- German Insurer

- 2018

- Diversifying Strategies

- TBC

- TBC

- TBC

- Liquid Alternatives

- Portfolio Review

Our specialist says:

Our collaborative and in-depth approach to the review helped the client to set its priorities for the period ahead. We pointed out weaknesses and strengths on all levels of the portfolio: by manager, strategy and allocation. The portfolio’s strengths, such as having high-quality incumbent managers, were valuable assets that the client could build on, while the weaknesses provided room for realising marginal gains, which can make a difference in the long-term. At the end of the review, we helped the client develop an implementation plan to crystallise those improvements in the future.

Engagement at a glance

This client, a German insurance company, sought bfinance’s assistance to conduct a review of its conservatively invested liquid alternatives portfolio, which deployed assets in low net exposure and market neutral strategies. The company’s successful insurance program had led to a prolonged influx of assets for the insurer to manage, and its leadership team wanted to review its portfolio allocations and formulate an action plan for future investment.

Client-Specific Concerns

With its business growing, this German insurer had already appointed a small-scale team of investment experts to oversee its market-neutral portfolio, which was specifically designed to align with the objectives of the company’s insurance program. Although the existing array of 12 external managers had met the company’s investment objectives—and the portfolio was generally well-diversified across liquid alternative strategies—the insurer wished to review its investment program and address any potential gaps, biases or risk concentrations.

The client also sought bfinance’s help to identify and address any manager-specific risks that might impact its investment program—and to provide advice and guidance with respect to its future implementation. The client was particularly eager to learn about any strategy-level portfolio enhancements that its in-house team could initiate as the insurer’s assets grew. Based on the dual-pronged nature of the review, it was undertaken jointly by bfinance’s Portfolio Solutions and Diversifying Strategies teams.

Outcome

- Delivering client-specific research: as part of its comprehensive review, bfinance assessed the current structure of the liquid alternatives portfolio and shared its view that the portfolio was already well-diversified: upon closer analysis, the portfolio’s diversification ratio was 51.7% (typical long-only portfolios skew towards directional equity and fixed income and have diversification ratios of 20% to 40%). The portfolio’s existing diversification ratio effectively reduced undiversified volatility from 3.2% to 1.6% per annum.

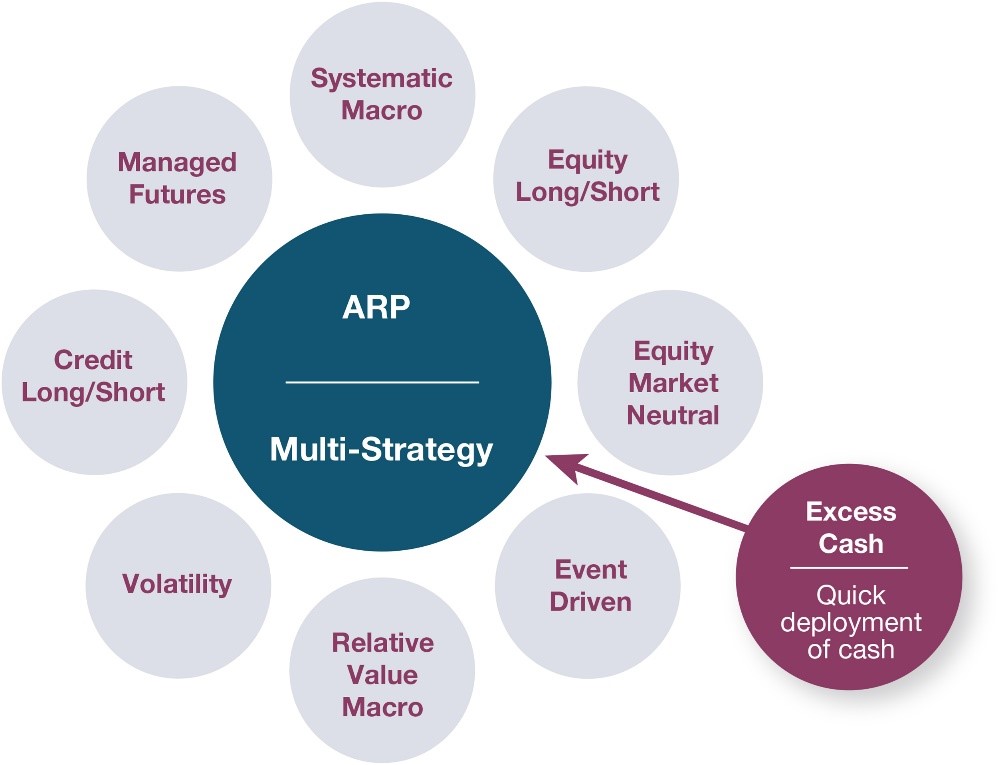

- Delineating potential sources of risk: the client’s liquid alternatives portfolio was focused exclusively on alternative risk premia (ARP) and equity market neutral strategies; within the former segment, the bfinance team noted that assets were divided into ‘multi-ARP’ strategies that made use of various risk premia and ‘single-ARP’ strategies that focused on a single premium. This mixture—of multi-strategy and single-strategy allocations—embedded a risk of potential over- or under-allocation, and in this case, the team noted a potential over-allocation to equity long-short strategies: The client’s portfolio was exposed to direct risk via dedicated equity long-short strategies and indirect risk via ARP and multi-strategy funds, both of which typically offer substantial exposure to equity long-short premia.

- Parsing drivers of portfolio volatility: at a portfolio weighting of 23%, the volatility premium—represented by a single ARP strategy whose main driver was short volatility exposure—constituted a sizeable risk overweight in the portfolio, especially given the client’s conservative investment profile; bfinance also noted a strong bias towards systematic (75%, typically risk premia-based) strategies relative to discretionary approaches (25%), and a bias towards strategies ‘driven’ by fundamentals as opposed to more transitory market stress.

- Reconceptualising the overall portfolio: having conducted quantitative and qualitative reviews of the client’s existing managers, bfinance identified several high-quality multi-strategy managers within the portfolio that matched the client’s objectives—managers whose strategies could serve as ‘core’ holdings while other, high-quality single-strategy managers that were also present in the portfolio could have their mandates sized to serve as high-alpha satellite allocations.

- Planning to accommodate future asset growth: Looking ahead, bfinance proposed that the insurer consider opting a core-satellite approach, which would enable its in-house team to focus on selecting and sizing appropriate satellite allocations, while the alternative risk premia/multi-strategy ‘core’ would be able to absorb excess cash efficiently without adversely impacting the weighting of ‘satellite’ portfolio allocations.

Core-Satellite Portfolio Concept

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)