From theory to practice

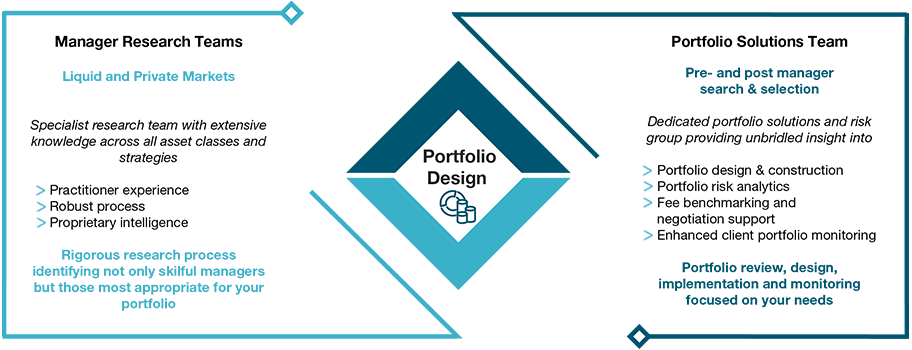

While Strategic Asset Allocation (SAA) should lay a strong foundation for achieving investment objectives, there is a significant gap between theoretical modelling and achieving the required real-world results. Portfolio design advisory support closes the implementation gap.

Some investors use bfinance Portfolio Design services at the level of a specific asset class or sub-group (such as “Equities”, “Growth Portfolio”, “Absolute Return Portfolio”). This often takes place before, or in conjunction with, manager selection activities within that asset class. Other investors seek to address more granular portfolio design considerations at the same time as conducting a high-level Strategic Asset Allocation review process.

Working for you

Each investor is unique and our Portfolio Design services are a true extension of our clients’ teams. We recommend a working group format for projects, with bfinance providing appropriate structure and in-depth analysis while clients remain in control of the process.

Different asset classes have their own specific implementation considerations, which change through time; these should be factored in when advising on overall portfolio construction. As well as solutions strategists, each Portfolio Design engagement is closely supported by relevant asset class specialists that are continually in the market examining strategies and managers in their sectors.

Latest case studies

Portfolio & Manager Review

A UK pension fund appointed bfinance to support them in the review and potential reconfiguration...

Listed Infra and REITs portfolio review

A Swiss foundation engaged bfinance to assist its investment team with a strategic review of its...

Equity Portfolio Design

The investor, a Canadian pension plan, engaged bfinance to reassess the design of their existing...

Strategic Investment Review

A UK-based Charity was seeking support for evaluating their current investment approach and...

Latest insights from the team

What our clients say

Their business model is different from other consultants. It's allowed us to do an open market search. It has achieved our primary goal to reduce fees across our portfolio.

I thought that the amount of analysis that was done on the submissions was really top notch. That’s the key strength and one of the key reasons why we use bfinance.

The first thing is their knowledge. They are very knowledgeable about the industry and all the players.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)