This paper serves as the fifth instalment of our ‘Liquid Private Markets’ series, and follows the ‘Navigating Potential Pitfalls in “Semi-Liquid” Private Equity’, ‘Rise of the Allocators: Multi-manager Strategies for Alternative Investing', ‘How Do “Liquid” Private Market Strategies Square the Circle?’, and ‘Open-end Infrastructure Withstands Investor Cooldown’ pieces.

bfinance insight from:

Anish Butani

Managing Director, Infrastructure

Ishan Issadeen

Director, Private Markets

Oliver Wade

Associate, Investment Content

The growing appeal of semi-liquid private market vehicles represents a significant shift in how institutional investors approach illiquid asset classes. The concept of infrastructure, with its income-generating characteristics and long-term investment appeal, and open-ended funds is not a new one, as explored in our recent article. What is new, however, is the emergence of evergreen, semi-liquid funds focusing on unlisted infrastructure that are attracting interest from both wealth and institutional investors alike—offering a flexible, income-focused alternative to traditional closed-end funds. While investor demand for these strategies is growing, they come with important structural considerations.

In our latest Q&A, Oliver Wade sat down with Anish Butani, Managing Director, Infrastructure, and Ishan Issadeen, Director, Private Markets, to address some of the more pressing questions that investors are now asking as they explore the role these strategies might play in their portfolios.

Q: How much liquidity is being offered by semi-liquid infrastructure funds?

Liquidity in semi-liquid infrastructure is designed to balance flexibility with the reality of investing in inherently illiquid assets. While most funds offer quarterly redemptions, typically capped at 5% of NAV, the nature of infrastructure means that liquidity provisions must be carefully managed to ensure long-term stability for all investors.

Investors should assess how managers structure their liquidity profile to ensure alignment with their own needs.Managers use a range of tools—including cash buffers, credit facilities, portfolio income, and liquid sleeves (such as listed infrastructure equity or debt)—to support redemptions. The size and composition of these liquidity reserves vary significantly across funds, and investors should assess how managers structure their liquidity profile to ensure alignment with their own needs.

Q: How different are the liquidity terms here compared to institutional open-ended funds?

Compared to closed-ended drawdown funds, institutional open-ended funds and semi-liquid funds are appealing to investors for aiding the speed of deployment. However, there are differences in how that capital is called and redeemed by investors.

While institutional open-ended funds admit investors into their funds via a ‘queuing mechanism’, typically contingent on managers sourcing new investment opportunities that require funding, investors in semi-liquid funds can subscribe on a monthly basis, with capital absorbed by liquid sleeves if there are not any private deals that require the capital.

There are differences in redemption processes, too. As mentioned above, semi-liquid funds typically restrict redemptions to 5% on NAV per quarter and 20% per annum, with liquid sleeves in place to help facilitate redemption requests in a timely manner. Institutional open-ended funds don’t typically have such restrictions in place once lock-up periods have expired, with requests typically satisfied in full by either incoming capital, portfolio company yield, or via divestments. Importantly, the aforementioned queuing mechanism applies here as well with no promise of liquidity but rather a ‘best efforts’ approach from the manager.

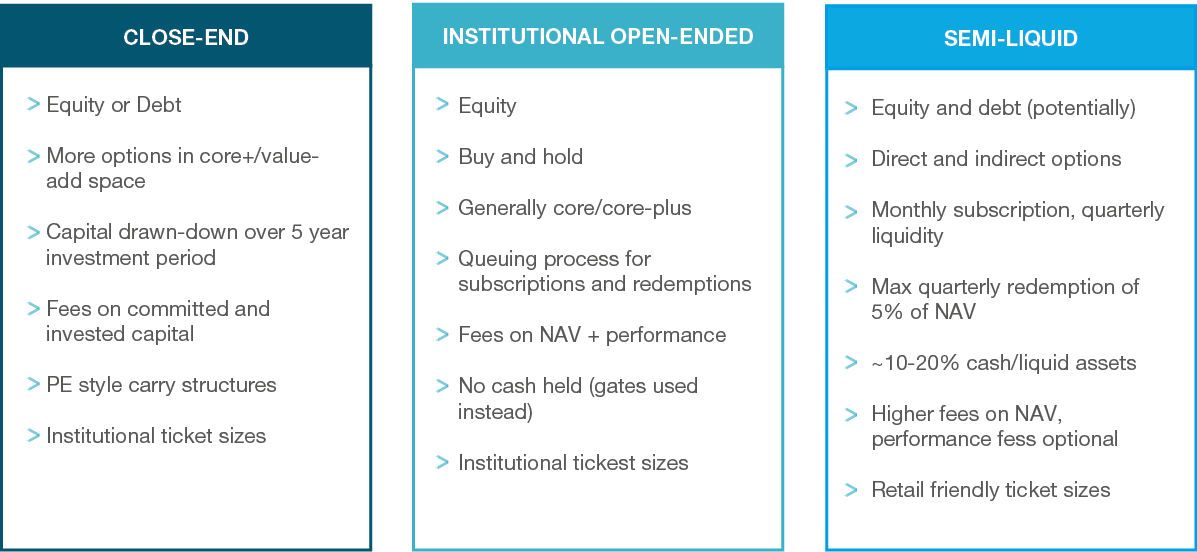

Main access points for infrastructure

Source: bfinance

Q: How diverse is the client base for semi-liquid infrastructure funds?

Interestingly, many newer semi-liquid funds have been built with a focus on wealth and intermediary channels, but we are also aware of institutional investors that are committing to these vehicles, attracted by the speed of deployment. A stable institutional anchor alongside retail flows can provide much-needed balance.

The composition of the client base plays a crucial role in how resilient a semi-liquid infrastructure strategy will be over time. If too much of the capital comes from a single investor type—say, wealth management clients—then you run the risk of correlated redemption behaviour in a downturn, which can be very difficult to manage in an illiquid portfolio.

If too much capital comes from a single investor type—particularly those prone to moving together, like wealth channels—you run the risk of a redemption domino effect in a downturn.Ideally, funds should have a good mix of investors—a blend of pension funds, insurers, wealth managers, family offices, and even DC pension schemes as they typically possess different liquidity requirements, and therefore redemption times vary.

Investors should definitely ask managers about the client mix, and how diversified that client base really is, not just in terms of numbers, but by type, geography, and size of ticket.

Q: How developed is the manager universe for semi-liquid infrastructure—and what does it mean for investors?

While institutional open-ended funds tend to focus on buying and holding core/core-plus assets over the long term, there is a much greater dispersion of strategies amongst semi-liquid funds. While return targets for semi-liquid funds are broadly similar to institutional open-ended funds (~10% net IRR), semi-liquid funds have to contend with the effect of cash-drag on investment returns. As a result, the illiquid portion of these funds need to ‘work-harder’ (take more risk) when combined with lower returning liquid assets.

From a recent evaluation of the semi-liquid infrastructure manager landscape, we identified three types of strategy:

- Direct strategies: typically offered by larger infrastructure managers that can provide investors with ‘one-stop’ access to their platforms, e.g. global value-add, global renewables, global core, high yielding debt, etc.

- Indirect strategies: these are typically provided by multi-managers that are targeting primaries, secondaries and co-investments, with an emphasis on the latter two types of investment.

- Hybrid strategies: where firms have a direct and indirect capability, the semi-liquid strategy is providing access to both types of investments.

While there are clear differences in the types of fund strategy, what they have in common is the emphasis on diversification and the multiple routes available for deploying capital, which is critical given that investors can subscribe on a monthly basis.

Q: What are the key issues in manager selection within the semi-liquid infrastructure space?

Within indirect or hybrid strategies, investors should beware of the potential ‘value-trap’ associated with discounted secondary positions aggressively marked-up to inflate performance. This can be misleading as the true long-term performance may differ from short-term gains.

While diversification is a benefit, there is a risk of over-diversification, making it challenging to monitor the performance of individual investments. The acceptance of monthly inflows could put managers under pressure by testing their ability to deploy capital efficiently.

For larger firms with multiple products that are offering access to transactions across the platform, understanding allocation policies is important. Are semi-liquid funds on equal footing with institutional open and closed-ended funds when it comes to getting access to new deals, or are they given lower priority with deals allocated on an ‘overflow’ basis? Alternatively, could semi-liquid funds introduce an element of style drift by including an allocation to deals outside of the scope of a manager’s institutional funds?

Fees in semi-liquid infrastructure are often higher than what investors might expect in closed-ended funds, and that reflects the added complexity of managing liquidity and ongoing flows. But it’s important to unpack what those fees actually cover.

Investors start paying full fees even if the fund is not yet fully deployed, which can impact early returns.Management fees are usually charged on NAV from day one, unlike closed-ended funds where fees are based on committed capital during the early years. The latter implies that investors start paying full fees even if the fund is not yet fully deployed, which can impact early returns.

Performance fees are another area to watch. Some managers charge performance fees on unrealised gains, and while hurdles are often used, they’re not universal. Investors need to ask whether performance fees are based on realised exits or on paper gains—and whether there’s a high-water mark to protect against paying fees on temporary uplifts.

To conclude, here are five critical questions for investors to ask:

- How much liquidity is being offered by semi-liquid infrastructure funds?

Investors should assess how managers structure liquidity, including cash buffers, credit facilities, portfolio income, and liquid sleeves, to ensure stability during normal and stressed conditions. - How different are the liquidity terms here compared to institutional open-ended funds?

Compare subscription and redemption processes, such as monthly subscriptions versus queuing mechanisms, and understand how semi-liquid funds manage liquidity differently from institutional open-ended funds. - How diverse is the client base for semi-liquid infrastructure funds?

A well-balanced mix of institutional and wealth clients helps mitigate redemption risks, particularly during market stress. Diversification by client type and geography is crucial. - How developed is the manager universe for semi-liquid infrastructure—and what does it mean for investors?

The space is evolving rapidly, with varied strategies and manager experience. Assess whether the manager is a long-established platform or a newer entrant to gauge operational maturity. - What are the key issues in manager selection within the semi-liquid infrastructure space?

Consider potential pitfalls, including fee structures and allocation policies. Evaluate how managers handle investment opportunities to ensure alignment with investor objectives.

In summary, semi-liquid infrastructure offers a compelling balance of yield, inflation protection, and flexibility. As investor demand continues to grow, the market is seeing an increasing range of managers and strategies, from direct and indirect structures to hybrid models. Selecting the right approach requires careful consideration of liquidity structures, investment strategy, and manager experience. With thoughtful due diligence on structure, fees, alignment, and resilience, semi-liquid infrastructure can serve as a valuable addition to an investor’s portfolio.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  French (Canada)

French (Canada)