bfinance insight from:

Ahmed Mohamoud

Associate, Public Markets

Martha Brindle

Director, Public Markets

Asset managers have moved en masse towards adopting Article 8 or 9 designations under the EU’s Sustainable Finance Disclosure Regulation (SFDR) framework, introducing new funds and repurposing existing ones. Although the initiative has improved overall levels of disclosure and encouraged managers to enhance sustainability practices, lingering ambiguity around regulatory definitions has created a new set of problems. Recent manager research indicates that a significant number of fund reclassifications could be required if more stringent standards were to come into effect.

In February 2022, Morningstar made headlines across the investment press when it announced that it had removed its ‘sustainable’ designation from more than 1,200 funds in its database, resulting in a 27% reduction in the size of the data provider’s sustainable fund universe, despite new launches. This cull was the result of an SFDR-related U-turn: having made the decision in 2021 to add the ‘sustainable’ tag to all funds which asserted Article 8 or 9 status, Morningstar decided—after an extensive review of the underlying disclosures—to revert to its previous approach and only include strategies that would have been deemed sustainable under its pre-existing in-house criteria. Given that asset managers launched more than 640 Article 8 or 9 funds in 2021 and moved 1,800 pre-existing funds towards Article 8 or 9 status, the recent removal essentially affected roughly half of all Article 8 and 9 funds listed on the database.

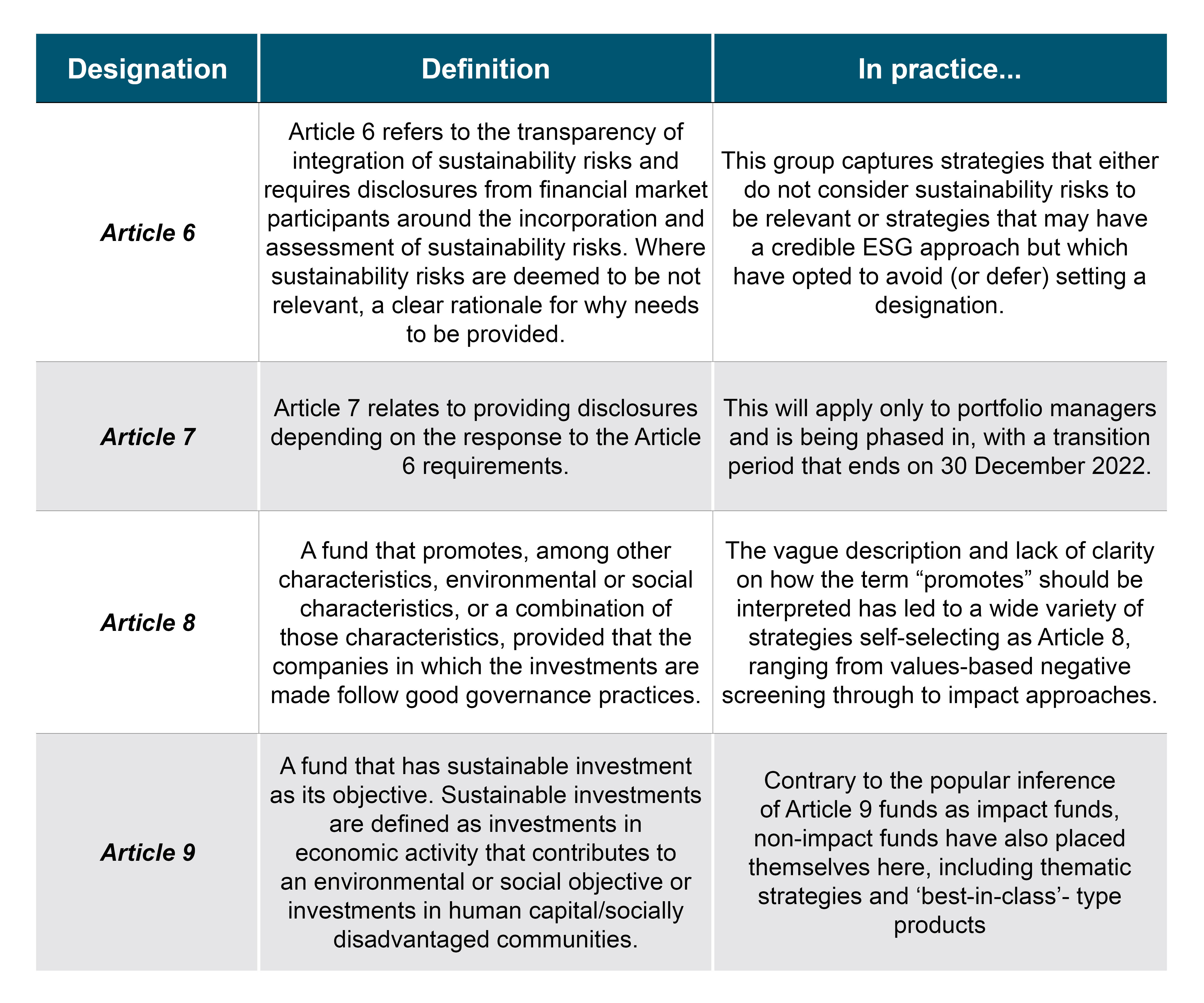

European SFDR funds…in definition and in practice

Source: bfinance

A label or not a label?

In some ways, Morningstar’s decision(s) symbolised the SFDR’s inherent identity crisis. On the one hand, officials from the European Commission (EC) and the European Securities and Markets Authority (ESMA) have repeatedly emphasised that the disclosure framework should not be used as a labelling framework —via public announcements, Q&A clarifications, conference speeches and communication through third party entities, such as the real estate association INREV (in February 2022). This stance suggests that fund research providers should not use the SFDR classification to influence their own frameworks. bfinance’s clients have followed this guidance: none have yet asked that Article 8 or Article 9 status be a hard requirement for manager searches, although we are aware that some asset owners have adopted this approach.

On the other hand, it is now evident from ESMA communications that the EC intends to define ‘minimum criteria’ for the Article 8 classification—potentially alongside the release of new Regulatory Technical Standards (RTS2), which have been repeatedly deferred and are now scheduled to arrive in January 2023. The move to create minimum thresholds is strongly indicative that SFDR is (or will be) a classification label, or perhaps it simply acknowledges the reality of the situation: that the article designations are being used as labels by asset managers (an inevitability, perhaps, given how keen managers are to advertise their ESG credentials) and that stronger restrictions are therefore needed now to avoid misleading investors. Numerous bodies, including a co-ordinated group of Non-governmental Organisations (in February 2022), have called for clear minimum thresholds in order to protect clients. The ‘label’ horse has bolted; now the cart must be attached.

A closer look at equity strategies

Although SFDR affects all public and private market asset classes, we have noted particularly strong momentum among public equity managers towards self-selecting Article 8 and Article 9 designations, supported by the relatively strong availability of ESG data for listed stocks across developed (and, increasingly, emerging) markets.

Among public equity managers, SFDR is bringing some immensely positive developments, as is the EU Taxonomy on sustainable finance. In certain cases, the regulations have acted as a helpful catalyst towards improving the quality or credibility of managers’ ESG practices, with teams taking the opportunity to codify processes and institute clearer frameworks. Information availability is a key area of improvement: mandatory periodic disclosures went live in January 2022 with full EU Taxonomy requirements kicking in from January 2023.

Yet managers have expressed frustration with the administrative burden, the lack of clarity and the legislation in general. One notable outstanding concern is the potential reputational risk associated with adjusting classifications in future, especially if upcoming regulatory technical standards or ‘minimum criteria’ enforce a stricter approach. We do see managers with highly credible ESG approaches that have chosen to retain the Article 6 designation, including managers with a primarily non-European client base and smaller firms with more limited resources.

Recent manager research illustrates the wide variety of ways in which managers have interpreted the initial regulations. We see numerous cases where strategies do not appear—in our eyes, at least—to ‘fit’ the Article that managers have chosen, especially when compared with the practices of their peers. If tighter regulatory standards do indeed take effect (and if they are as credible and meaningful as some hope), they have the potential to drive a substantial proportion of managers to alter their Article designations.

Ripe for re-designation? A few anonymised real-life examples

Source: bfinance

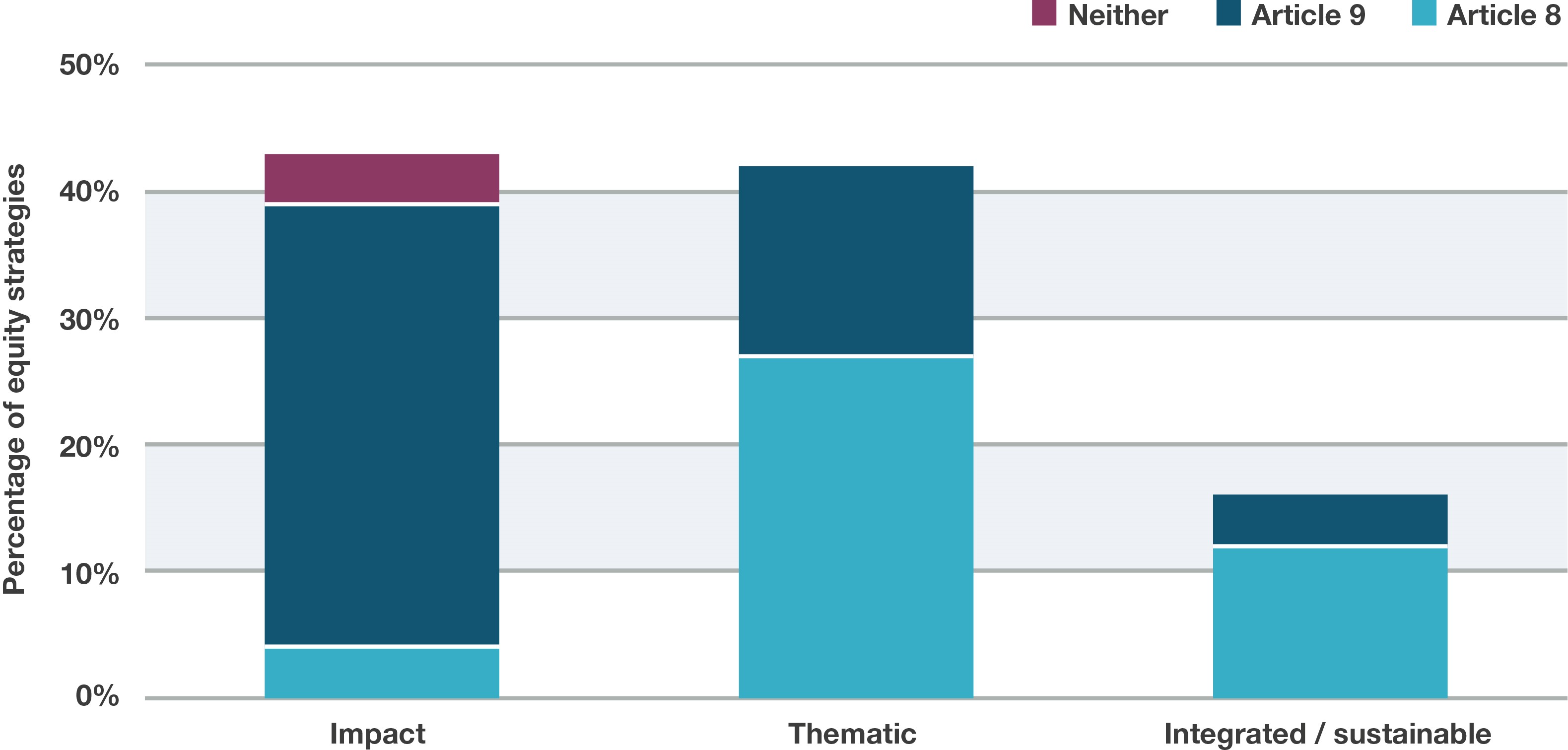

To some extent, we do see an association between funds that investors would define as ‘Impact’ strategies and the Article 9 designation, inasmuch as the vast majority of Impact equity strategies in Europe bear the Article 9 tag. Yet some thematic strategies and ‘best-in-class’-type sustainable investment strategies have also been labelled by the manager as Article 9.

For example, the chart below showcases a real-life example of managers that participated in a recent bfinance search for “global impact and thematic equity” on behalf of a European pension fund (EUR 100 million). The investor was seeking strategies that go beyond ESG integration and sustainability, offering a dedicated ESG-thematic or impact approach. This chart shows strategies’ SFDR designations (Article 8, 9 or neither) and the bfinance categorisation of these strategies (as impact, thematic or integrated/sustainable).

Although there were no requirements around SFDR labels, the client did want to understand cases where ‘impact’ strategies were not labelled as Article 9. Indeed, this manager peer group illustrates the importance of not making Article 9 a prerequisite for manager searches, even if impact is a clear priority: doing so risks excluding valid impact strategies, including some offered by non-European managers or smaller managers and a few ‘Article 8’ strategies that have strong impact credentials.

Manager search snapshot: RFP responses for €100m ‘global impact and thematic ESG equity’ mandate

Source: 2021 bfinance manager research. ‘Impact’ defined as having dual financial and non-financial objectives and measurable, demonstrable impact. ‘Thematic’ defined as one or more ESG themes that determine investments and portfolio construction. ‘Integrated/sustainable’ defined as good ESG integration, but strategy is not based on explicit ESG theme(s).

Managers in third column were ultimately judged to be inappropriate to the search criteria, which were designed to exclude strategies that merely provide ESG integration. Managers had positioned these strategies as being more impact-oriented or ESG-thematic than was the case in order to pitch for business. Careful analysis should identify strategies that are pitched as impact-oriented or ESG-driven but lack processes that support that claim.

Learning the lessons

As other regulators around the globe move to implement their own sustainable disclosure frameworks, they should be able to draw valuable and pertinent lessons from the European experience. Already, we see that the developers of the UK’s Sustainability Disclosure Requirements (SDR) are taking a more stringent approach than their European predecessors, presumably to avoid some of the criticisms that have dogged the latter.

Yet, whatever regulatory improvements occur, the onus will remain on investors and their advisors to define and scrutinise sustainability with care. Even when new standards and minimum criteria arrive—potentially an important step—it does not appear likely that SFDR classifications will become a robust practical tool that will help sophisticated institutional investors to identify strategies that are likely to suit their needs. The strategies—and investors’ priorities—are too varied to make such a goal realistic.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (Canada)

English (Canada)  French (Canada)

French (Canada)