A forward-looking approach

A robust Strategic Asset Allocation (SAA), optimised to deliver the preferred characteristics, should form the bedrock of an investment portfolio. Yet investors are increasingly aware of the limitations of traditional SAA approaches, in which long-term strategic weights are based on single-point capital market assumptions that are used as the inputs for falsely comforting mean-variance optimisations.

As a result, we see growing demand for more nuanced, sophisticated, risk-aware approaches. We focus on providing forward-looking stochastic analysis, clarifying the probability of achieving targets and customising to clients’ needs.

Above all, our clients stay in control. SAA development is an iterative process with close client involvement and knowledge transfer. New asset classes can be considered; specific macroeconomic questions can be addressed in more depth; changing ESG considerations can be incorporated. The project team is based around the client's needs, with close collaboration from our ESG, Risk and Portfolio Design specialists as needed. Results are delivered in a board-ready report with experts presenting to the relevant stakeholders in your organisation.

Improving portfolio resilience

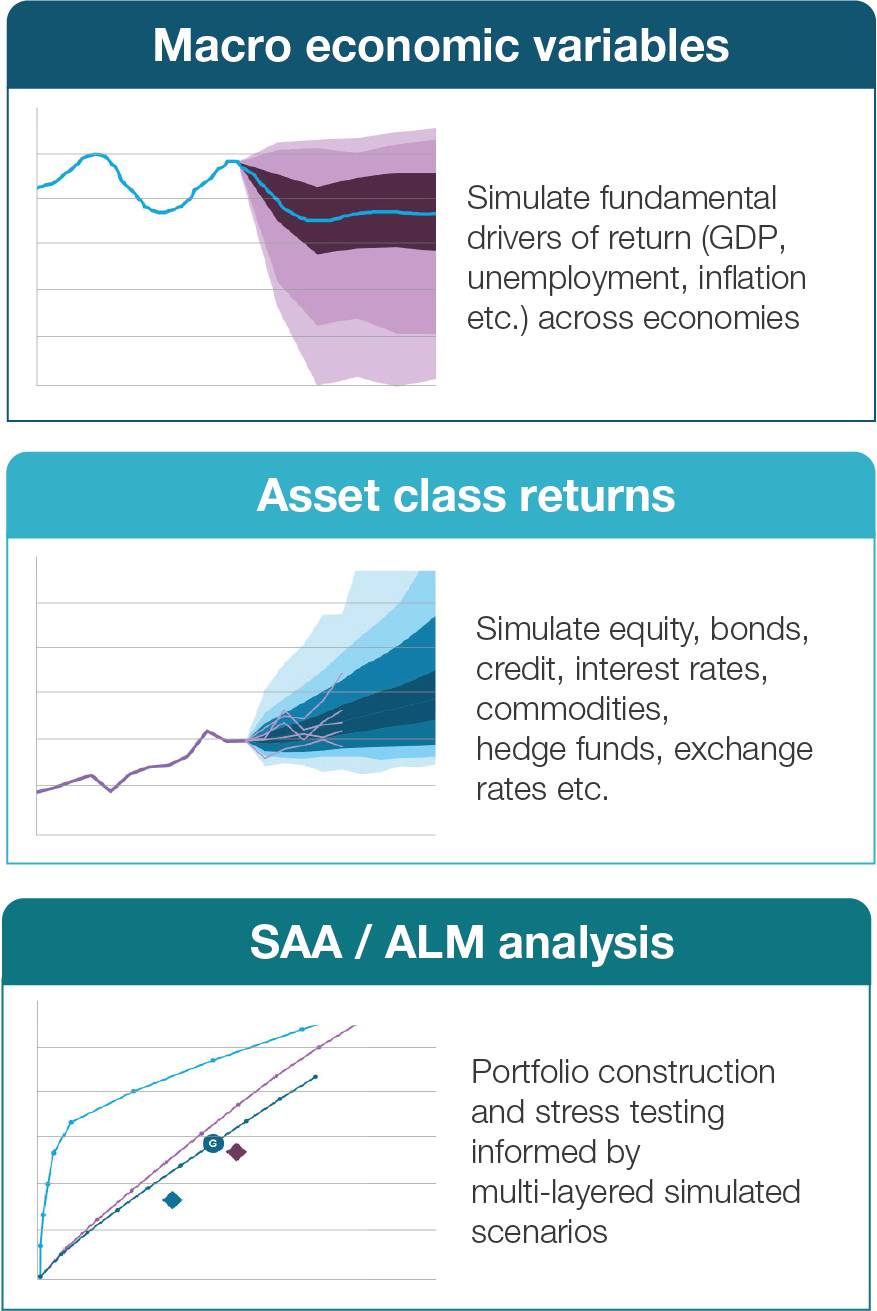

When developing a SAA, it is crucial to have a clear understanding of how the portfolio is likely to weather evolving macroeconomic conditions and unexpected market events. This might include adverse asset class scenarios (e.g. equity market corrections) or specific macro environments such as inflation, recession or rising yields. In order to do this effectively, it is crucial to understand how key macroeconomic variables interact with asset classes and sub-asset classes, rather than handling the two subjects in isolation.

We use a holistic framework that simultaneously simulates economies and asset classes. Scenarios based on real-world behaviour (“stylised facts,” such as correlations that vary by time horizon) but allow investors to gain a clear understanding of “where the portfolio could go”. Modelling also covers different time horizons (intra-year, business-cycle and long-term).

This clarity not only helps to improve resilience (to the extent desired by the investor) and inform future dyanmic or tactical shifts, but also supports strong governance of the SAA function. Senior stakeholders can gain a better view on potential outcomes and develop clear positioning on risk tolerance.

Latest case studies

Strategic Asset Allocation, Global

A UK-based family office engaged bfinance to assist in defining a Strategic Asset Allocation (SAA)...

CMA and SAA Support

A Middle Eastern endowment engaged bfinance to assist in refining its Shariah-compliant Strategic...

Policy and Strategic Asset Allocation support

The client, a Middle-Eastern financial institution, sought support for reviewing and creating its...

Strategic Asset Allocation

In early 2023, an Italian family office engaged with bfinance to create a Strategic Asset...

Latest insights from the team

What our clients say

The feedback from our auditors was ‘where do you find these different names?’ Better diversification leads to a better return; working with bfinance gives us an advantage that we wouldn’t have had with a traditional consultant.

They can reach every manager in the market. They have capabilities of doing such a deep dive on each manager, it is impossible for an organisation like us to do it on our own.

My experience working with bfinance has been absolutely positive. We have been working with them for several years which attests to the professionalism and timeliness of the whole team.

They have experts that knock your socks off. They have true experience. They’re the experts. This is what you don’t get in other consultants.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)