IN THIS PAPER

Impact investing: where are we now? A recent Asset Owner Survey of global pension funds, insurers, endowments and others reveals that 53% of investors are either already carrying out “impact investing” or are planning to do so. Yet the proportion currently involved has only risen by two percentage points over the past two years. Implementation issues and the profile of today’s strategy landscape must be understood.

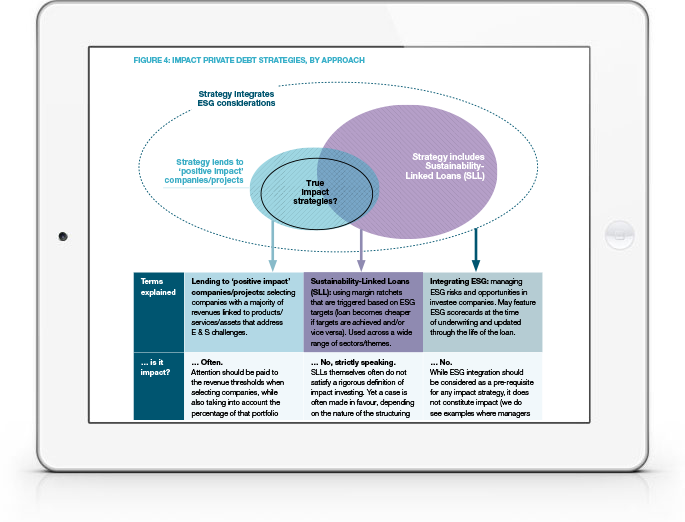

Overview of the impact private debt asset class. Following a period of rapid expansion, there are well over 100 institutional-quality private debt strategies that target one or more environmental sustainability themes in developed markets and the list grows far longer when expanding parameters (geography, theme, SMA, et cetera). These include infrastructure debt funds, direct lending funds, natural capital debt, real estate debt and more. Many specifically lend to impactful companies/projects, while others lend to a more diverse group of companies (often using Sustainability-linked Loans) and a minority do both. A broad view is key; ‘impact’ labelling, naming and marketing do not ensure that a strategy will be impactful.

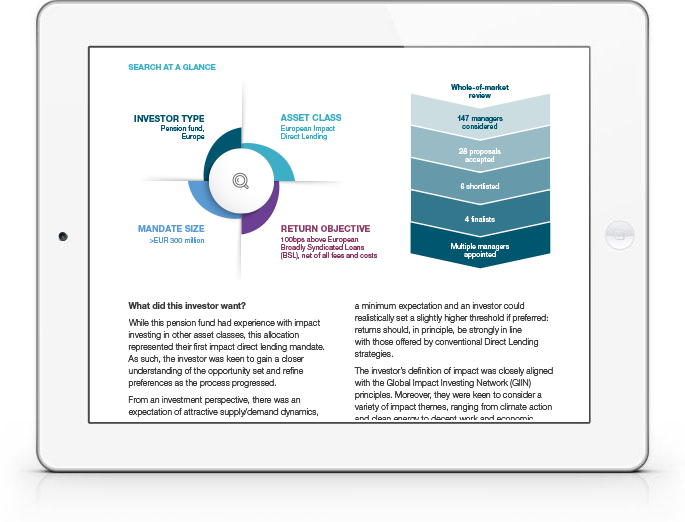

Impact direct lending manager selection in practice. Using an illustrative manager search by a European pension fund (>EUR250 million), we consider the questions and issues faced by real-world allocators today. The case study highlights key differences between impact and conventional strategies—such as greater portfolio concentration, smaller investee company size and a larger proportion of unsponsored debt—and considers some of the key debates faced during effective due diligence. How robust and relevant is the (typically carved-out) impact investment track record? What approaches are being used to mitigate fundraising risk? How can investors assess the quality of the dealmaking pipeline?

WHY DOWNLOAD?

Impact Private Debt is on the rise. Private Credit fund managers have followed closely behind their Private Equity counterparts as they seek to tap into the large and growing universe of institutional investors who are putting impact intentions into practice.

This report seeks to illuminate some of the opportunities and challenges within impact private debt investing. A bird’s eye view of the broader environmentally-oriented Impact Private Debt landscape—including Infrastructure Debt, Real Estate Debt and more—provides insights on the current investible universe, while an illustrative manager search case study focused on European Direct Lending provides deeper insight on the implementation experience.

When investing in this sector, it is crucial to scrutinise both investment credibility and impact claims with care: not all prospective candidates are true impact strategies and branding/labelling is not necessarily helpful in guiding allocators on this subject. The manager search case study begins with market landscaping in an ever-growing field and progresses to the assessment of prospective managers as well as detailed due diligence. We ask: how is impact defined and how can the credibility of impact strategies be assessed? How can investors gain comfort on track records, fundraising risk and more in a nascent asset class? What are the key points of differentiation between asset managers’ approaches?

This article is the latest in a series of reports focused on the practicalities of impact investing: previous publications have covered Impact Private Equity, Impact Real Estate, Natural Capital, Public Equity and more. These educational briefings are designed to support asset owners—pension funds, endowments, insurers, family offices and others—and the broader investment community.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)