- Swiss Foundation

- 2023

- Global Listed Infrastructure and REITs

- EUR 500 million

- Review and identify potential improvements

- Portfolio design

Our specialist says:

A thoughtfully constructed portfolio that integrates both listed and unlisted assets, coupled with an optimal mix of active management styles, can significantly enhance an investment portfolio's resilience and performance. By carefully selecting managers and aligning strategies with the investor's overall philosophy, trustees can achieve better governance and long-term outcomes, balancing the benefits of active management with the associated active risks.

Client-Specific Concerns

A Swiss foundation engaged bfinance to assist its investment team with a strategic review of its global listed infrastructure and REITs portfolio. The foundation's current portfolio includes two managers for infrastructure and two for REITs. The review focused on several key areas: performance evaluation of the portfolio and incumbent managers, peer group comparison, an assessment of the added value provided by active management, and the effectiveness of integrating listed real assets with unlisted allocations. Based on the outcomes of this review, the foundation may consider adjustments to its listed infrastructure and REITs portfolio, including potential manager replacements if deemed necessary.

Outcome

- Potential to refine manager selection and portfolio construction: Both portfolios employed a dual-manager approach, pairing a low tracking error manager with a higher tracking error counterpart. The review found that the low tracking error managers consistently outperformed their benchmarks, though they faced challenges during the macroeconomic turbulence of 2022 and 2023. However, questions arose regarding whether the low tracking error approach was fully aligned with the foundation's broader, non-benchmark-oriented investment philosophy. In contrast, the higher tracking error managers, while better suited to the foundation's mindset, demonstrated weaker performance relative to a broad peer group of similar strategies. The recommendation was to shift towards a higher tracking error portfolio construction, leveraging more complementary management styles to better align with the foundation's overall investment approach.

- Benefit in allocating actively: Although long-term data is limited, the analysis suggests that active management in listed infrastructure and REIT strategies can deliver positive relative performance, lower volatility, and downside protection, thereby enhancing the risk/return profile relative to benchmarks. The peer group analysis, which included 28 infrastructure managers, and 65 REIT managers based on recent bfinance manager selection projects and data from the eVestment database, indicated that most managers achieved positive relative returns on a net-of-fee basis. Overall, while active management introduces active risk—meaning the potential to underperform the index—there is a notable skew towards positive relative returns over the long term.

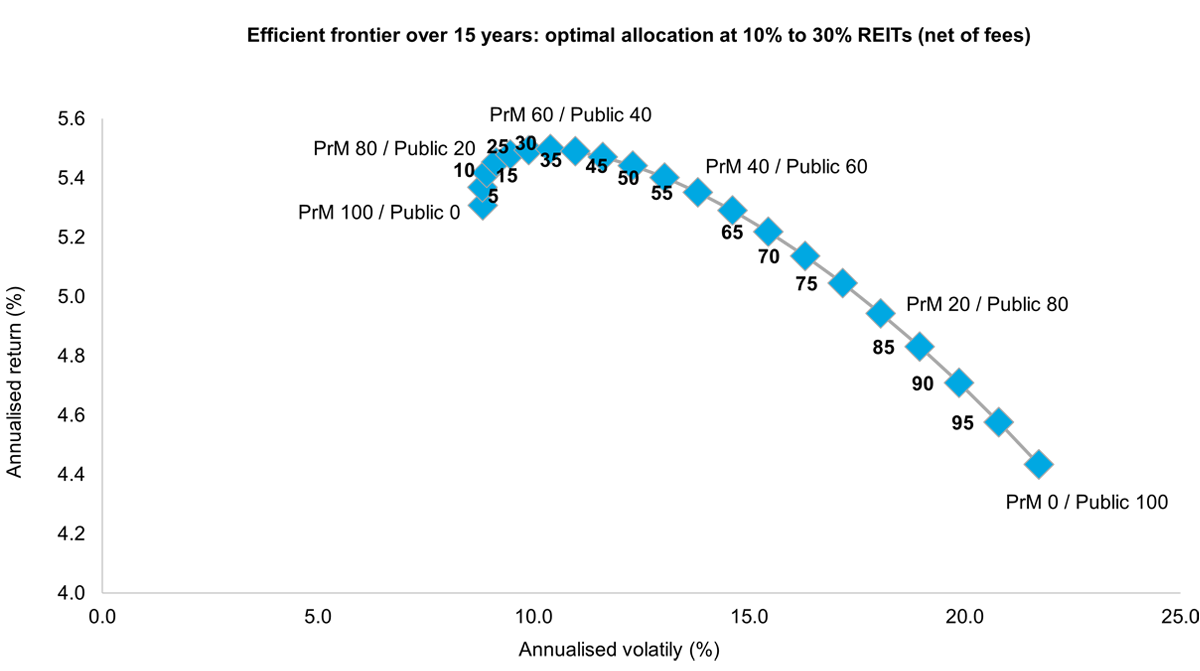

- Merit in combining listed with unlisted: From a qualitative perspective, the case for REITs is strengthened by the complementary exposure they offer compared to private real estate. Listed real estate provides access to alternative growth sectors such as telecommunications towers, healthcare facilities, self-storage units, data centres, and specialised housing, which may not be easily accessible through private real estate investments. Additionally, for this foundation, the inclusion of US-based REITs diversifies its predominantly European exposure. An allocation to listed infrastructure complements unlisted infrastructure by providing access to larger companies that are typically difficult to reach in the unlisted market. Beyond size, both listed and unlisted markets offer exposure to similar asset types. Additional benefits of incorporating listed assets include enhanced manager diversification, lower management fees, exposure to diverse public and private market pricing dynamics, and improved portfolio liquidity. Quantitative efficient frontier analysis, utilising both refined and unrefined index performance, indicates a positive impact on the portfolio’s risk/return profile with a listed allocation of 10% to 30%.

Results as of September 2023, in USD, total return, net of fees. Benchmarks: Preqin Real Estate Index, FTSE EPRA NAREIT Developed Index. Metrics represent annualised figures where applicable.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)