IN THIS PAPER

Interrogating the foundations for expected return and volatility: Assumptions should be handled with care and the artificially smooth volatility profile of private equity should be circumvented in asset allocation modelling.

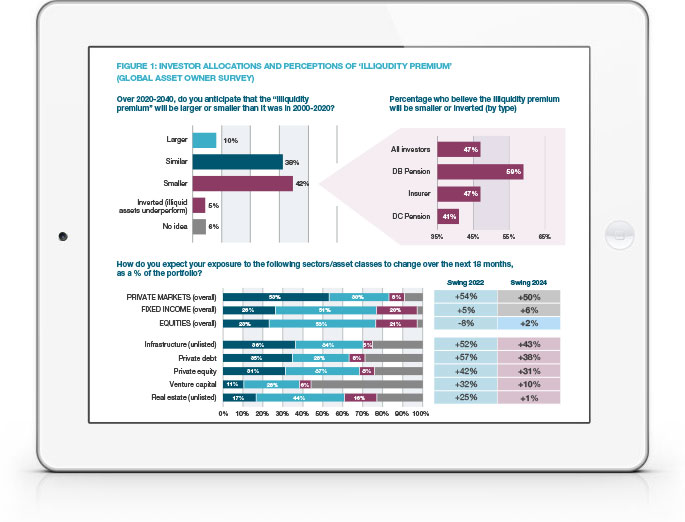

A public-plus-premium approach: We propose an approach based on taking public equity return expectations (with some consideration for stronger and weaker methods) and adding an ‘illiquidity premium’ on top. Conclusions regarding the extent of this ‘premium’ have varied widely; a variety of research conclusions should be considered.

Eye on trends: Whatever the historic data may suggest, investors integrating private markets into asset allocation cannot overlook the significant changes in the asset class—size, structure, landscape of managers, investor base, instruments, valuations—that may affect risk and return going forwards

WHY DOWNLOAD?

The absence of robust benchmarks that can be used to estimate the returns and volatility of private market asset classes is a problem that has long vexed investment strategists.

This limitation has become increasingly consequential over time as investors have dedicated larger allocations to illiquid investments such as private equity, private credit and infrastructure. Insufficiently conservative estimates may present a key risk, but overly conservative assumptions could inhibit exposure to asset classes that represent an increasingly large slice of the real economy. Private equity alone now represents approximately ten percent of total public equity market capitalisation, up from less than five percent in 2010; the growth of unlisted infrastructure and private credit is similarly striking.

Where attempts have been made to compile a meaningful volume of historic data, researchers can find it difficult to determine how to address issues such as de-levering and correct for factors such as size and value. It is also tricky to mould the information into LP-centric (as opposed to GP-centric) forms – forms that take full account of the gulf between fund IRRs and true, time-weighted, risk-adjusted, net-of-fee, returns for investors.

Even where such problems may be overcome, strategists enter even rockier terrain when considering the dramatic changes that have occurred in private markets—and their relationship with public markets—in the recent past. Yet major shifts have undermined the validity of historic data as a tool for analysis, including: this rapid growth itself, buoyed by hugely positive fundraising dynamics (now considerably softened); the decline in IPO activity; the long standing downward trend in private equity fund distributions; and the ways in which GPs have pivoted towards other forms of exit (or indeed non-exit).

Indeed, the latest bfinance Global Asset Owner Survey (November 2024) indicated that nearly half of investors are now anticipating a reduced long-term illiquidity premium (page 4). It is more important than ever to validate how private markets are incorporated within asset allocation, and to ensure that this subject is appropriately governed.

In this article, we consider how to produce SAA model inputs specifically for the Private Equity asset class, with an approach founded on applying ‘illiquidity premia’ to public market return expectations. In addition, the report closes with a reflection on governance and the importance of maintaining ownership of these decisions, no matter how much delegation an institution uses for implementation.

We hope that the discussion helps to support investors who are tackling the crucial subject of asset allocation decision-making for private markets, both within their institutions and (where relevant) by their service providers

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)