IN THIS PAPER

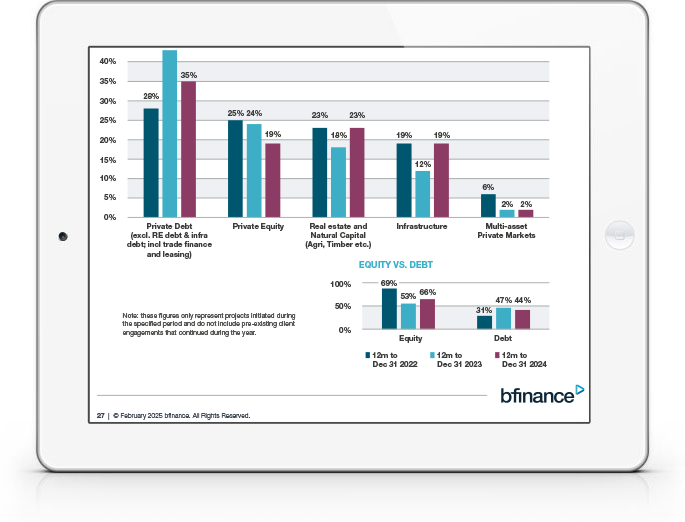

Private markets fundraising hit its lowest level since 2015, with activity slowing across Private Equity, Private Debt, and Real Estate. However, secondaries and infrastructure remained resilient, with record-breaking secondaries transactions and mega-fund closings in the pipeline for 2025.

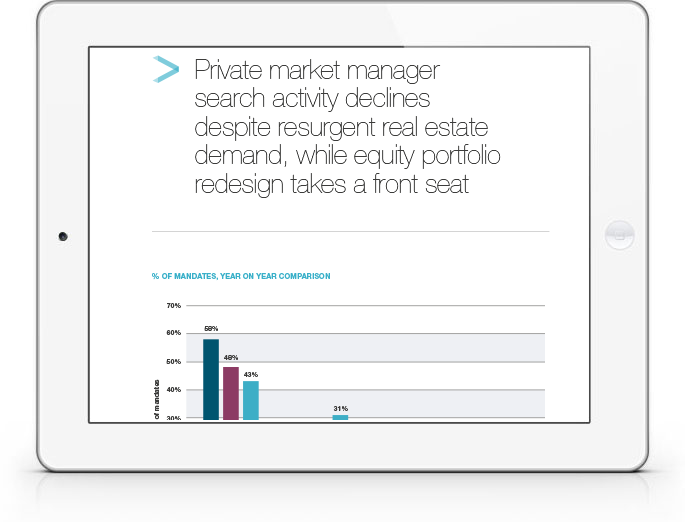

Equity market concentration remains a concern for investors, with the big tech stops continuing to drive returns, which has led to a notable increase in manager searches, accounting for over 30% of new mandates in 2024. Investors are increasingly reassessing regional, style, and factor exposures, seeking to mitigate risks stemming from narrow leadership in large-cap equities.

Fixed income strategies continue to play a crucial role in portfolio rebalancing, with Investment Grade and Emerging Market Debt manager searches reflecting a shift towards credit opportunities amid tightening spreads and evolving yield curve dynamics.

Hedge fund selection is increasingly geared towards convexity and market-independent strategies, with over 80% of searches targeting defensive diversification approaches. Investors continue to prioritise resilience against macroeconomic uncertainty and liquidity risks, even as directional strategies outperform.

WHY DOWNLOAD?

Each quarter, bfinance publishes information on investor activity, key market trends and manager performance. A quarterly snapshot of the key developments within equity, fixed income and alternative investments, including analysis of which asset manager groups performed well and which didn't.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)