Manager research

Get in touch

Private Markets

The private markets team includes dedicated specialists for private equity, private debt, real estate and infrastructure, providing exceptional breadth and depth of coverage.

Fixed Income

The fixed income team includes dedicated specialists for full bond market coverage, from core global aggregate through to leveraged loans and alternative credit.

Equity

The equities team includes dedicated specialists for deep expertise across the full spectrum of listed public equity strategies for manager research and selection.

Diversifying Strategies

The diversifying strategies team provides wide-ranging expertise within liquid markets that are intended to improve on traditional portfolio outcomes and manage risk.

What sets us apart?

Control

Our goal is to work an extension of your team, giving you the tools you need to reach robust, informed decisions. Stay in the driving seat with continuing flexibility and additional resources when you need them. Negotiate with a stronger hand.

Customisation

Establish unique priorities, adapt the process to suit the needs of your in-house team, ensure the widest choice of providers, define specific ESG and impact investment parameters.

Clarity

Full transparency on method and analysis so that decisions can be justified with a robust audit trail. Visibility and validation underpin strong governance.

bfinance gave us feedback at every stage of the process and listened to our input. I liked that it was not ‘a closed box’ - we were able to add our thoughts to the process.

strategies in our Investment Manager Platform

average mandate size for clients worked with between 2023-2024

manager meetings conducted last year

strategy types across liquid and private markets

Our manager research philosophy

An innovative approach to manager research

Every institutional investor is unique, with specific priorities, needs and resources. The bfinance philosophy on manager selection grew out of our belief that these differences should sit at the heart of our approach.

No buy-lists

The platform provides extensive coverage of the provider universe, from household names to hard-to-reach boutiques, with a robust audit trail on key decisions. Unlike the ‘off the shelf’ recommendations so often used by our peers, solutions are targeted to clients’ specific needs and constraints

Expert resources

Each client has full access to their dedicated project team including their senior asset class specialist. We retain a staff of senior researchers across all major public and private markets, many of whom have managed money, as well as a team of analysts.

Harnessing competition

We create a level playing field for asset managers, ensuring that all providers who are suitable for a single investor’s mandate can compete on fair terms. True competition also supports investors’ interests and gives clients a stronger hand in negotiation.

ESG tailoring

When it comes to responsible investment, investors bring very different beliefs and requirements. A highly customised approach ensures that ESG verdicts are not ‘one size fits all’, while deep expertise helps our clients look past superficial box-ticking.

Ensuring integrity

The firm is committed to a business model that avoids conflicts of interest and consistently supports the provision of independent, objective advice. For example, the firm does not manage money or provide OCIO services. An innovative pricing model aligns our interest with those of our clients.

Full-service care

We provide extensive wraparound services, many of them on an inclusive basis. These include board education, analysing portfolio risk exposures, strategy selection, reviews of the opportunity set, negotiating terms and monitoring manager performance.

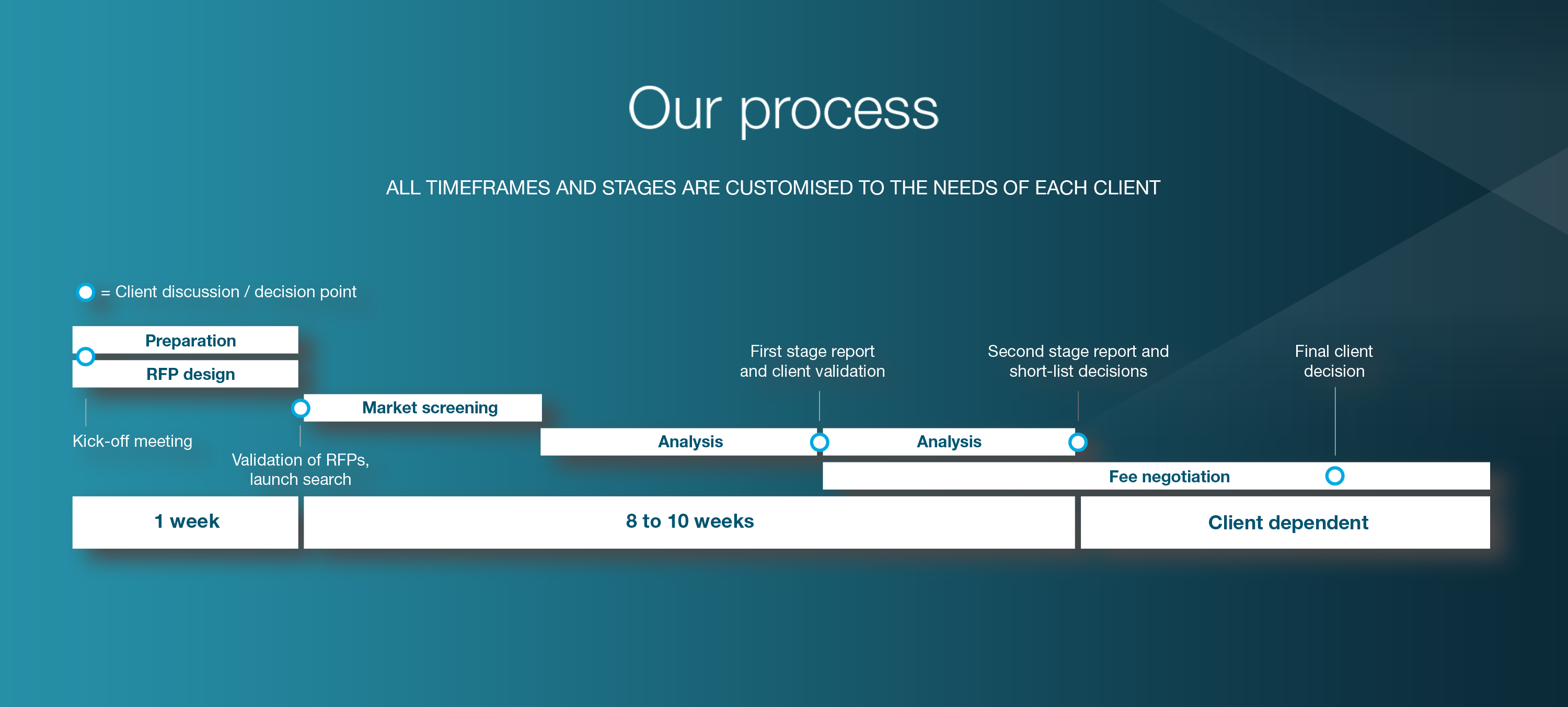

Our Manager Research Process

All timeframes and stages are customised to the needs of each client

Successful manager research with bfinance

Manager Research Case Studies

European and Global Shariah Equity

The asset owner appointed bfinance to re-tender the European and Global equity sleeves of a multi-manager, multi-regional fund as part of a prudent governance exercise.

Global ESG Equity

The asset owner, a Nordic private pension plan, was seeking one global ESG equity manager to complement their existing global equity allocation. The investor was open to all management and...

Operational Due Diligence, Venture Capital

The internal investment team of a large UK insurance company was looking to make an allocation to a venture capital fund and required a detailed ODD review to support the Investment Committee in...

Portfolio & Manager Review

A UK pension fund appointed bfinance to support them in the review and potential reconfiguration of its active global equity and multi-asset credit portfolios.

Global Impact Equity

The investor was looking to upgrade their sustainable ESG offering to a stronger impact proposition which could demonstrate positive impact contributions across multiple sustainable development...

Global Shariah Equity

The client, a Middle Eastern insurance company, was seeking Shariah-compliant active global equity solutions, to be be managed in a segregated account structure (‘Discretionary Portfolio Management’...

European Equity

The client, a prominent Italian private pension investor, was seeking at least one pan-European equity manager to complement their existing European equity allocation.

Currency Overlay

This Canadian investor was seeking to manage their non-CAD exposures through a dynamic (non-passive) currency overlay, with an emphasis on risk management as opposed to 'currency alpha'.

Award-Winning Manager Research

Get in touch to receive tailored financial advice from an award-winning Manager Research firm.

What our clients say

One strength is clearly the quality of the work. The research they do and the due diligence on managers are quite comprehensive.

Working with bfinance is key for us to reach as many managers as we could. We are not able to do this due diligence on our own.

They can reach every manager in the market. They have capabilities of doing such a deep dive on each manager, it is impossible for an organisation like us to do it on our own.

How can we help you?

Connect with one of our investment specialists today and let us know how we can help.

Frequently Asked Questions

Manager research involves the investigation and selection of investment managers that best fit one’s investment strategy and goals, or that will complement existing managers and strategies. This process includes a thorough assessment of each manager's performance, risk management, and overall fit.

The first step in the manager research process is an initial consultation to understand one's investment objectives, risk tolerance, and specific needs, to provide our researchers with the information required to support an investor’s end goal.

The timeline can vary greatly depending on the scope of the project, but a typical research process can take anywhere from a few weeks to several months.

Our latest manager research insights

Private Markets and the Asset Allocation Imperative

The question of how to integrate private market investments into strategic asset allocation models represents one of the most significant and sensitive issues that allocators face today. This report explores the foundational assumptions...

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)