bfinance insight from:

Peter Hobbs

Managing Director, Head of Private Markets

Harry Wu

Senior Associate, Private Markets

The full effects of the pandemic on real estate markets are still unclear. Yet what is already evident is that the impact will not be evenly felt. Some real estate equity strategies have delivered positive performance while others have almost halved in value; some are well placed to take advantage of opportunities going forwards while others are constrained.

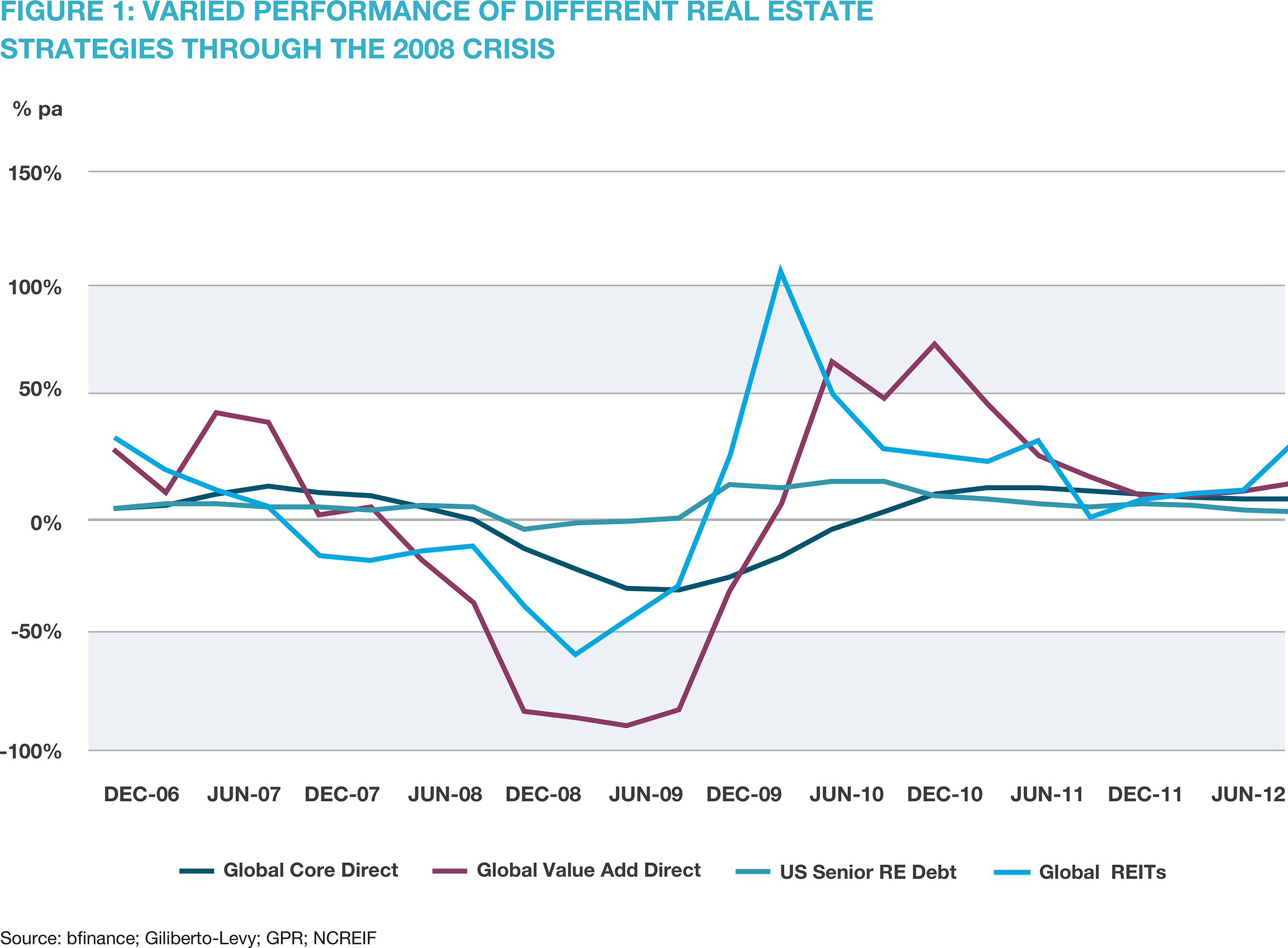

Performance dispersion can be thought about through a range of lenses. Real estate, as a label, masks a very wide range of strategy types, which can be expected to perform differently in stressed periods – a point illustrated in this chart, which shows the performance of just four of these strategies through the 2008 crisis.

Within strategies, a substantial amount of manager dispersion can be attributed to COVID-hit geographies and sectors, with a severe downturn in retail and hospitality counterbalanced by a surge in valuations for logistics property and a robust residential sector. Logistics is proving to be a particular beneficiary, with a surge of demand and rental growth leading to a further ratcheting up of prices – often involving heated bidding wars.

There are, however, other important drivers of dispersion: use of leverage, portfolio diversification, recent bidding discipline, and rapid asset-gathering which has driven rushed deployment. 2020 will be more likely to reward managers who took a more measured stance during the latter part of a relatively benign decade.

Key red flags amid current conditions include:

Exposure

- to underperforming sectors;

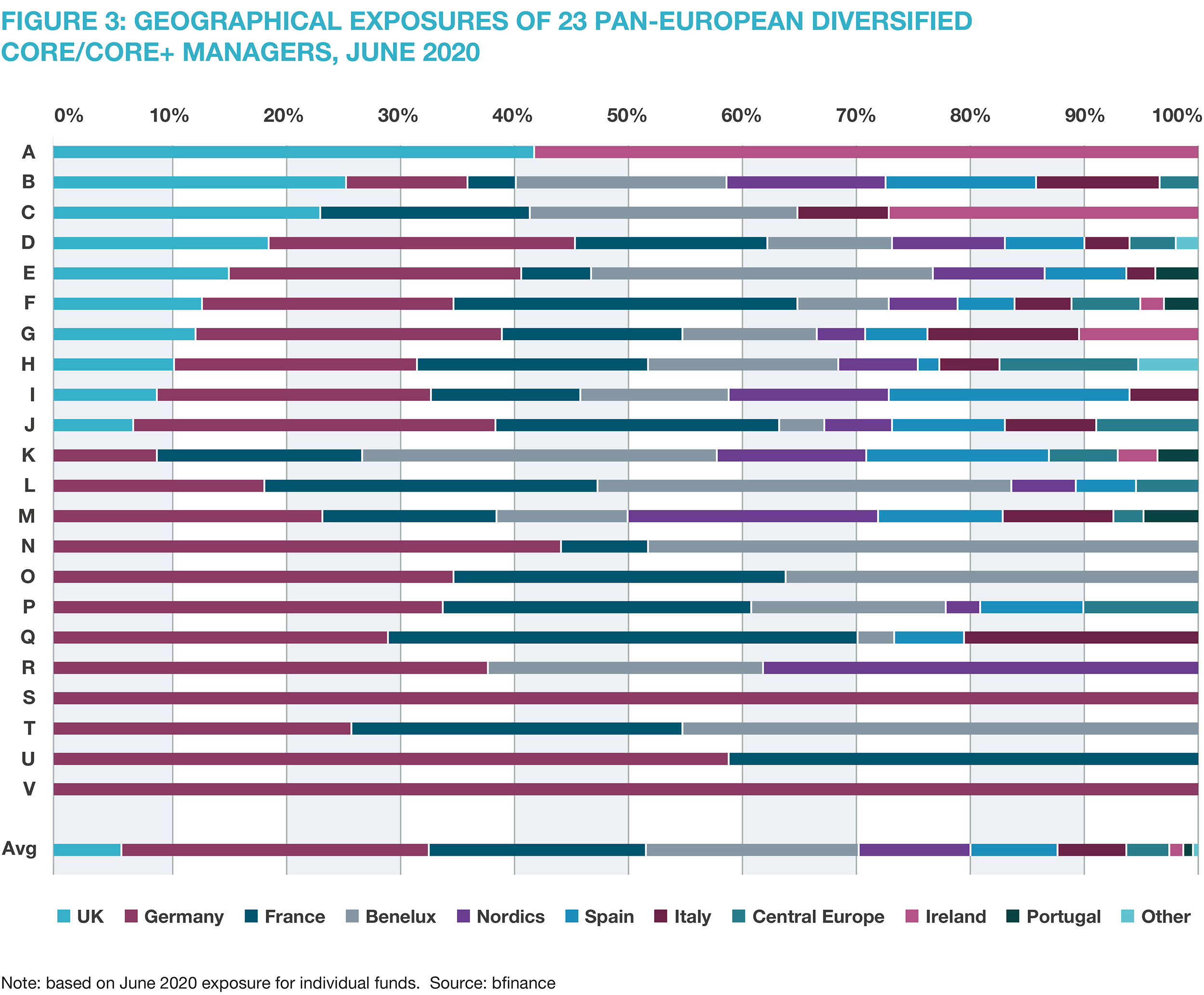

- to under-performing geographies (e.g. Italy, Central Europe and UK in European strategies);

Cashflow

- weak credit quality and short cashflow duration

- higher vacancy rates and low yields;

Concentration

- low overall portfolio diversification (# of positions);

- high percentage of portfolio in a small number of assets;

Capital markets

- high leverage and weak financing terms;

- vintage year – high exposure to aggressively priced assets and low levels of dry powder;

Other

- rapid growth in fund assets during last three years that has often driven rushed deployment;

- corporate pressures/instability, such as merger, acquisition, reduced profitability and reputational issues;

- staff turnover, particularly involving portfolio managers and dedicated teams;

- weaker ESG processes.

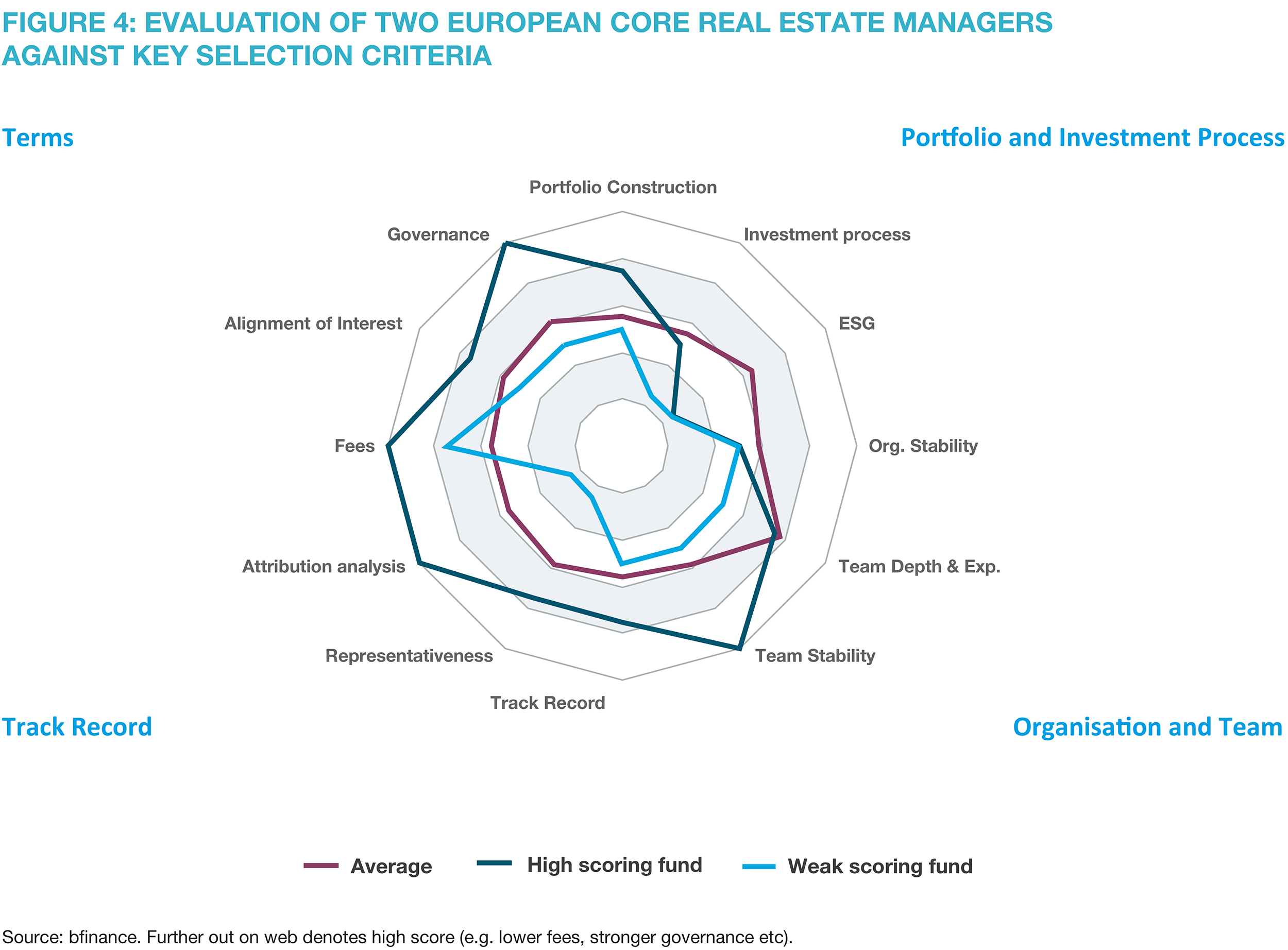

This is certainly not a thorough list, with a broader range of assessment criteria covered in the case study which appears below. However, these key areas of sensitivity have proven helpful for assessment or re-assessment of managers during the COVID-19 era. It is rare that managers are consistently weak or strong across all of these aspects: the vast majority of strategies that we’ve assessed during recent months tend to have a number of areas of concern. For instance, some of the larger funds with good asset level diversification have high exposure to Retail and Southern/Central Europe. By contrast, some of the smaller funds that suffer from greater concentration have far less exposure to the weaker sectors and geographies.

In addition, it is important to keep a very close eye on how managers are approaching valuations and cashflow projections now. Some have been marking down assets more severely than external valuers; others are merely keeping pace. Some are presuming that ‘rent holidays’ will be repaid next year; others are presuming that those rents will go unpaid, leaving the possibility of repayment as a potential upside to their forecasts. We also note considerable differences in managers’ current strategies for new acquisitions: is it better, for instance, to chase logistics in a period when these assets are being hotly contested or target the more complex office sector or, even, the unloved retail and hospitality sectors?

These differences in strategy are, in part, driven by lack of clarity over the economic outlook. Macroeconomists disagree on whether a temporary recession or a prolonged recession represents the most likely scenario. In terms of fundamentals, it is likely that COVID-19 will continue to produce supply chain disruptions and affect retail and hospitality, while other sectors – such as logistics leased to e-commerce operators, cold storage and multifamily real estate – are initially more resilient. However, the weaker economic scenarios bring an adverse effect for most sectors, with falling tenant demand, declining rents, more vacancies, and greater likelihood of obsolescence (making it harder and more expensive to re-lease buildings that become vacant). When it comes to pricing, good quality real estate should remain attractive versus fixed income amid the unprecedented QE and assurances from central banks, but poorer quality sectors and assets with weak cashflow prospects are set to see further weakness.

Sector in focus: European Diversified Core Real Estate

Throughout 2020, the bfinance team has supported clients in reviewing and selecting managers within the up-and-coming ‘European Core Real Estate’ sector. European core is a relatively new strategy type in comparison with its US counterpart, due to the historic home bias of European real estate investors and the difficulties of investing in markets with different regulations and legal frameworks. Yet the last decade has seen it grow from a negligible base to a highly credible segment with more than 25 managers handling a combined AuM of over $30 billion. By contrast, the US market has a similar number of managers managing around $300 billion.

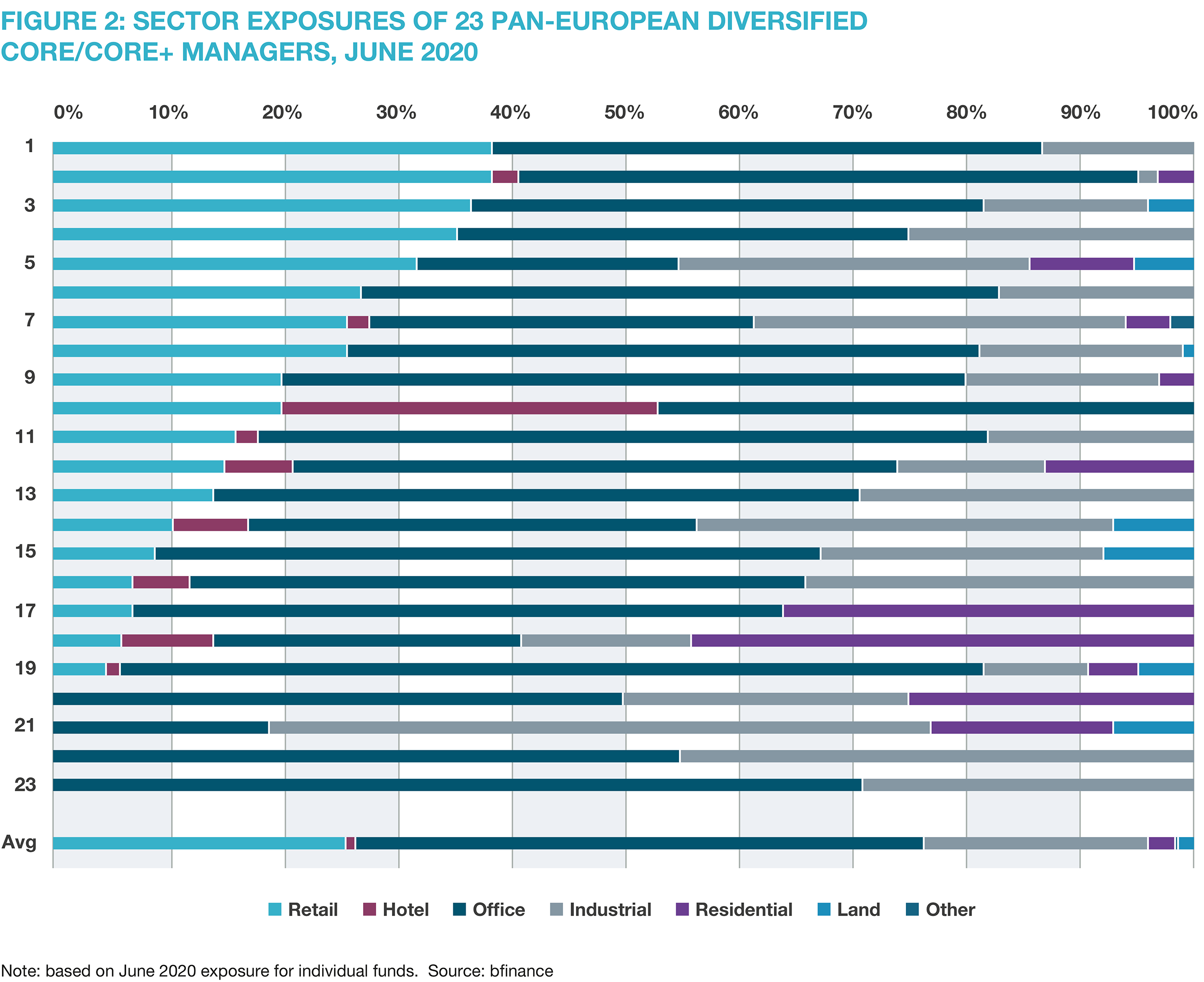

Many of these European managers have relatively short track records compared with their US peers, and/or have experienced a rapid growth in their AuM during the last five years. They are also very heterogenous from the perspective of portfolio composition, whereas their US counterparts are relatively homogenous and have quite similar performance histories. The very different sector and geographic exposures of European managers can be seen in the following charts.

Notwithstanding their overall attractions, a number of these strategies face significant COVID-19 challenges, due to their relatively high exposure to Retail and Offices and the high pace of deployment over the past two to three years. In most cases, managers are facing reductions in their cashflows due to rent holidays and are proceeding cautiously with new acquisitions.

Most managers expect their 2020-21 returns to fall short of their targets. Target returns range from 6% to 9% and target yields, from 3% to 5%, with many managers expecting returns close to zero during 2020 and yield closer to 2% for the year. There are also considerable differences in how aggressively managers have downgraded their valuations in comparison with the official valuers and the presumptions which were being used to estimate return forecasts. Importantly, there are significant variations in the level of detail in which managers evaluate the potential performance of their individual assets, and the detail they provide to their investors – this issue is relatively common among private market funds in general, and we see investors becoming less tolerant of low transparency on these points.

Manager analysis highlights the many factors driving performance dispersion beyond sector and country exposure, with a strong contribution from asset-specific selection and management. A range of relevant manager assessment criteria – and the scores given to two managers – are shown in Figure 4. These criteria vary in their importance as predictors of performance and their relevance to specific investors. Managers, as shown here, are rarely strong or weak on all aspects.

One key difference between managers, which lies within the “portfolio structure and risk” component of the analysis, is the average amount of leverage used. The differences between managers are huge: some employ leverage of around 15% or less, while some are at 35% or higher. There is a strong current focus on leverage as part of a broader consideration of a range of risk factors, as summarised in ‘red flags’ box above.

Does this crisis undermine the role of real estate in investor portfolios?

Real estate, and other private market asset classes, will continue to play a key role in investors’ portfolios. The fundamental attractions of the asset class remain intact:

- Strong overall returns and risk-adjusted returns. Over the 20 years to end-2019, global unlisted real estate delivered higher annualised returns than global equities; listed real estate returns have been even higher.

- Income/cashflows, with relatively high yields supported by lease structures.

- Diversification from traditional asset classes. Global unlisted real estate has had a correlation of 0.5 with global equities through 1995-2019; listed real estate has had a correlation of 0.6.

- Inflation sensitivity. Although the inflation-sensitive characteristics of real estate vary over time and from market to market, it can have direct inflation linkages depending on the lease terms (particularly through a more operational property).

- Low volatility. Even when real estate return series are corrected to account for valuation smoothing, this asset class is less volatile than public equities.

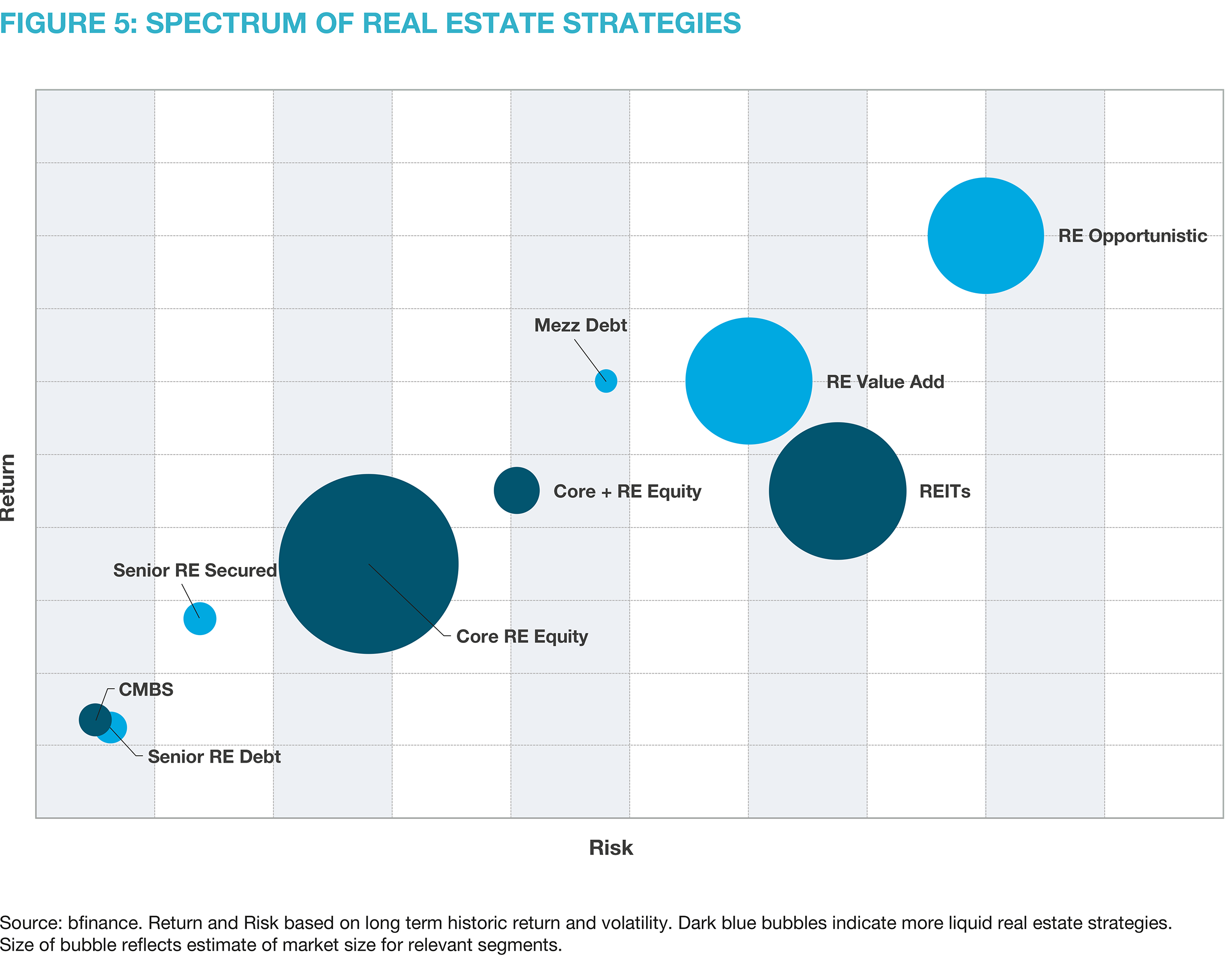

That being said, we expect that investors will increasingly look to achieve those desirable characteristics by combining a variety of strategies from across the spectrum of real estate illustrated in Figure 5 – debt and equity, unlisted and listed, conservative and aggressive.

This is not a new trend, but it is one that may well be enhanced by the pandemic and its economic repercussions. The significant dispersion of performance through the current cycle reinforces the case for well-diversified real estate exposure. This is the case for sectors, geographies (domestic and international) and managers. But it is also the case for different strategies, with increasing evidence of the benefits of building real estate exposure across the ‘four quadrants’: debt and equity, unlisted and listed.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  French (Canada)

French (Canada)