- Middle Eastern Asset Manager

- 2024

- European & Global Shariah Equity

- USD 170 million (in aggregate)

- Portfolio review and Manager research

Our specialist says:

Identifying managers capable of delivering sustainable alpha was a top priority for this client and bfinance were able to cast a broad net to identify potential candidates. Not all managers had a live or extended Shariah track records.

To ensure adaptability to Shariah constraints, it was crucial that managers, who already had a good conventional performance profile, could smoothly implement the client’s Shariah restrictions - without materially impacting their investment process and in turn inhibiting their repeatable alpha potential.

- 163Considered

- 12Proposals accepted

- 4Shortlist

- 1 manager to be selected

European managers

- 278Considered

- 38Proposals accepted

- 8Shortlist

- 1 manager to be selected

Global managers

Client-specific concerns

The asset owner appointed bfinance to re-tender the European and Global equity sleeves of a multi-manager, multi-regional fund as part of a prudent governance exercise. The asset owner prioritised the pursuit of ‘sustainable alpha’ and was seeking a manager that could deliver a smooth path of excess returns across different market environments.

Shariah compliance was required but the investor was open to different implementation approaches, such as by defining the eligible universe with a Shariah index, using an external advisor, or coding restrictions into compliance and trading systems.

Outcome

- Pursuing ‘sustainable alpha’: the path of returns was as important as the magnitude of returns for this client. bfinance assessed portfolio fundamentals and philosophical approaches to filter out strategies with strong and persistent style biases. From a quantitative track record perspective, bfinance researchers evaluated outperformance consistency, and both up-capture and down-capture, to give weight to managers able to deliver performance in different market environments.

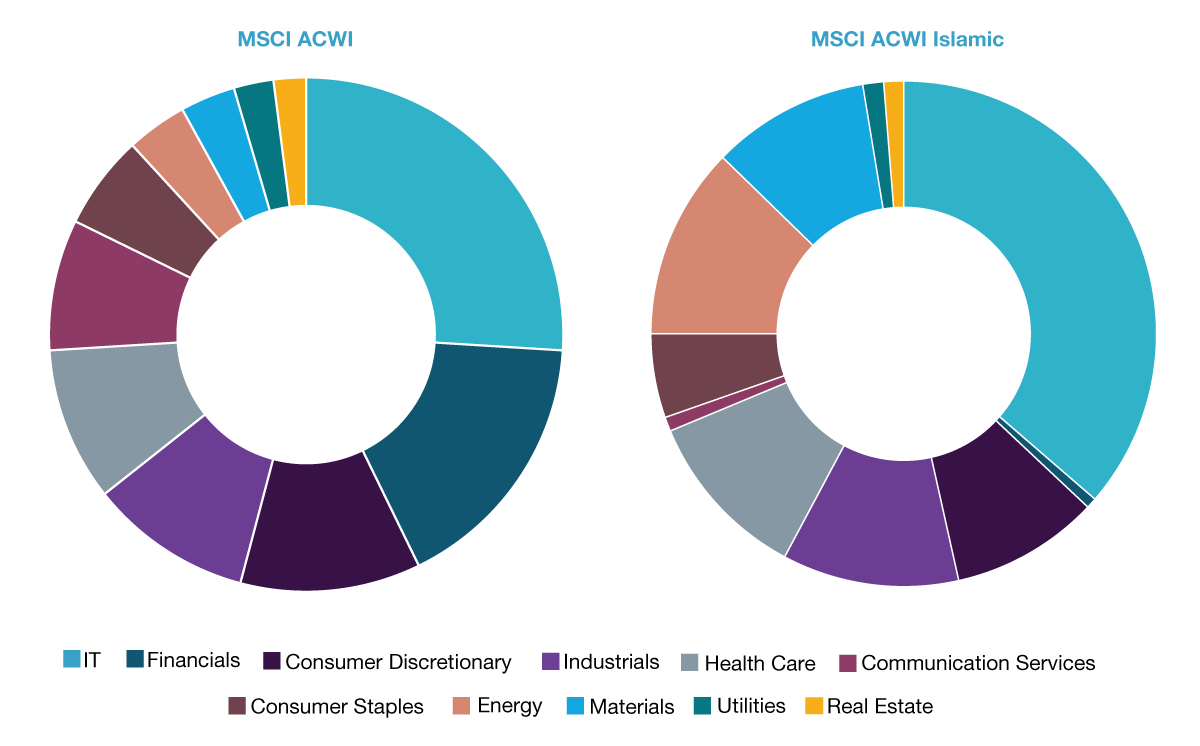

- Assessing Shariah compliance: as well as understanding how a manager would implement the Shariah requirements as part of its investment process, bfinance assessed the extent to which conventional portfolios and performance may be impacted by this adaptation. For instance, bfinance used performance attributions to evaluate (for example) how significant financials have been to historical alpha (given the sector is largely excluded from Shariah indices).

- Finding international manager partners: the client was seeking managers that could be a strategic partner. The search targeted international managers rather than local players and was open to managers that had not yet run a Shariah-compliant version of their strategy. This broadened the eligible universe of candidates for the investor.

- Fee improvements: as a retender, the search held up the incumbent manager against the broad universe for revaluation in a competitive whole-of-market process. This enabled bfinance to help the asset owner better understand the characteristics and relative strengths of their existing mandate against the strongest alternatives in the market. Costs were an important consideration – not just the absolute fee levels proposed but the value for money for each strategy’s alpha generation. The bfinance search process helped achieve fee discounts of over 40% versus rack-rate levels in some cases.

Source: MSCI, at December 2024.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)