- Canadian Defined Contribution Pension Scheme

- Q3 2021

- Infrastructure

- CAD 250 million

- Global

- Minimum 6% net IRR with strong cash yield

- Open-ended pooled fund

- Manager research

Our specialist says:

It’s even more important to pay attention to fund terms in open-ended infrastructure strategies, since they are more long-term in nature than their closed-ended counterparts. The shift towards calculating performance fees using yield-based tests is a significant and (mostly) positive change, but investors must ensure that managers are not kicking into an open goal where minimum thresholds are inappropriate.

- 29Considered

- 19Long List

- 8Shortlisted

- 5Finalists

- 2Selected

Client-Specific Concerns

This Canadian Defined Contribution pension scheme was making their debut allocation to unlisted infrastructure. The plan’s structure necessitated a focus on open-ended strategies.

The investor was open to considering a wide range of core/core-plus strategy types, including global and regional, large cap and mid/small cap, diversified and more sector specific. While broad geographical and sector diversification was the primary goal with a global mandate, the investor had indicated that they were likely to prefer North America if regional mandates were ultimately to be considered as well.

Outcome

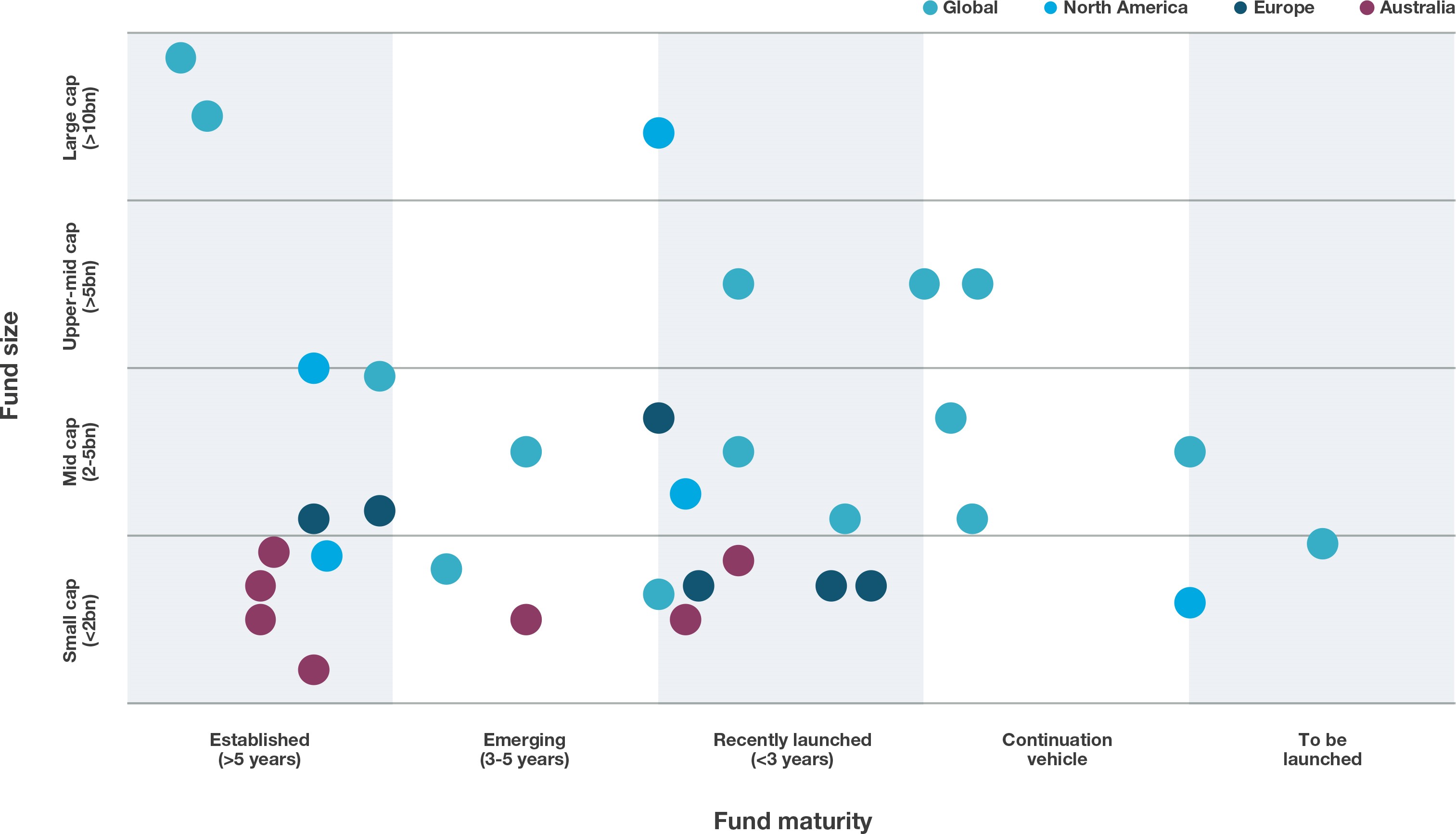

- Analysing a rapidly growing strategy universe. Surging demand for open-end strategies has driven increased availability. There are more than 30 options available now (as illustrated in the chart on this page), versus a handful five years ago. In a number of cases, managers already had well-established closed-end strategies. Most of the proposals accepted for this manager search had a core/core+ focus; some included ‘build to core’ investments targeting double-digit returns.

- Scrutinising alignment of interest and costs. The team performed detailed line-by-line analysis of all fees and costs, with an eye towards overall fee leakage when different levels of return are achieved. Strong alignment of interest is particularly crucial for open-end strategies, since the assets tend to be purchased on a buy-and-hold basis. A few years ago, we would typically see managers charging performance fees based on on-paper NAV valuations against a preferred return target. This approach should not now be considered ‘best practice’. Higher competition and return compression has led to the emergence of different measures, such as inflation-linked hurdles and yield-based performance tests. Alignment mechanisms have also evolved to reflect the long-term nature of these strategies, including shadow re-investment programmes and mandatory re-investment of bonuses into the fund.

- Developing combination analysis. Researchers initially developed a ‘core’ / ‘satellite’ framework to account for the variety of offerings that could potentially be part of an appropriate solution, and then proceeded towards detailed combination analysis of finalists. The investor ultimately selected two large cap global managers with that were highly complementary in terms of sectors, deal sizes, geographies and more.

- Examining exposure to renewable energy infrastructure: bfinance provided tailored reporting for the pension fund’s board of trustees to facilitate its internal decision-making and manager ratification process, which allowed the client to have a full, auditable record of the selection process. The team also assisted the client in negotiating management fees, resulting in material reductions in the preferred managers’ initial offered rates.

Open-ended infrastructure strategies, by fund maturity and fund size

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)