IN THIS PAPER

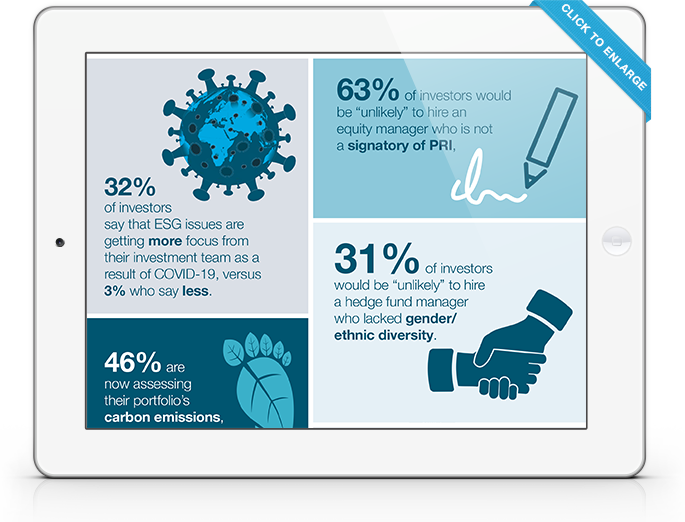

Priorities. Has COVID-19 distracted attention from the ESG agenda or added fuel to it? How have objectives changed? The data reveals a massive increase in the proportion of investors tracking portfolio carbon emissions and the rising popularity of SDG-mapping.

Portfolios. How extensive is ESG integration across different asset classes, ranging from emerging market equities to private debt? Which implementation approaches – negative screening, thematic investing, active engagement and more – are investors using in different parts of the portfolio? In which asset classes do investors expect a correlation between ESG integration and outperformance?

Providers. With investors increasingly saying that ESG issues matter in manager selection, how many have actually terminated managers on the basis of poor ESG characteristics? Which key factors make investors less likely to hire a manager?

WHY DOWNLOAD?

The data presented here, which was collected in December 2020, looks beneath the rhetoric and high-level indicators to showcase the rapid evolution in ESG implementation practices being adopted by investors worldwide.

Three key issues stand out. ‘Impact’ is now in focus, with investors moving towards thinking about ESG in terms of outcomes. ESG is increasingly becoming a total-portfolio subject, with investors seeking to approach the key issues in a way that addresses all asset classes. Thirdly, investors are battling the data challenge – the difficulty of obtaining consistent, standardised ESG information across all asset classes and asset managers – and looking to policy-makers as well as international industry bodies for clearer, globally co-ordinated action.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  French (Canada)

French (Canada)