Access private markets

Get in touch

Solutions for private market success

For wealth managers, simply having access to private market investment is not enough. Success lies in delivering compelling, market-ready products that truly engage high-net-worth (HNW) clients.

More than a gateway: bfinance Access empowers wealth managers to deliver outstanding private market offerings, regardless of where you are on your journey. With research and consulting expertise, paired with leading tech and infrastructure partners, Access is a 360˚ solution built for business impact.

The outcome? HNW clients achieve portfolios that embody current best practice among the most sophisticated institutional investors. Risk and return parameters, diversification objectives and liquidity needs are all customised to the needs of your client base.

Unleash potential

We are witnessing an extraordinary wave of democratisation in private market investment, with a proliferation of opportunities intended to facilitate HNW access to Private Equity, Private Debt, Infrastructure, Real Estate and more. With bfinance Access, wealth managers unlock the benefits of private markets for their clients and businesses.

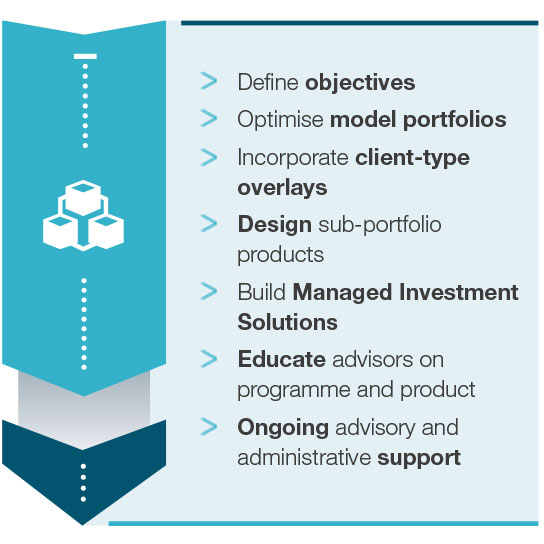

Access starts by assessing your goals, constraints, and existing investments, optimising model portfolios to agree long-term desired exposures. Sub-portfolios are then developed and constructed into customised Managed Investment Solutions offering an annual programme of opportunities. Fund sourcing is supported by a rigorous asset manager search process, refined over 25+ years. Educational resources and marketing materials enhance advisor engagement. Comprehensive ongoing services include reporting, cashflow management and much more.

Read our Frequently Asked Questions here.

Achieve seamless efficiency

Client reporting, subscription processes and cashflow management are taken care of, so you can focus on what matters most.

25+ years

of private markets advisory heritage

500+

private markets engagements across 33 countries and 170 clients

US$40bn+

assets deployed into private markets for clients

1400+

private markets managers on our open-access manager platform

Engage your client advisors

Advisor education is critical to ensuring appropriate client buy-in to your private markets offering.

Through your white-labelled platform, advisors can access research, educational content and fund-specific materials, as well as accessing their clients’ portfolios through interactive dashboards. Our team continues to function as an extension of your own, refining the programme based on your evolving objectives and delivering ongoing support.

Frequently Asked Questions

Find out more about bfinance Access

bfinance Access is a comprehensive B2B solution designed to help wealth managers unlock the potential of private markets for their high-net-worth (HNW) clients.

Many wealth managers struggle to deliver compelling, market-ready private market solutions that resonate with clients. bfinance Access empowers wealth managers to overcome this challenge by providing:

- Outcome-oriented approaches: The program focuses on achieving specific client goals, guided by a consultative approach and deep industry knowledge.

- Comprehensive investment expertise: bfinance Access offers a full suite of services, from portfolio design and manager research to due diligence and ongoing monitoring.

- Leading technology and infrastructure: cutting-edge technology and robust infrastructure are leveraged to ensure a seamless client experience.

The bfinance Access solution has been developed to enable wealth managers to offer unique and differentiated solutions. As a fully independent investment consultant, bfinance does not manage assets or distribute investment products – we work for our clients as an extension of their team to deliver solutions which are fully tailored to their firm's objectives. We understand that no two firms are the same.

bfinance Access offers wealth managers and their advisors the opportunity to move away from opportunistic fundraising into third-party products, and instead deliver a programme of their own products with a long-term strategy that clients can understand and engage with from inception.

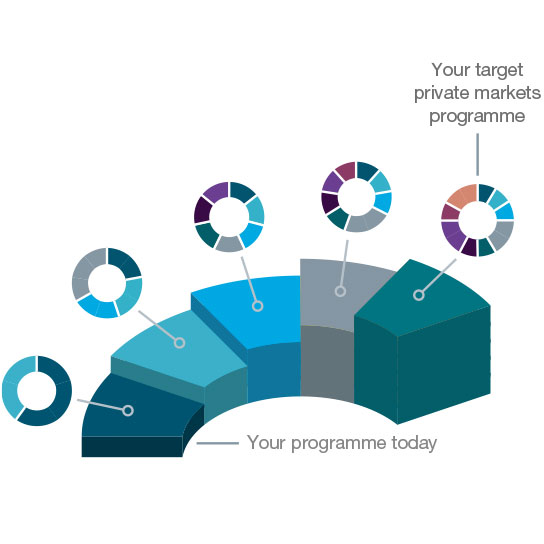

With its comprehensive framework, bfinance Access goes beyond simply providing ‘access’ – it empowers wealth managers to harness the full potential of private markets at any stage of their implementation journey, from initial entry to advanced integration.

With highly competitive and transparent pricing, Access is designed to ensure fair fees for underlying clients alongside a strong commercial proposition for wealth managers.

bfinance Access provides a complete solution with three main stages:

- Understanding your needs: This stage involves assessing a wealth manager's existing private market capabilities and defining the goals of their program.

- Building the right product: bfinance Access helps design and implement tailored investment portfolios, including model portfolios, fund selection, and white-labelled technology for a seamless client experience.

- Enabling Growth: This stage provides ongoing support, including analytics, educational content, and product support to empower sales teams and drive growth. As a continued extension of your team, bfinance monitors and reports on the development of your programme – providing recommendations on programme enhancements to ensure it continues to meet the needs of your firm and your underlying clients.

bfinance has comprehensive coverage across all private markets asset classes and sub-asset classes:

- Private Equity including Buyout, Growth, Venture, Secondaries, Co-Investments and Impact.

- Private Credit including Corporate Lending, Trade Finance, Speciality Finance, Asset-Backed Lending and Special Situations / Distressed Credit Opportunities.

- Infrastructure including Renewables, Value-Add, Core/Core+, Infra Debt and Listed Infrastructure.

- Real Estate incuding Core, Value Add, Opportunistic, Real Estate Debt and REITs.

bfinance Access offers flexible solutions incorporating both closed-ended and open-ended evergreen semi-liquid funds which are adaptable to diverse client needs, including:

- Multi-vintage, multi-asset class Managed Investment Solution (MIS): this option combines different asset classes across multiple vintage years to provide diversification with a single commitment.

- Single vintage, multi-asset Class MIS: this option combines different asset classes within a single vintage to provide diversification with 3-4 commitments over multiple vintage years.

- Single asset class MIS: this option combines multiple funds within a given asset class into a vintage solution to provide diversification within a given asset class – or across more than one asset class when multiple single asset class MIS are offered. This option offers more customisation to investors to weight their portfolios according to their own preferences.

- Single Fund Managers: this option provides access to single funds and requires 15+ commitments for reasonable diversification. This option offers the highest degree of customisation to investors.

By working with you to define your private markets programme objectives upfront, bfinance can make recommendations of the appropriate type of solutions which best suit your client base and programme objectives.

Leveraging our significant experience in private markets fund search and selection, we source the most appropriate and best managers in the market to build your solution(s).

The bfinance Access solution is designed to accommodate a broad range of client needs with global coverage. Through a collaborative consultation process, we help you identify the specific client segments you want to target with your private markets solution. This may involve creating tailored strategies for different client types and mandates within your organization.

After defining these needs, we leverage our approved partner network of technology and infrastructure providers to identify the most suitable investment structures to achieve your goals. Our solutions include various structures and wrappers that enable private market program delivery across a diverse client base, including professional, semi-professional, well-informed, and retail investors.

By building effective private market programmes, wealth managers:

- Improve client retention by offering an increased investment opportunity set and enhanced risk vs. return outcomes.

- Win new clients by becoming a market innovator and offering a unique investment proposition.

- Create new revenue streams which are long-term and recurring in nature.

The implementation of effective private market programmes allows wealth managers to benefit from increased operational efficiency, while clients gain exposure to the performance and portfolio benefits that a top-tier solution can provide.

With bfinance Access, regulated entities are appointed as Investment Manager, with bfinance as the Programme Manager. This model enables wealth managers to tailor their investment management fees, creating a valuable additional income stream as you scale your programme.

bfinance Access provides tools and expertise to help wealth managers effectively model and manage cashflows and exposure at both the programme level and underyling client level – ensuring both a strong oganisational understanding of programme development, and enriched client | advisor engagement at individual portfolio level through interactive dashboards.

For funds where capital calls are a consideration, bfinance Access can provide customised capital call schedules tailored to the desired operating model of your firm – e.g. annual, quarterly or in-line with target funds. This has both operational benefits to the wealth manager and helps clients to understand their available liquidity.

Through the Access platform, each end investor has their own individual client capital accounts which provides fund and portfolio level reporting via interactive account dashboards and/or API integration to a wealth managers own reporting engine.

Interactive dashboards provide real-time visibility, reducing administrative burdens for wealth managers.

bfinance Access programmes are delivered through white-labelled platform technology and wealth-friendly structures in partnership with leading private markets platform providers. Investments can be made by individuals, investing entities, nominee or omnibus accounts.

Through a streamlined platform, advisors and clients can easily opt to make an investment, complete AML/KYC and legal reviews with minimal effort – with subscription documents pre-populated.

It is possible to invest as individual clients, investing entities and nominee accounts. Investing through your nominee account can provide substantial advantages:

- Streamlined KYC and AML: completed on the nominee entity only. There will be no requirement to complete KYC and AML of the underlying clients of the nominee account.

- Asset retention: Create ‘stickiness’ by internally pledging client assets to cover undrawn commitments.

- Flexibility on client minimums: The minimum for the nominee entity as an LP remains €100,000, but you control the minimum amount for your clients investing into your nominee account.

- Transferability: facilitates the transfer between your clients with no need to notify the fund, providing the potential to create your own internal secondary market.

bfinance Access provides ongoing support and resources to empower advisor teams, including:

- Advisor education series: Provides in-depth insights into private markets, program methodology, and client benefits.

- Product-specific training: Covers specific funds and products offered through the program, ensuring advisors are well-equipped to discuss solutions with clients.

- Market updates and insights: Keeps advisors informed about current trends and opportunities within private markets.

- Ongoing programme management and reporting: continual re-assessment of programme goals in-line with programme development to ensure products continue to be aligned with the firm’s objectives. This includes detailed fund level and programme level reporting.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)