Investment manager selection

Get in touch

Private Markets

The private markets team includes dedicated specialists for private equity, private debt, real estate and infrastructure, providing exceptional breadth and depth of coverage.

Fixed Income

The fixed income team includes dedicated specialists for full bond market coverage, from core global aggregate through to leveraged loans and alternative credit.

Equity

The equities team includes dedicated specialists for deep expertise across the full spectrum of listed public equity strategies for manager research and selection.

Diversifying Strategies

The diversifying strategies team provides wide-ranging expertise within liquid markets that are intended to improve on traditional portfolio outcomes and manage risk.

What sets us apart?

Control

Our goal is to work as an extension of your team, giving you the tools you need to make robust, informed decisions. With bfinance, you stay in the driving seat, having the flexibility to adjust and access additional resources when needed. This approach empowers you to negotiate with a stronger hand, ensuring you get the best possible outcomes.

Customisation

We understand that each client has unique priorities and requirements. With bfinance, you can establish your own set of priorities, adapt the process to suit the needs of your in-house team, and ensure access to the widest choice of providers. Moreover, we are dedicated to incorporating Environmental, Social, and Governance (ESG) factors that align with your specific impact investment parameters.

Clarity

Transparency and clarity are at the core of our approach. We provide full visibility into our method and analysis, allowing you to make well-justified decisions backed by a robust audit trail. Our commitment to visibility and validation ensures strong governance and enhances your confidence in the decision-making process.

bfinance gave us feedback at every stage of the process and listened to our input. I liked that it was not ‘a closed box’ - we were able to add our thoughts to the process.

strategies in our Investment Manager Platform

average mandate size for clients worked with between 2023-2024

manager meetings conducted last year

strategy types across liquid and private markets

Our manager selection philosophy

An innovative approach to manager selection

Our philosophy on manager selection at bfinance is built on recognising the uniqueness of each institutional investor. We firmly believe that your specific priorities, needs, and resources should be at the heart of our approach. Unlike the one-size-fits-all recommendations offered by many peers, our platform provides extensive coverage of the provider universe, from well-established names to boutique managers. Our decisions are based on a thorough audit trail, ensuring tailored solutions for each client.

No buy-lists

We do not rely on generic buy-lists. Instead, we curate investment solutions that precisely match your requirements and constraints. By avoiding the cookie-cutter approach, we deliver targeted and customised recommendations that align with your investment objectives.

Expert resources

With bfinance, you have full access to a dedicated project team, including a senior asset class specialist. Our team comprises experienced researchers across major public and private markets, many of whom have real-world experience managing money. Additionally, we have a team of skilled analysts to support your investment journey.

Harnessing competition

We level the playing field for asset managers, ensuring that all providers suitable for your mandate can compete on fair terms. By promoting true competition, we safeguard your interests and strengthen your negotiating position, leading to better outcomes for your investments.

ESG tailoring

We understand the significance of responsible investment, and our highly customised approach ensures that ESG considerations align with your beliefs and requirements. Our deep expertise helps you look beyond superficial box-ticking and make impactful investment decisions.

Ensuring integrity

At bfinance, we are committed to maintaining a business model free from conflicts of interest. We do not manage money or provide OCIO services, ensuring that our advice remains independent and objective. Our innovative pricing model aligns our interests with yours, fostering a long-term partnership.

Full-service care

Our support extends beyond manager selection. We offer extensive wraparound services, many of them on an inclusive basis. These services include board education, portfolio risk exposure analysis, strategy selection, opportunity set reviews, negotiating terms, and monitoring manager performance.

Manager Selection Expertise

At bfinance, our expertise lies in empowering you with an efficient and effective manager selection process. Experience the difference of our innovative approach, tailored solutions, expert resources, fair competition, ESG alignment, integrity, and comprehensive support. Let us be your trusted partner in achieving your investment goals through well-informed manager selection decisions.

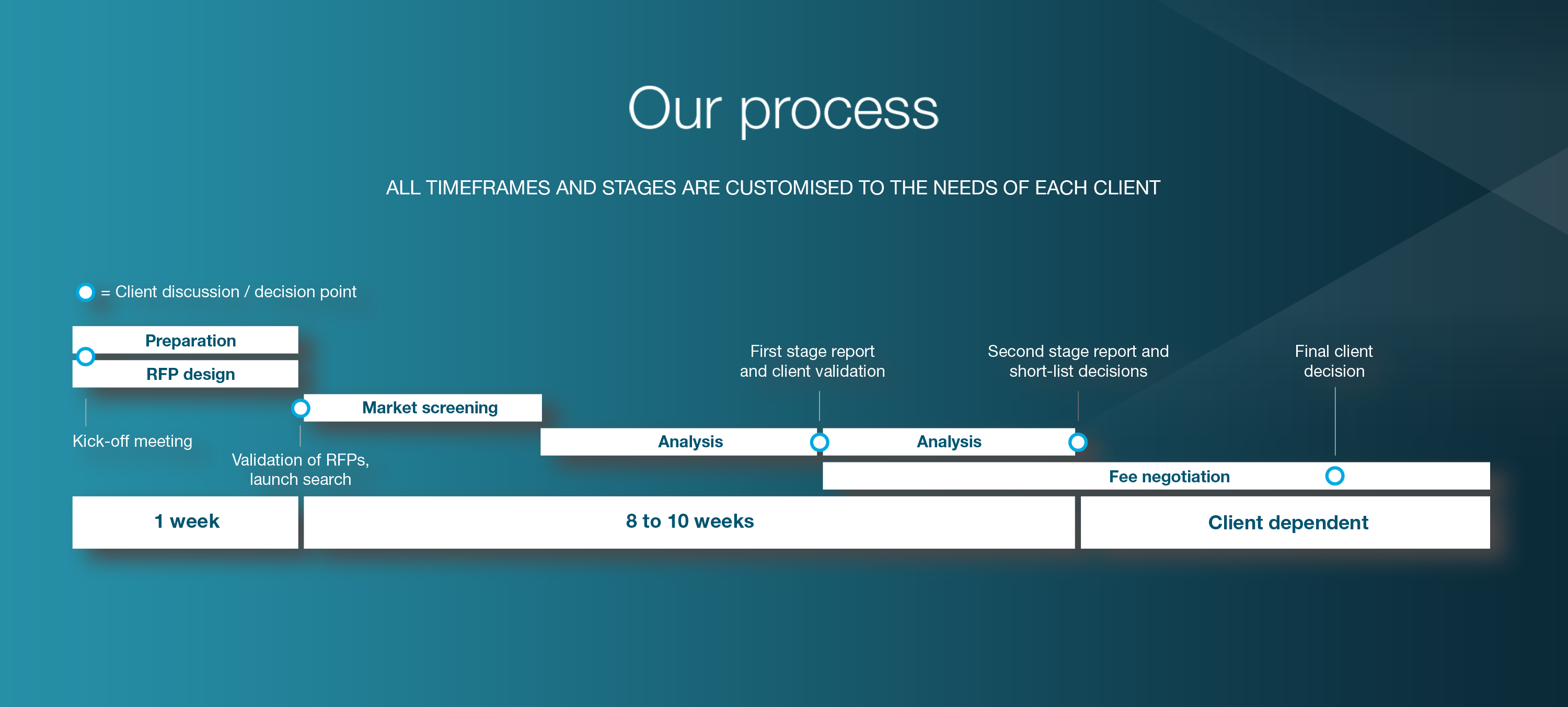

Our Manager Selection Process

All timeframes and stages are customised to the needs of each client

Recent case studies

Successful manager selection with bfinance

Manager Research Case Studies

European and Global Shariah Equity

The asset owner appointed bfinance to re-tender the European and Global equity sleeves of a multi-manager, multi-regional fund as part of a prudent governance exercise.

Global ESG Equity

The asset owner, a Nordic private pension plan, was seeking one global ESG equity manager to complement their existing global equity allocation. The investor was open to all management and...

Operational Due Diligence, Venture Capital

The internal investment team of a large UK insurance company was looking to make an allocation to a venture capital fund and required a detailed ODD review to support the Investment Committee in...

Portfolio & Manager Review

A UK pension fund appointed bfinance to support them in the review and potential reconfiguration of its active global equity and multi-asset credit portfolios.

Global Impact Equity

The investor was looking to upgrade their sustainable ESG offering to a stronger impact proposition which could demonstrate positive impact contributions across multiple sustainable development...

Global Shariah Equity

The client, a Middle Eastern insurance company, was seeking Shariah-compliant active global equity solutions, to be be managed in a segregated account structure (‘Discretionary Portfolio Management’...

European Equity

The client, a prominent Italian private pension investor, was seeking at least one pan-European equity manager to complement their existing European equity allocation.

Currency Overlay

This Canadian investor was seeking to manage their non-CAD exposures through a dynamic (non-passive) currency overlay, with an emphasis on risk management as opposed to 'currency alpha'.

Award-Winning Manager Selection

Get in touch to receive tailored financial advice from an award-winning Manager Selection firm.

What our clients say

One strength is clearly the quality of the work. The research they do and the due diligence on managers are quite comprehensive.

Working with bfinance is key for us to reach as many managers as we could. We are not able to do this due diligence on our own.

They can reach every manager in the market. They have capabilities of doing such a deep dive on each manager, it is impossible for an organisation like us to do it on our own.

How can we help you?

Connect with one of our investment specialists today and let us know how we can help.

Frequently Asked Questions

Manager selection involves identifying, evaluating, and selecting the most appropriate investment managers who can manage certain portfolios or asset classes. The due diligence exercise involves an extensive review of the manager's performance history, investment strategy, risk management practices, and fee structure to ensure that they are aligned with investor objectives.

Manager selection is important because investment managers drive portfolio performance and risk profiles. Effective manager selection enhances return, diversification, and investment activities aligned with set goals of investors. Conversely, poor manager selection can result in underperformance, increasing risk with the chance of losses. By selecting managers carefully, investors optimise their investment outcomes, seeking to ensure long-term success.

Yes, selecting a manager is time well spent for an investor, where one can provide customised investment solutions based on an investor's preferences. Consultants are able to differentiate their proposals for service as they filter and recommend the very best managers to existing and prospective investors. Proper selection of managers results in improvement in investment outcomes.

The duration of the process differs in each case based on customer requirements and search complexity, and mostly it takes weeks or sometimes months.

Our latest manager selection insights

Private Markets and the Asset Allocation Imperative

The question of how to integrate private market investments into strategic asset allocation models represents one of the most significant and sensitive issues that allocators face today. This report explores the foundational assumptions...

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)