- Pension Fund, UK

- 2024

- Global equities & multi-asset credit (MAC)

- GBP +2 billion

- Review current equity and MAC portfolios

- Portfolio design,ESG, Manager selection

Our specialist says:

This project exemplified bfinance’s integrated approach, leveraging the collective expertise of the Portfolio Design, ESG and Manager Research teams. These teams collaborated closely to assess individual managers and strategically combine them to optimise the client’s equity and MAC portfolios. The focus extended beyond theoretical improvements to practical viability, ensuring that the proposed changes were not only cost-effective but also implementable. This collaboration was crucial in developing a refined portfolio allocation that was strategically sound and operationally feasible, showcasing bfinance’s commitment to delivering robust and pragmatic portfolio strategies.

Client-specific concerns

A UK pension fund appointed bfinance to support them in the review and potential reconfiguration of its active global equity and multi-asset credit portfolios. Comprising four equity and two MAC managers, these portfolios were analysed to ensure alignment with the fund's strategic objectives, which include meeting the performance targets of MSCI ACWI +1.5% net of fees for equities, and 3-month SONIA +3% net of fees for MAC. bfinance also conducted a thorough review of the accessible managers through the client’s investment platform, assessing potential portfolio adjustments to enhance the existing investment strategy, and evaluating the feasibility of these adjustments for implementation.

Outcome

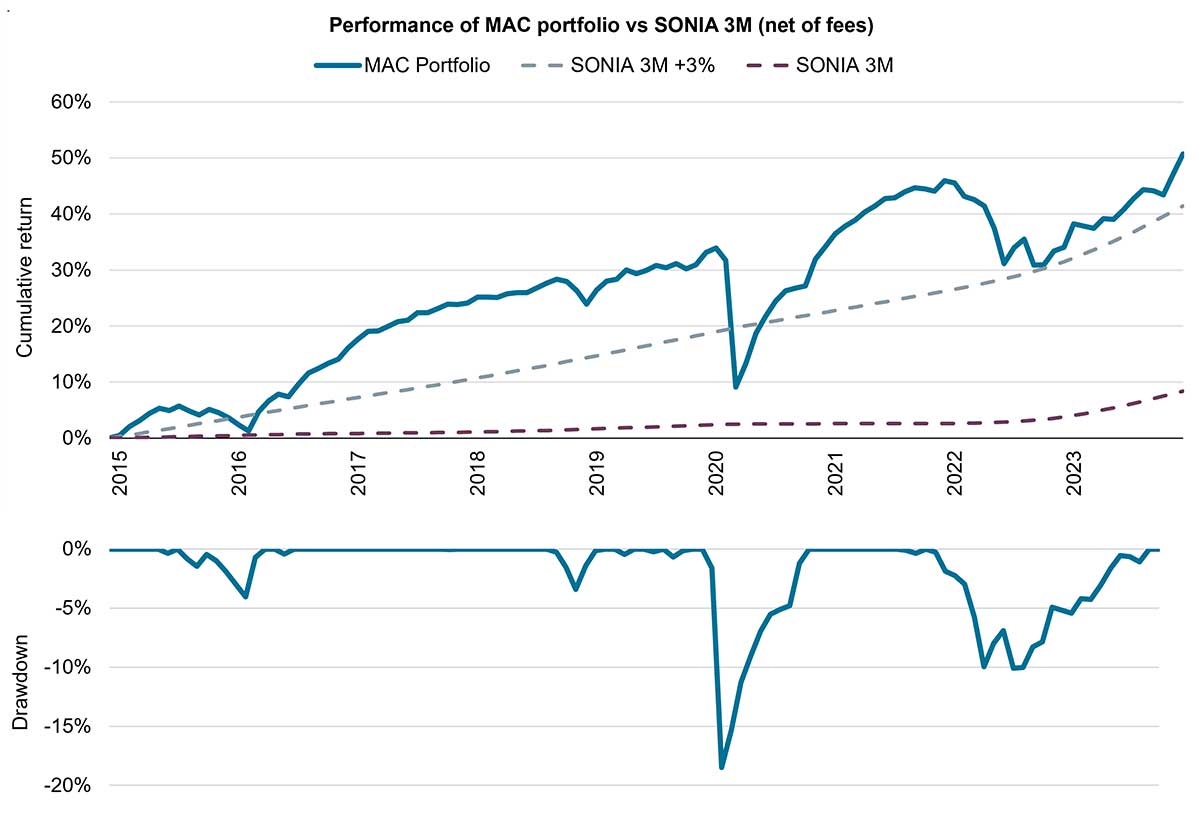

- Aligning investment strategy with long-term objectives: Both the existing equity and MAC strategies were found to be well-aligned with the client's long-term objectives. The equity portfolio applied a style-based approach with adjustments in aggressiveness possible by selecting managers with varying degrees of assertiveness within each style category and fine-tuning their portfolio weights. The MAC portfolio, focusing on higher-risk credit segments, has indeed achieved the target SONIA +3% return. The analysis confirmed that the client's current portfolio managers were meeting these strategic objectives and were considered among the best available on their platform.

- Refining the current investment strategy: Although the portfolios were achieving their objectives, bfinance identified opportunities for potential enhancements. For equities, it was proposed to replace a growth-oriented manager with one specialising in a core/quality strategy to reduce the growth bias and increase quality exposure of the portfolio, thereby potentially improving the risk/return profile. Additionally, bfinance proposed rebalancing the portfolio to further reduce the clear growth bias and therefore enhance consistency in relative performance. In the MAC portfolio, consideration was given to replace one of the two managers with a differentiated investment strategy, thereby introducing new return drivers to enhance diversification.

- Merits for implementation of the proposed changes: Evaluating the merits of the proposed changes was crucial. While maintaining the current portfolios was a viable option, especially given the alignment with strategic objectives and the high calibre of existing managers, the proposed enhancements for the equity portfolio presented compelling opportunities to refine the risk/return profile and add diversification benefits. The anticipated costs for these changes were estimated at 5-15 basis points, which is viewed as a reasonable and justifiable cost-of-change. The case for revising the equity portfolio appeared stronger than that for the MAC portfolio, which faced higher transition costs and greater uncertainty in assessing which high-quality manager would outperform the other.

MAC strategies produced a sharp drawdown in 2020 but recovered rapidly. As expected, 2022 proved a challenging year too. Despite these challenging periods, The MAC portfolio achieved a return in excess of its net-of-fee SONIA 3m +3% objective.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)