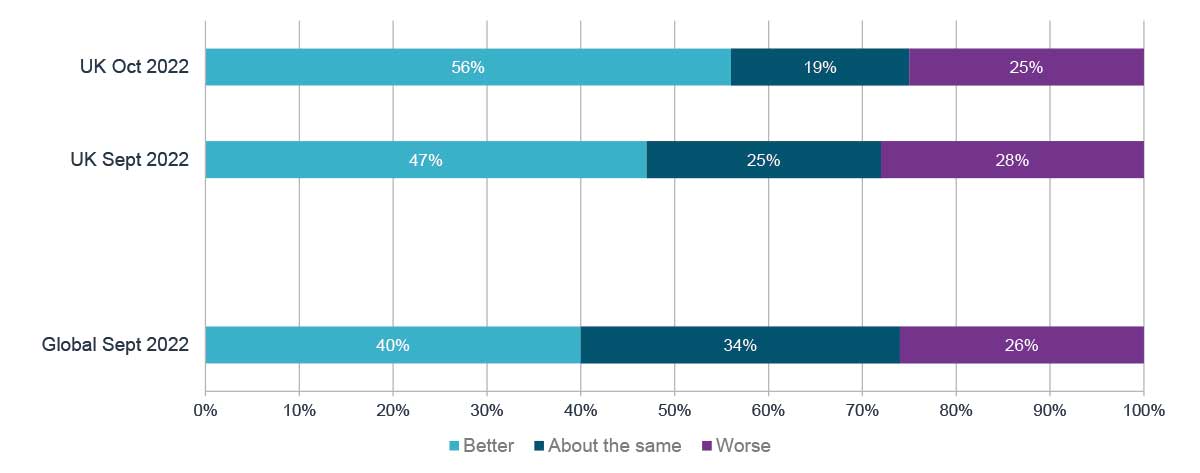

Despite the pain experienced by UK investors during recent turmoil, rising interest rates are benefiting those with pension liabilities - to the extent that more than half of the Asset Owner respondents and 60% of Corporate Pension Funds now say that their overall asset-liability balance has improved since January 2022. Endowments and foundations are more likely to have seen their asset-liability balance become worse, since their liabilities are more likely to be expressed in cash or AuM terms and their stakeholders (universities, charities and others) are likely to have similar-or-greater funding needs in an inflationary environment.

If you are an investor with explicit liabilities: has your overall asset-liability balance (e.g. funding ratio) become better or worse since January 2022?

Finally, the trend in favour of Liability Driven Investing appears to have faded. In September, UK investors provided evidence of an ongoing shift towards LDI approaches over the medium term: 24% of the investors for whom the topic is relevant intended to "move more towards LDI" (68% "keep the same approach" and 8% "move away"). In the October snap poll, not a single investor participant indicated that they were moving towards LDI: "keep the same approach" was the universal response.

This data should be viewed as highly preliminary: the sample size is modest and a lot of UK investors (corporate pension funds in particular) are still weighing the impact of recent events. Upcoming investment committee meetings and board discussions will be required to clarify the next steps. Yet, if these findings are indicative of behaviour, we can expect a meaningful shift in the UK fundraising climate.

The bfinance 2022 Global Asset Owner Survey will be published in early November. To request an advance copy of the report, contact

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (Canada)

English (Canada)  French (Canada)

French (Canada)