bfinance insight from:

Anish Butani

Senior Director, Private Markets

Gerald Wu

Senior Associate, Private Markets

As the global economy emerges from the shadow of COVID-19, demand for infrastructure has surged among bfinance clients. While this appetite is mostly focused on the unlisted space, there is a growing willingness to consider listed strategies, and investors are reappraising the claims made in its favor.

Note: a version of this article was previously published in the GLIO Journal Issue 9 (calameo.com).

Listed infrastructure managers frequently make a number of claims about the attractive characteristics of the asset class. For example, this sector purports to exhibit greater inflation sensitivity than conventional equities – a key draw in today's climate of rising inflation. It has historically boasted greater resilience during downturns, which plays to investors’ concerns following a rapid and sustained market rebound. Proponents also like to cite the potential discounts available versus unlisted infrastructure – an argument which initially became popular while illiquid asset valuations soared, and has been bolstered by a stream of profitable ‘take-private’ transactions. Higher cashflows, stronger returns and reduced volatility also feature on the tear sheet.

Different investors, of course, are likely to prioritise different characteristics depending on their strategy. Some allocators place listed infrastructure in a portfolio of unlisted infrastructure, creating flexibility and the possibility of relative-value plays between the two; some treat listed infrastructure as a stand-in for unlisted infrastructure in circumstances where liquidity requirements, execution risks or regulatory impediments rule out the illiquid route, including certain Defined Contribution pension markets; some look to place listed infrastructure alongside a portfolio of public equities or growth.

Attraction 1: Performance in market corrections

The ups and downs of 2020 provided analysts with an opportunity to validate expectations that listed infrastructure should limit downside capture during equity slumps – a key attribute for this asset class. A reappraisal of the figures after the March 2020 crash and the subsequent recovery showed that listed Infrastructure remains compelling versus listed equities, mitigating losses during down-markets while maintaining a high return capture in up-markets.

After the March 2020 crash and the subsequent recovery, figures showed that Listed Infrastructure remains compelling versus listed equities, mitigating losses during down-markets while maintaining a high return capture in up-markets.

This pattern reflects the tendency of listed infrastructure to benefit from buoyant macroeconomic conditions and to exhibit its relative resilience as a provider of essential services in down markets. While the 2020 upheaval was unlike any that preceded it in terms of its impact on specific sectors, the overall figures remain compelling.

FIGURE 1: MONTHLY & QUARTERLY LISTED INFRASTRUCTURE UPSIDE & DOWNSIDE CAPTURE

Attraction 2: Valuations versus unlisted infrastructure

As illiquid infrastructure valuations rocketed in the post global finance crisis decade, the potential appeal of listed infrastructure as a cheaper entry point became a topic of discussion.

Today, we note that listed infrastructure assets could still be seen as attractively priced versus unlisted counterparts, based on a range of valuation metrics. On average, 80% of illiquid infrastructure deals were struck above listed multiples; direct investors have paid a valuation premium of 40% when compared with the GLIO Index.

FIGURE 2: VALUATION COMPARISON

However this ‘relative value’ argument is somewhat problematic: there is no fundamental reason why valuations on the liquid side must necessarily be drawn into alignment with valuations in private markets, as long as there is sufficient investor appetite and capital available to retain those assets in private hands.

The premium has driven considerable M&A activity in recent months: the listed space has become an attractive hunting ground for leading unlisted infrastructure managers; KKR & Equitix (John Laing), BlackRock and Goldman Sachs (Calisen) and Macquarie Infrastructure & Real Assets (Cincinnati Bell) have all led take-private transactions in recent months.

Attraction 3: Inflation linkage

We fully expect listed infrastructure to be well-positioned, relative to equities, in an environment of rising inflation. Many assets can charge prices which are wholly or partly linked to inflation: revenues are often connected directly or indirectly with inflation through tariff and concession structures with in-built adjustments. These features combine to produce higher cash flows and potentially higher distributions paid out to investors, thereby protecting real returns in various inflationary scenarios.

Attraction 4: Strong total return profile

The asset class has historically provided higher income and capital appreciation than the broader global equity market. For the period January 2003 to March 2020, a composite of listed infrastructure equities delivered a total return of 11.4% (7.9% capital appreciation and 3.3% income return) compared to 7.7% total return for the MSCI World Index (5.0% capital appreciation and 2.6% income return).

The asset class’ stronger return figures are underpinned by more consistent and higher cash flows for the underlying companies. Listed infrastructure has historically demonstrated higher EBITDA growth: for calendar years 1999 through 2020 the 8.9% average EBITDA growth for global infrastructure equities meaningfully exceeded the 2.6% average annual EBITDA growth of global equities.

FIGURE 3: STRONG EBITDA GROWTH

Attraction 5: Lower volatility

Over the medium term, listed infrastructure has delivered strong risk-adjusted returns compared to equities. Based on 15 years’ worth of data including the global financial crisis period, various listed infrastructure indices (which represent well-diversified portfolios) have outperformed the MSCI World index in terms of achieving higher annualized return (8.5-9.4%) with lower annualized standard deviation (11.6-13.8%). This demonstrates that higher returns have not been sacrificed for the defensive characteristics of infrastructure over the medium term.

FIGURE 4: HIGHER RETURNS COUPLED WITH LOWER VOLATILITY

A proxy for unlisted infrastructure?

Infrastructure assets, regardless of whether they are listed or unlisted, exhibit the same characteristics and operating cash flows.

Infrastructure assets, regardless of whether they are listed or unlisted, exhibit the same characteristics and operating cash flows.

Private market and listed infrastructure investors invest, fundamentally, in the same type of underlying assets. In some cases, the assets themselves are exactly the same: this can occur when direct managers take a large shareholding in listed companies (e.g. Vienna Airport is partly owned by IFM) or where assets are partly owned by a listed entity and an unlisted investor (e.g. the 407 ETR toll road in Canada is owned by both Canadian pension funds and the Spanish listed operator Ferrovial).

Much is made about the overlap in valuation technique, particularly the common usage of the discounted cash flow approach, but many public market investors often adopt multiple-based valuations and shorter-term forecasts and public markets are more susceptible to shorter term trends.

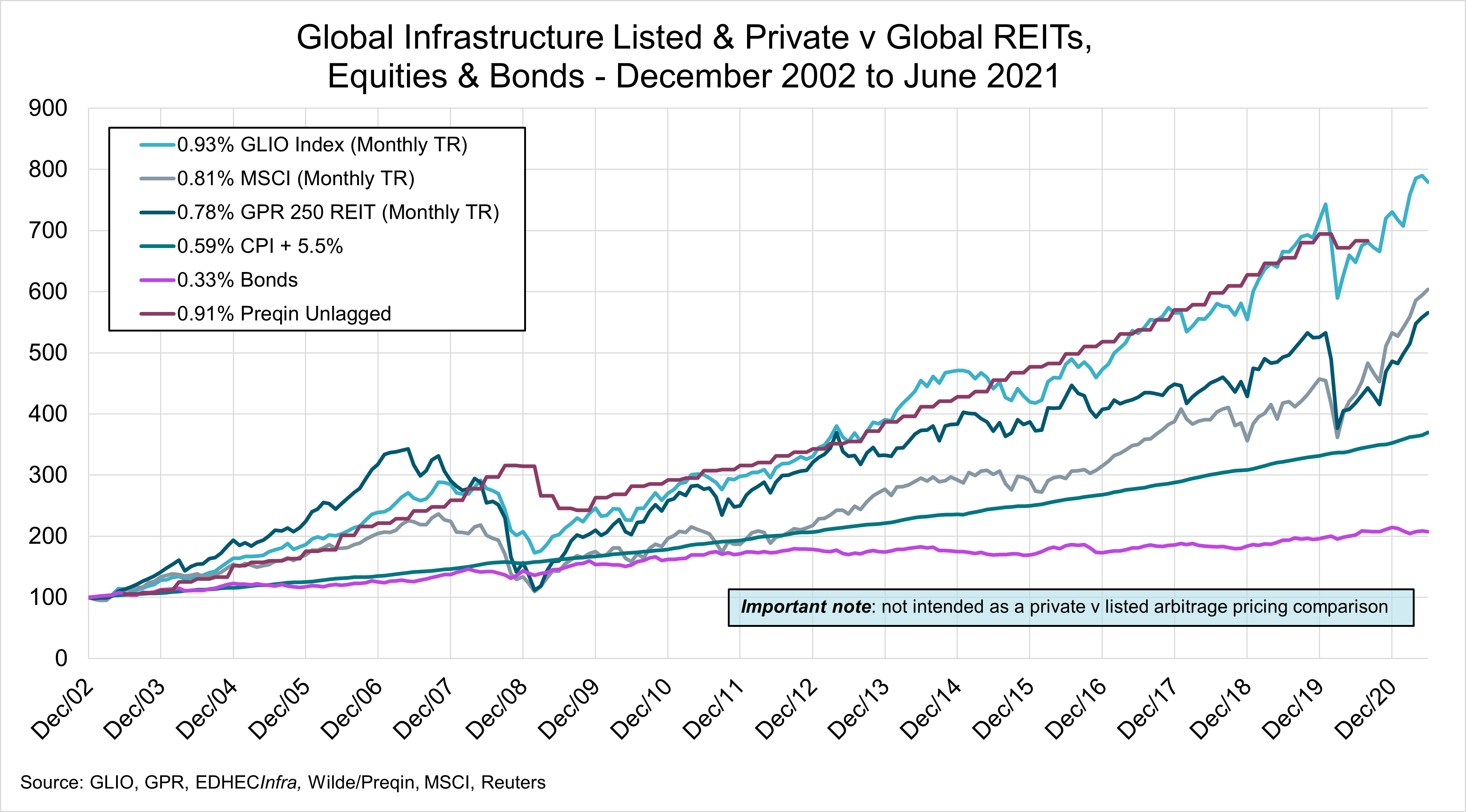

Overall, there appears to be a healthy correlation between returns for listed and unlisted infrastructure, as set out in Figure 5.

FIGURE 5: LONG-TERM GLOBAL ASSET CLASS PERFORMANCE

Listed versus private infrastructure fund performance – vintages

The argument against listed infrastructure, in favor of private markets, most often revolves around the volatility in short-term pricing driven by market-to-market rather than mark-to-model valuation. While that variability in pricing is clear on a monthly, quarterly or even yearly basis, infrastructure investors should of course be focused on longer-term outcomes. In fact, private market investors must be comfortable enough to commit their capital for many years.

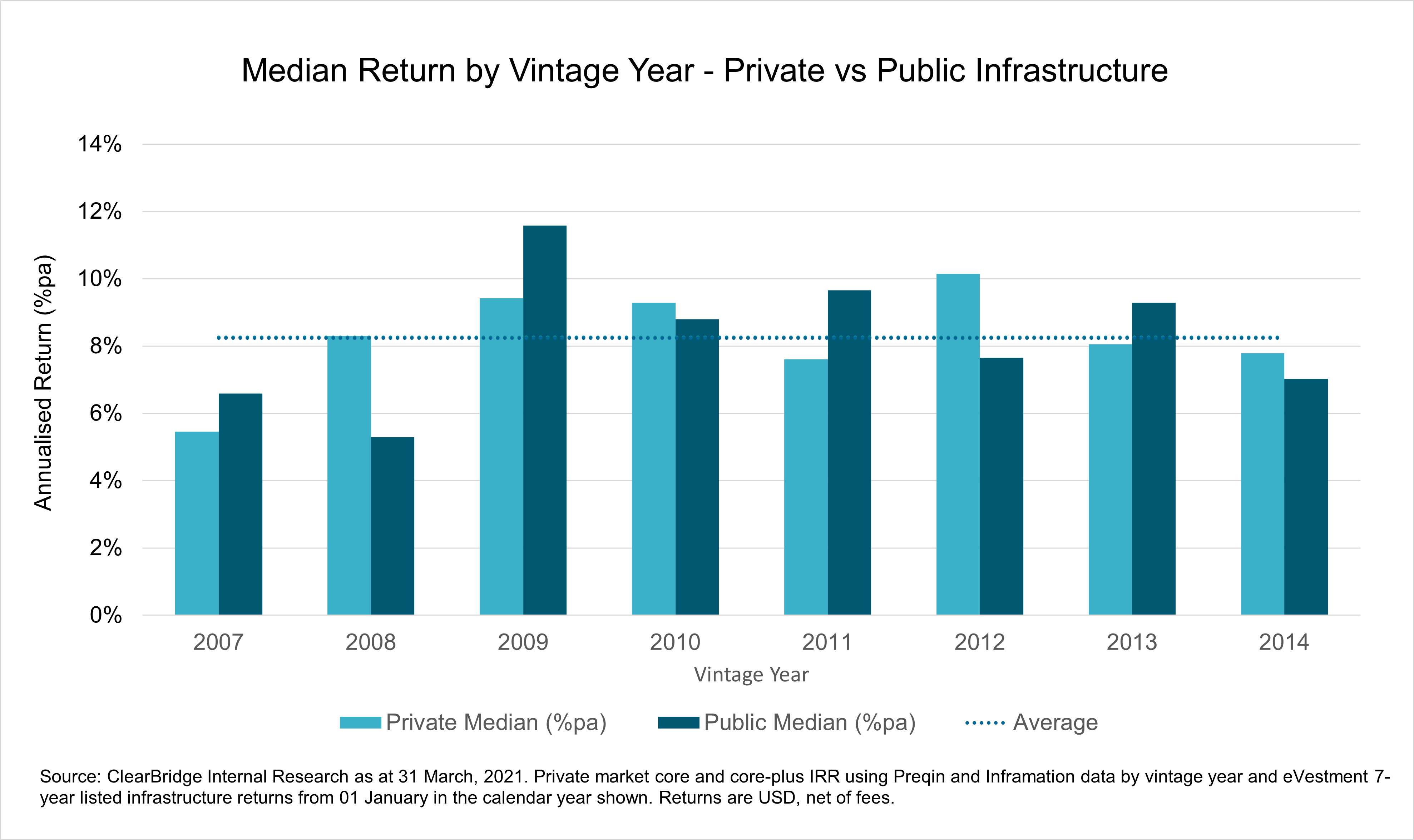

Figure 6. compares the median IRR of private infrastructure by vintage year to the median return from a seven-year investment in listed infrastructure. The underperformance of listed infrastructure for an investor who funded in January 2008, just prior to the GFC, or the outperformance for the investor who had spare capital to fund at the start of 2009, highlights the arbitrage opportunity, but on average the returns outcomes have been very similar.

FIGURE 6: MEDIAN RETURNS BY VINTAGE YEAR

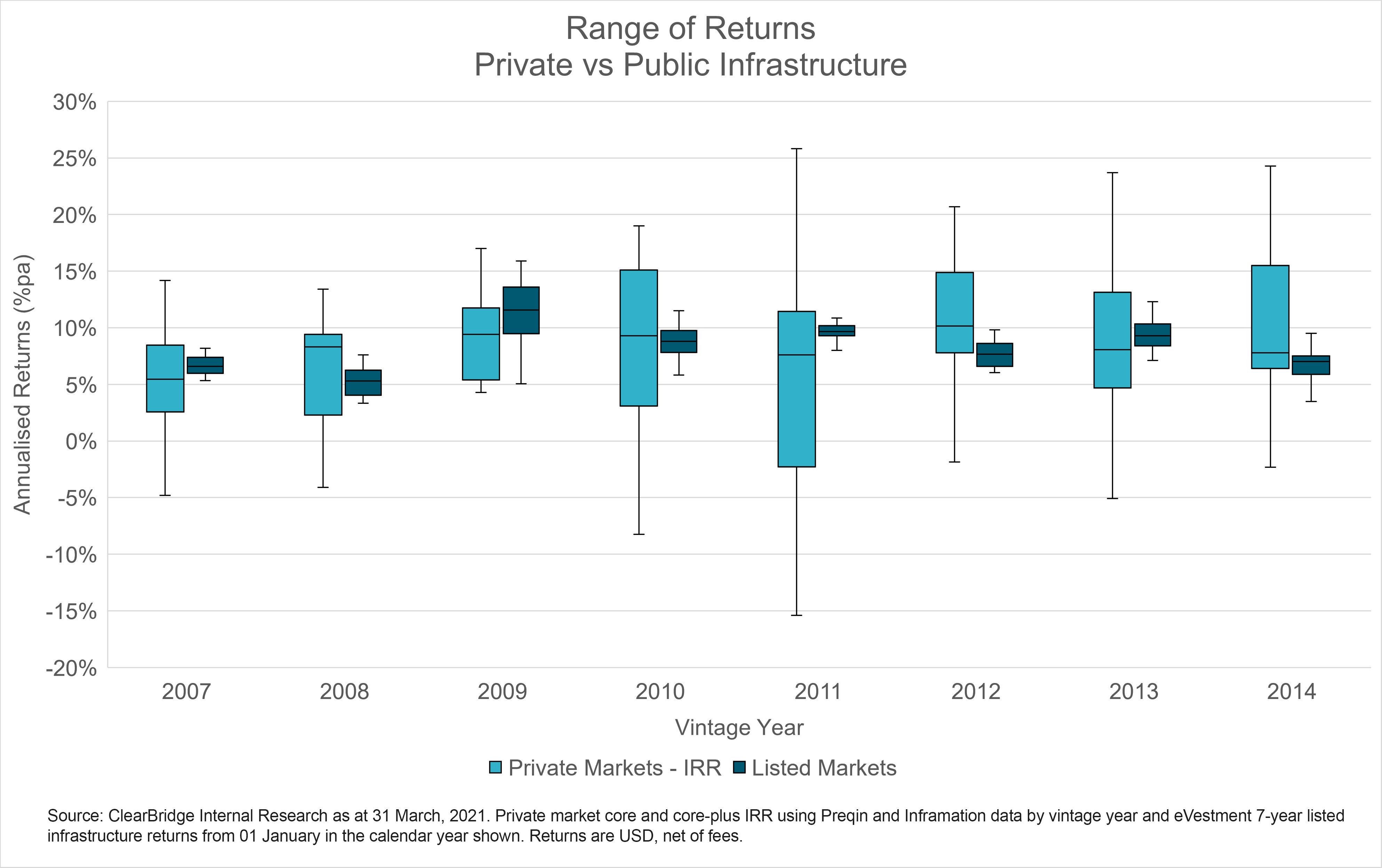

Median returns, of course, don’t tell the full story. Figure 7. shows the range of returns by quartile over the same vintage years.

FIGURE 7: RANGE OF RETURNS – PRIVATE VS. LISTED INFRASTRUCTURE FUNDS

For every vintage between 2007 and 2014 – eight years of analysis – private infrastructure funds have displayed a far wider range of potential returns for investors. If a key objective is to achieve stable returns over time, then the narrower range of outcomes suggest that listed infrastructure could be considered as part of an overall infrastructure program. The greater range of returns from private infrastructure reflect the nature of private markets performance, and as a result investors need to pay greater attention to the manager selection process.

Implementation challenges

Once investors make the strategic asset allocation decision to invest in listed infrastructure, crucial implementation decisions follow. There is, for instance, significant dispersion in the performance delivered by different asset managers in this space. Here are some key areas to consider within strategy selection and manager due diligence:

1) Differences in portfolio composition

When depicting the listed infrastructure manager universe, there are two distinct camps: one comprising managers based in the USA (typically branching out from REITs managers); the other featuring managers based in Australia or Europe that typically provide investors with developed exposures in unlisted infrastructure.

As such, approaches to portfolio construction may vary: the former group, for instance, have greater exposure to the energy and railroad sectors which underpin a large proportion of the investible universe in North America. Some firms are even able to offer different investment options to investors, covering income and balanced (income/growth) outcomes. It’s worth noting that we also observe products combining listed infrastructure with REITs in one offering (The Rise of Listed Infrastructure and REITs, 2020).

2) Understanding and selecting benchmarks

The main benchmarks still differ considerably in terms of breadth and sector exposure. Some funds, particularly the more mature ones, benchmark against the S&P listed infrastructure index, which is relatively narrow (75 stocks globally) and skewed towards utilities. Other funds use the broader Dow Jones Brookfield Global Infrastructure Index (over 100 stocks), which focuses more on companies’ exposure to infrastructure in terms of underlying revenues, or the even larger FTSE index containing approximately 200 companies worldwide. More recently, the GLIO index was established in 2016 in consultation with listed infrastructure managers. The GLIO index is also steered by a specialist advisory committee which helps the index adapt over time in line with market developments which is essential to accurately track the asset class.

Each benchmark is unique and has its own limitations: it is crucial to scrutinise the choice of yardstick, validate its rationale in relation to the investment strategy, and appreciate the implications for performance measurement, risk management and compensation.

Each benchmark is unique and has its own limitations: it is crucial to scrutinise the choice of yardstick, validate its rationale in relation to the investment strategy, and appreciate the implications for performance measurement, risk management and compensation.

A minority of managers do not use a listed infrastructure benchmark at all, instead opting for an absolute return or inflation-plus-X% target – an approach which is more aligned with unlisted infrastructure investments.

3. Scrutinizing performance

While most infrastructure managers have beaten their chosen benchmarks in recent years, closer examination reveals that much of the outperformance has been the result of exposure to stocks outside of the chosen benchmark: many funds have off-benchmark exposures of 20-30%; for others the figure is as high as 60%.

Demand on the rise?

The tailwinds are now firmly in place for rising demand for listed infrastructure among investors in 2021, following a notably subdued 2020. The core tenets of this strategy remain clear and relevant amid current conditions. For investors that do decide to implement investments in this space for the first time, thoughtful deployment within a diverse universe of strategies will be key to success.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  French (Canada)

French (Canada)