IN THIS PAPER

Market review: There are now more than forty evergreen and semi-liquid private equity strategies, many of which have been launched in the 2020-2025 period, with over US$30 billion in assets under management. New data provides insight into their liquidity profiles, portfolio composition, fees and performance targets.

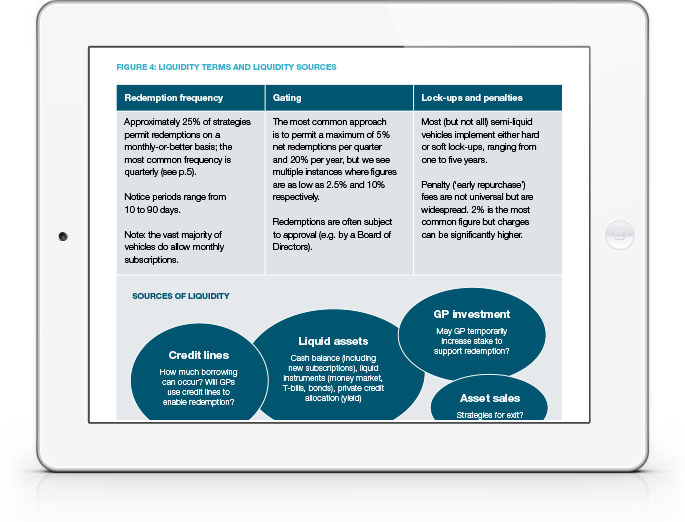

Liquidity mechanisms and credibility: How much liquidity is being offered and what are the mechanisms underpinning its delivery? Cash, liquid investment allocations, credit lines, GP commitments and exits are in focus, as is the resilience of the client base

Alignment of interest is key: LP-LP alignment can be complex, with investors entering and redeeming from a vehicle at different times. Fee structures and the valuation approach require scrutiny: management fees based on NAV from day one and/or performance fees based on NAV (unrealised gain) can result in rather different LP-GP alignment versus a conventional closed-ended private equity vehicle.

WHY DOWNLOAD?

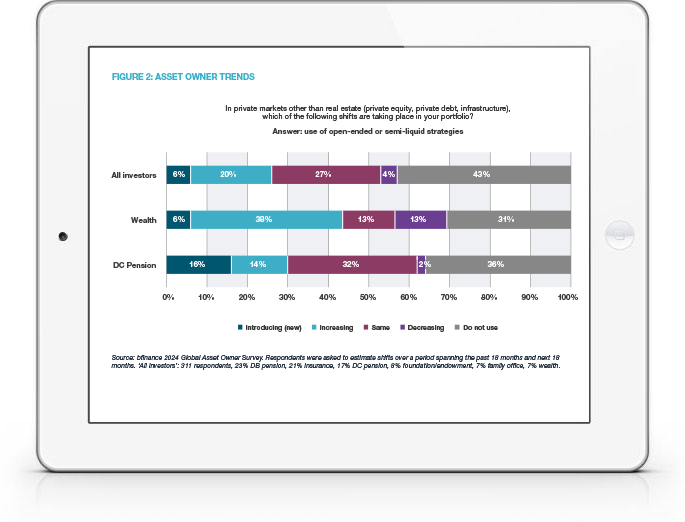

Semi-liquid private market strategies are drawing attention, with rapid growth in the number and size of evergreen strategies targeting infrastructure, private debt, private equity or combinations of private market asset classes.

In private equity, evergreen AuM has surged with mature vehicles accumulating assets rapidly and many new launches occurring in the 2020-2025 period. Strikingly, this growth has come during a period when industry-wide private equity fundraising has markedly slowed.

Yet investors must tread with care. The ‘round peg’ of unlisted assets and the ‘square hole’ of liquidity are not easily partnered. Moreover, frictions may only become obvious when redemptions requests outweigh inflows for an extended period of time. The difficulties faced by open-end real estate funds since 2020 serve as a fresh cautionary tale, warning LPs against complacency.

In order to avoid potential pitfalls, it is crucial for investors to interrogate asset managers’ approaches in detail. This report asks five questions:

- How much liquidity is being offered and what are the mechanisms underpinning its delivery?

- Is the client base appropriately diversified and robust?

- What measures are in place to ensure fairness between LPs?

- Are fees and costs appropriate?

- Should lower performance be expected?

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)