- Middle East

- 2023

- All asset classes, global

- USD 2 billion

- Provide capital market assumptions and SAA support

- Strategic Asset Allocation

Our specialist says:

The final SAA represents a well-balanced, diversified, and Shariah-compliant multi-asset portfolio, with a notable local bias. Despite this, the endowment fully utilised the 30% international investment allowance to maximise diversification. Within the international allocation, the portfolio is weighted towards assets less accessible locally, such as private equity, trade finance, leasing, and value-add real estate. This approach aligns the endowment’s strategy with global peers while respecting Shariah principles.

Client-Specific Concerns

A Middle Eastern endowment engaged bfinance to assist in refining its Shariah-compliant Strategic Asset Allocation (SAA) and broader investment strategy. The endowment's investment team had typically relied on an internal model to determine the most appropriate SAA. To enhance this analysis, the team sought to incorporate up-to-date capital market assumptions (CMAs) provided by bfinance, alongside broader feedback on the internal model and investment strategy.

Outcome

- Updating Shariah-compliant CMAs: bfinance delivered Shariah-compliant CMAs aligned with the endowment’s strategic and business objectives. These CMAs covered a broad investable universe, including traditional asset classes as well as those specific to Shariah-compliant portfolios, such as sukuks (both local and Asian), local equities, leasing, and venture capital. The endowment required institutional-grade projections for expected returns, risk levels, and correlations across investment horizons from 1 to 15 years. Additionally, detailed annual figures were provided to support the endowment’s annual payout ratio planning.

- Providing feedback on investment strategy: In addition to quantitative inputs, the endowment sought a comprehensive review of its overall investment strategy. This included a thorough assessment of the Investment Policy Statement (IPS), focusing on strategic parameters such as investment objectives, risk tolerance, and the investable universe. One key recommendation was to shift the focus towards growing the asset base on a real (inflation-adjusted) basis, rather than a nominal one, to ensure the endowment’s purchasing power increases over time.

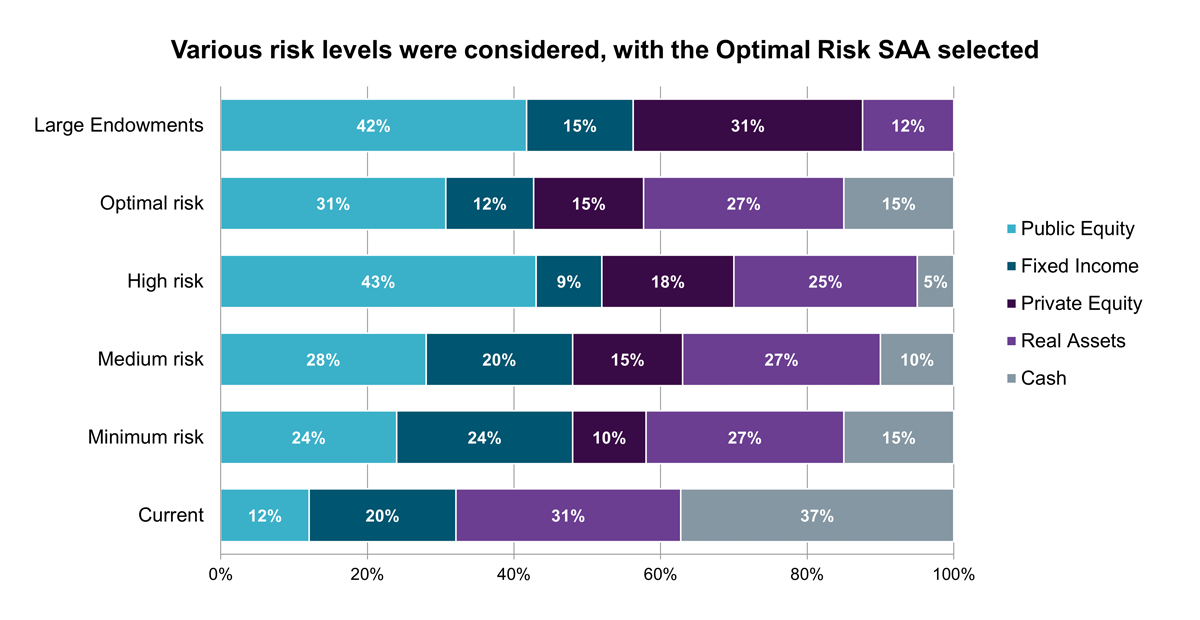

- Comparing peer groups: While conducting the SAA analysis internally, the endowment also aimed to benchmark its approach against other endowments in the US and the UK. It was identified that Shariah-compliance influenced the SAA, particularly within the private equity portfolio, which is limited to venture capital due to restrictions on leveraged buyouts. Consequently, the endowment's private equity allocation was lower than that of its peers, with a greater emphasis on core and value-add real estate to balance the portfolio's risk profile.

Source: NACUBO website and endowments‘ websites and annual statements.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (Canada)

English (Canada)  French (Canada)

French (Canada)