bfinance insight from:

Marco Stigler-Thomas

Director, Client Consulting

Analysis of investor data gathered for the latest bfinance Global Asset Owner Survey reveals distinctive challenges and priorities for family offices in 2025.

With a theoretically broader remit for unconstrained esoteric investing, flexible time horizons and comparatively high return targets, family offices often tend to stand apart—in surveys of this type—from institutional counterparts such as insurers and pension funds. This brief analysis shows a selection of findings, with an eye on the similarities and differences in key trends for both groups.

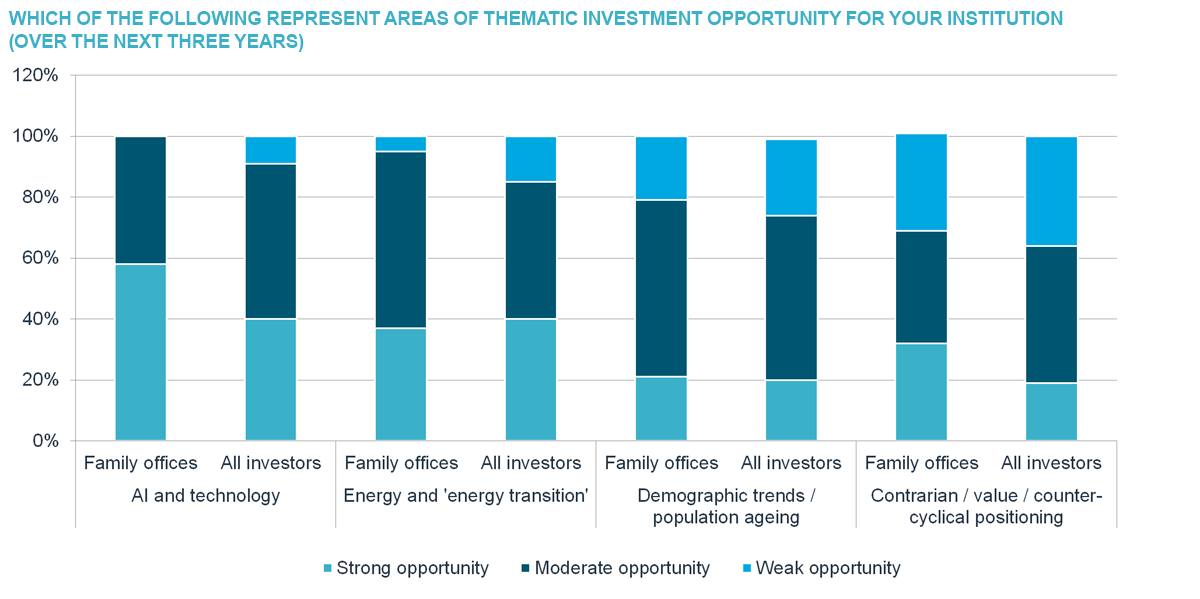

1. FOs seeking technology/artificial intelligence opportunities

Nearly 60% of family offices, according to late-2024 data, believe there is a “strong opportunity” in AI/technology investing, versus 40% of the broader investor group surveyed by bfinance (pension funds, insurers and others). By way of contrast, family offices were less likely to predict attractive opportunities relating the “energy transition” (37% of them believe there is a “strong opportunity” here, versus 40% of the broader investor community).

Source: bfinance Global Asset Owner Survey. Data gathered October 2024

To some extent, the perception of opportunity may be influenced by asset class usage (illustrated in #2 below): family offices are significantly more likely to invest in venture capital, where emergent digital technology is a prominent theme, due to a combination of smaller size and relevant expertise/access. Meanwhile, they are less likely to have exposure to unlisted infrastructure (an asset class in which energy transition opportunities are particularly evident).

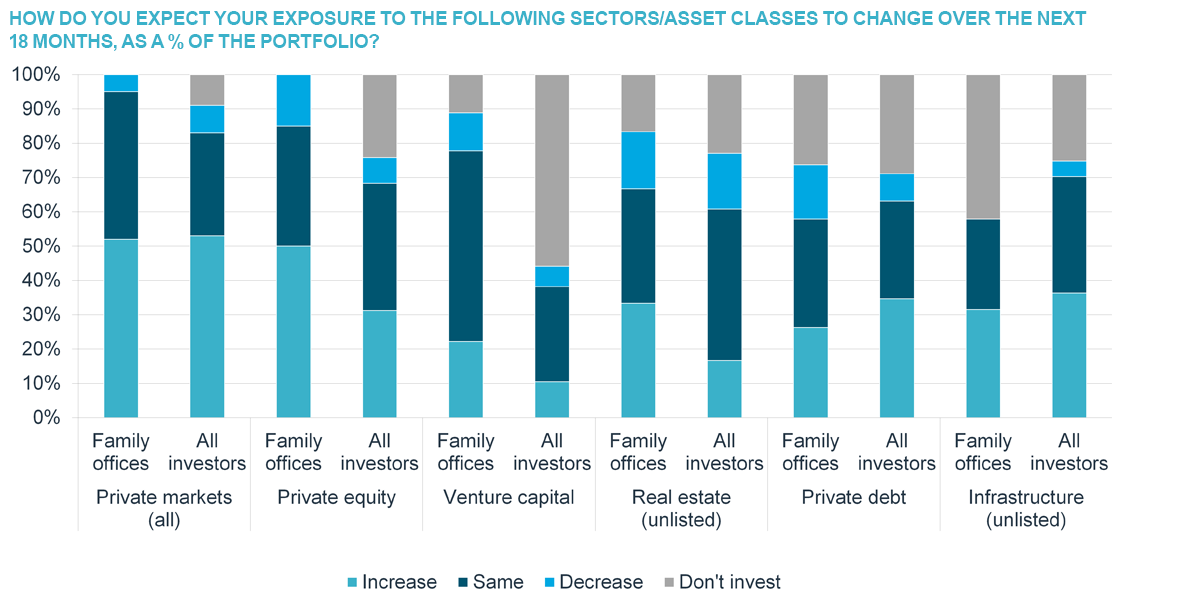

2. Leaning further into private markets

As noted above, family offices are significantly more likely to have exposure to certain illiquid asset classes than their institutional counterparts – particularly venture capital (89% invest in this asset class, versus 44% of the full investor group) and private equity (100% versus 76%). The UBS Global Family Office Report 2024 states the average family office asset allocation to private equity is around 22%, which is the highest allocation of all alternatives.

Interestingly, the latest data shows that family offices are also more likely to be increasing their exposure to certain illiquid asset classes over the coming months.

Source: bfinance Global Asset Owner Survey. Data gathered October 2024

For example, 50% of family offices are boosting private equity allocations, compared with 31% of the broader investor group surveyed here. In addition, 33% are now hiking exposure to unlisted real estate, versus just 17% of the full investor group, even though both cohorts exhibit similar opinions about the trajectory of real estate market recovery: >60% of both groups expect a moderate (5%+) or significant (10%+) recovery in core real estate valuations in the twelve months to end-October 2025. From our experience, family offices can be described as contrarian investors and are more opportunistic investors. According to J.P. Morgan Private Bank 2024 Family Office report private equity mean allocations are just slightly 2% above mean allocations to real estate with 14.47% and it is often invested through concentrated and direct exposure. Meanwhile, even though family offices are still less likely than investor peers to have exposure to unlisted infrastructure (58% versus 75%), there is a very strong positive trend in favour of this asset class.

It’s worth noting, however, that family offices show the weakest trend towards private debt among all investor groups surveyed: although three quarters of family offices use this asset class, just 26% are increasing exposures while 16% are cutting their allocations; the surge of institutional activity in this sector, combined with the prospect of potential interest rate cuts, has weakened family office demand.

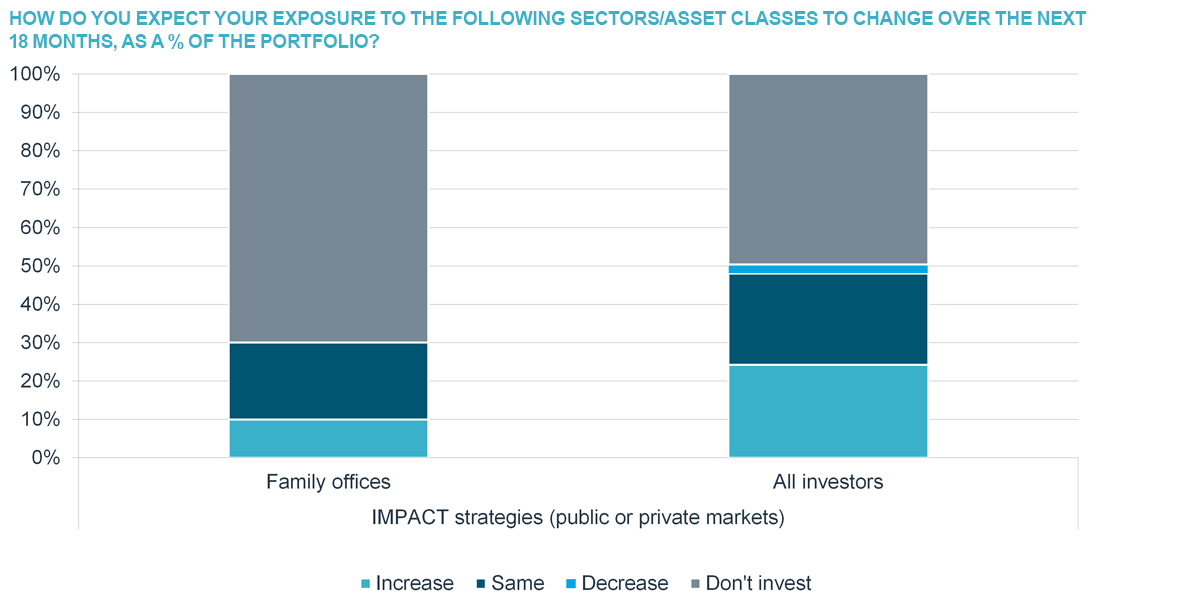

3. Dividing over impact investing

Although we do see family offices that are extremely active in the impact investment theme (including bfinance clients), survey data shows that family offices are considerably less likely to be involved in this area than the broader investor peer group: nearly 30% of family offices are either currently investing in ‘impact strategies’ or intend to invest soon, compared with around 50% of all surveyed investors.

Source: bfinance Global Asset Owner Survey. Data gathered October 2024

With family offices seeking, over time, to integrate the priorities and beliefs of the next generation within their investment mandates and missions, it will be interesting to see how this subject evolves in the future. Where families do decide to get involved in impact investing (and of course many already have), they possess certain advantages versus institutional peers in terms of flexibility: family offices can be thoughtful and non-prescriptive in terms of the financial profile they’re able to accept and the nature/measurability of the positive impact—environmental, social or both—that they’re looking to generate.

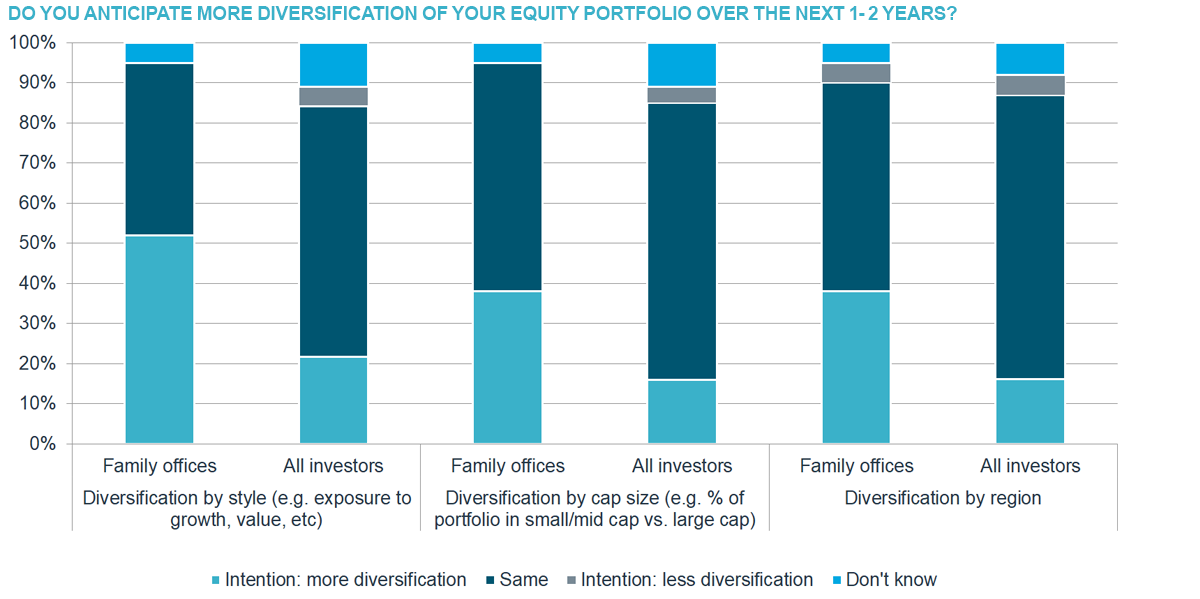

4. Diversification: equity ‘style’

Family offices are considerably more likely than institutional counterparts to be anticipating diversification of their public equity exposures over the next one-to-two years. Indeed, more than half of family offices surveyed anticipate more diversification by equity ‘style’ (e.g. growth, value etc.), versus just 22% of the full investor group.

Source: bfinance Global Asset Owner Survey. Data gathered October 2024

That being said, it’s important to bear in mind the context of current portfolios. Family offices are more likely (at risk of over-generalising) to have quite a concentrated portfolio of stocks, with specific positions held for a variety of reasons (including legacy ownership status) and may be intending to improve diversification from this basis. Institutions, on the other hand, are more likely to hold a significant proportion of their equity allocations in passive or otherwise highly diversified portfolios; here, the subject of overall equity market concentration—which has increased over the course of 2023-24—is more relevant. Family offices are not regulated in the same manner as their institutional peers, which allows them to be more adventurous and invest in niche asset classes with higher return targets and less liquidity.

Closing thoughts

The trends shaping family office investment strategies in 2025 reflect their distinct approach within the broader asset owner landscape. Their growing interest in technology and AI, increasing allocation to private markets, and exploration of diversified equity strategies highlight opportunities to leverage their flexibility and bespoke investment preferences. While family offices may be less aligned with institutional peers in areas like private debt or impact investing, their unique position allows them to adapt thoughtfully to shifting priorities and emerging opportunities.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)