- Australian Superannuation Fund

- 2024

- Public markets asset classes

- AUD 5-10 billion

- Global

- Double-digit % savings on manager fees

- Fee reviews and Transaction costs analysis

Our specialist says:

When preparing to negotiate management fees with an investment manager, it is important that a holistic approach is taken. Looking at headline figures such as the management fee or performance fee in isolation could lead to other crucial factors being overlooked.

This fee review highlighted the importance of that – the investor’s portfolio consisted of managers with strong performance and management fees below peer group medians, though there was still scope for greater improvement. The breadth of our analysis, combined with our unique position in management fee negotiations, allowed the client to realise material savings, with the backdating of revised fee schedules.

Client-Specific Concerns

The superannuation fund wanted to review the management fees they were paying for investment services considering the performance achieved, with the aim of securing better commercial terms. While the fund had been invested with many managers for a significant period, some commercial arrangements had been negotiated recently. The client portfolio consisted of a mixture of pooled fund and SMA vehicles.

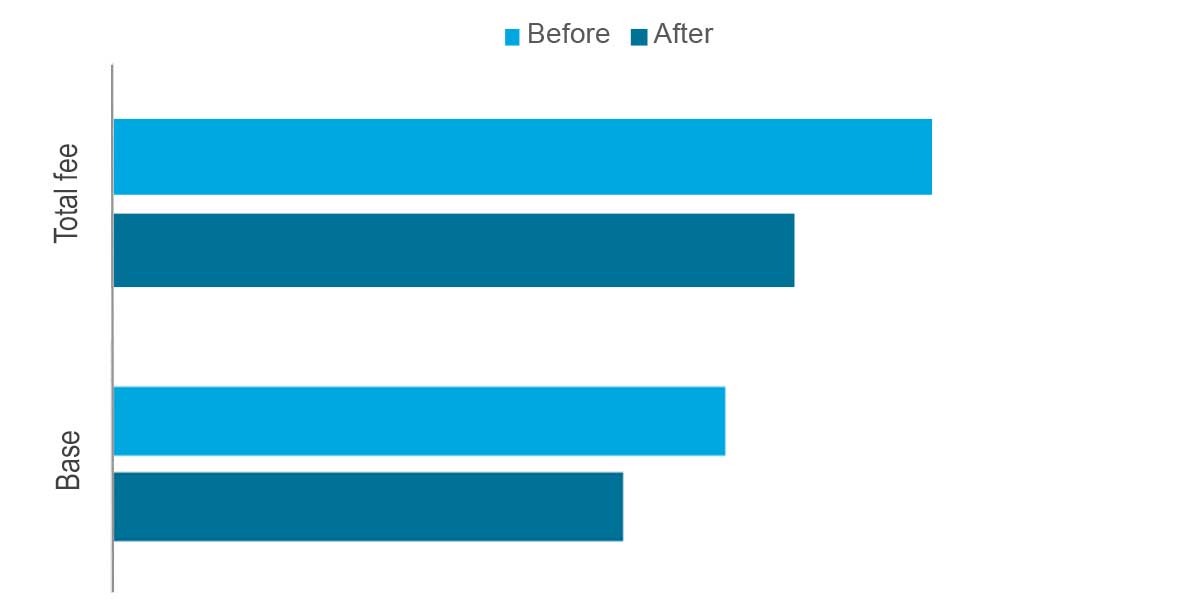

Base and Performance Fee Reduction - savings at all performance levels (Example manager)

Outcome

- Strong strategies with competitive fees: The analysis revealed strategies with competitive fees (6 below bfinance's median) and/or strong performance, making renegotiation challenging. Several had isosteric approaches or operated in capacity-constrained asset classes. Given the client’s smaller scale allocations, a more refined negotiation approach was necessary.

- Crafting negotiations: With no clear leverage from high fees or weak performance, bfinance developed a nuanced negotiation strategy a tailored strategy using multiple points of leverage like client relationships, servicing issues, and the fee structure. This included market comparisons and insights on flat versus tiered fees and excessive performance fees that favoured managers.

- Effective negotiations with instant savings benefits: Negotiations were successful with most managers engaged, with overall savings of +10%. Changes implemented included significant savings achieved through restructuring of performance fees (with a lower base fee, higher hurdle rate and overall lower total fee load). Negotiations were iterative, with 4 out of 5 negotiations yielding further reductions post offer. All renegotiated fee schedules were backdated by two months to ensure benefits were experienced immediately.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)