- Belgian Private Pension Fund

- 2021

- Multi-asset

- EUR 1.2 billion

- Global

- Part of engagement

- Strategic Asset Allocation

Our specialist says:

Our offering goes far beyond just providing basic risk and return expectations for a given investment portfolio—we are able to really give our clients an understanding of their portfolios: we can help them ascertain where the returns are likely to go, what is driving long-term performance and which types of economic scenarios would hurt that performance the most. Armed with this insight, clients can explore suitable scenarios for optimising their strategic asset allocations by making informed adjustments—including the addition of new asset classes—and we can demonstrate the forward-looking risk and return expectations of their new allocation targets.

Engagement at a glance

This client, a Belgian pension fund, sought bfinance’s help in reviewing the appropriateness of its current strategic asset allocation (SAA) relative to its investment objectives. As a secondary stage in this process, the pension fund’s investment team also wanted to explore the potential for the incorporation of new asset classes, such as infrastructure, to enhance the risk-return profile of the fund’s EUR1.2 billion portfolio and provide enhanced inflation protection in the coming years.

Client-Specific Concerns

This pension fund’s in-house investment team enlisted bfinance’s help to confirm the alignment of its existing SAA framework with its investment goal—which it didn’t disclose so as not to bias the assessment—and make any necessary adjustments required to increase the portfolio’s robustness. The client was particularly concerned with gaining several key insights into its current SAA, including whether the investment program was assuming sufficient risk to deliver the desired returns, how inflation might impact those returns, whether allocating to global equities would be more beneficial than using regional equities and how incorporating infrastructure exposure would complement the portfolio’s investable universe of assets.

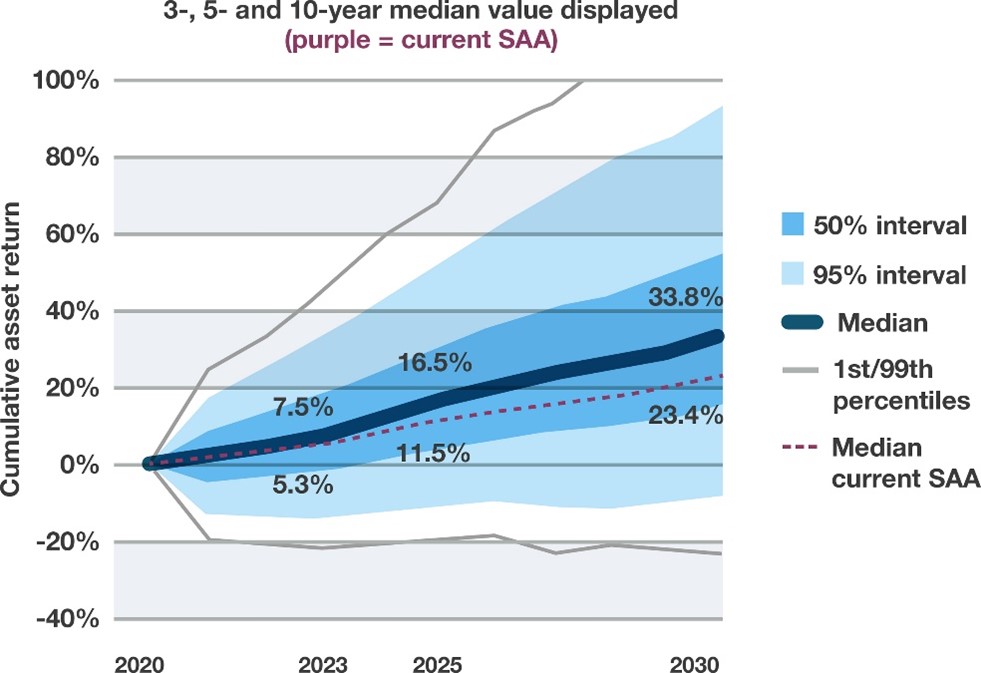

Figure 1: Considering probabilities around target SAA expected return

Indices are not investible and do not represent performance; it is not possible to invest directly in an index.

Outcome

- Capital market assumptions, bfinance’s team determined that SAA’s three-year expected return was 1.8% per annum, deemed insufficient by the client

- Performing efficient frontier analysis: the bfinance team supported the client in formulating an updated target SAA by changing the asset-class weightings and modelling the impact of new asset classes on the portfolio. With only a modest addition of risk, the updated SAA’s three-year expected net return rose meaningfully.

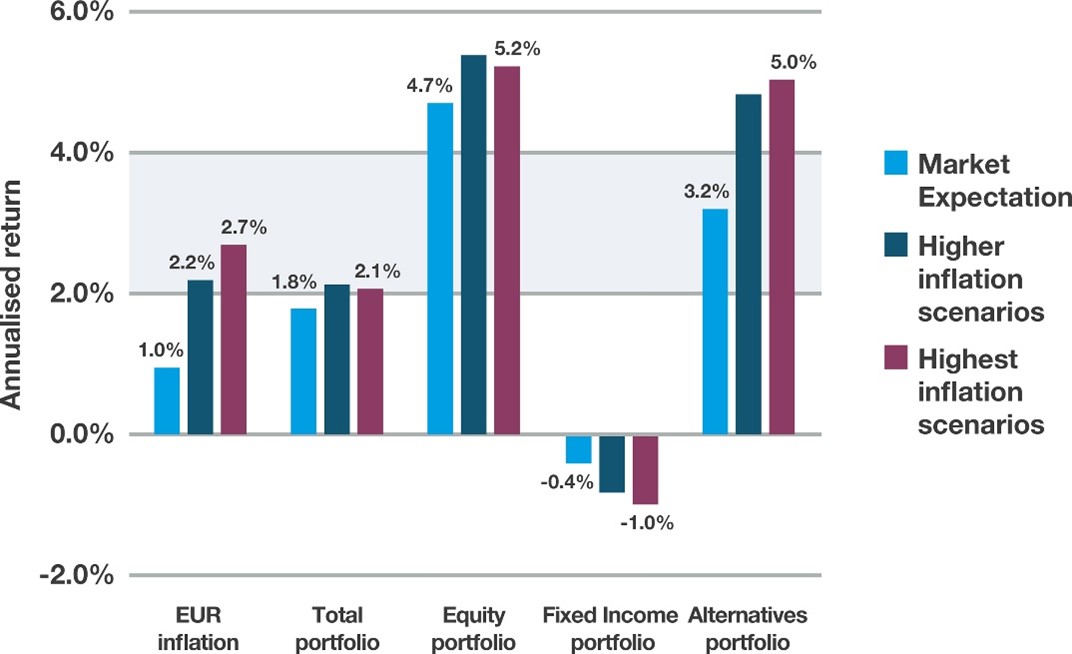

- Stress-testing the existing and evolved SAA: in the final stage of analysis, bfinance explored the expected impact of inflation, deflation and stagflation on the investment portfolio, giving the client further confidence that its new, optimised SAA target would be robust in the face of macroeconomic pressures and heightened volatility in global capital markets.

- Reconceptualising the overall portfolio: having conducted quantitative and qualitative reviews of the client’s existing managers, bfinance identified several high-quality multi-strategy managers within the portfolio that matched the client’s objectives—managers whose strategies could serve as ‘core’ holdings while other, high-quality single-strategy managers that were also present in the portfolio could have their mandates sized to serve as high-alpha satellite allocations.

Figure 2: Portfolio expected to benefit from higher inflation (illustrative)

Indices are not investible and do not represent performance; it is not possible to invest directly in an index.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)