- UK

- 2023

- All asset classes, global

- Multi-billion

- Set SAA for various family generations

- Strategic Asset Allocation

Our specialist says:

A well-constructed SAA, optimised to achieve the desired investment characteristics, is fundamental to a resilient portfolio. This clarity not only strengthens portfolio governance by providing a clear view on potential outcomes and risk tolerance but also enhances the portfolio's ability to withstand market fluctuations. Trustees can benefit from improved decision-making capabilities and more robust oversight of the investment strategy.

Client-Specific Concerns

A UK-based family office engaged bfinance to assist in defining a Strategic Asset Allocation (SAA) tailored to the needs of multiple generations within the family. Each generation is represented by a distinct capital pool, yet none currently has an articulated SAA. The generations have varying risk-return profiles and spending requirements, necessitating bespoke strategies. Additionally, each generation's asset pool includes substantial immovable assets, such as real estate and direct equity holdings. While an SAA is not yet in place for any generation, the family office manages a mature and diversified investment portfolio. The office seeks to streamline its operations and implement these portfolios with greater efficiency.

Outcome

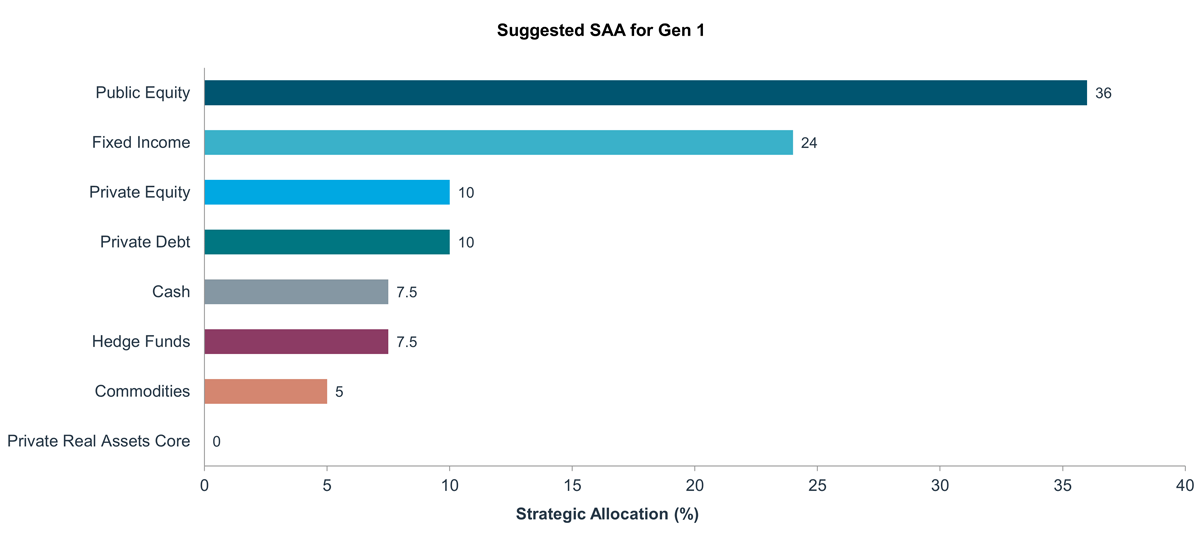

- Defining SAAs: The investable universe spans a wide range of global public and private asset classes, including equities, credit, commodities, hedge funds, private equity, and private debt. The analysis focused on global asset classes, with fixed sub-asset class weights aligned to market levels, in accordance with the client’s preference for multi-asset mandates. The SAA for each generation was informed by efficient frontier analysis. For example, Generation 1, characterised by a more conservative risk profile, targets an equity allocation of 50% to 70%, aiming to optimise portfolio outcomes. In contrast, younger, more risk-seeking generations target a 70% to 90% equity allocation, favouring both public and private equity, while diversifying across fixed income, hedge funds, private debt, real assets, and commodities. Generation 1 captures the equity risk premium through a higher allocation to conservative equity assets and mitigates overall portfolio risk with increased investments in fixed income, private debt, private real assets, and cash.

- Analysing tail risks: Given the significant equity allocations, tail risk analysis identified public and private equity as the primary contributors to overall risk across generations. High equity risk weights were observed, which is consistent with the challenges of achieving diversification within the tail of the distribution, even in portfolios with strategically lower equity allocations. The analysis further highlighted that risks associated with interest rates, credit, real assets, and currency are substantially mitigated in the tail through diversification. Scenario analysis identified that a 2008 GFC type scenario aligns with a 1% tail risk event for the portfolios.

- Spending analysis: The analysis suggested that the asset base for each generation is poised for sustainable growth, considering their respective spending levels. As the portfolio size increases, the payout ratio decreases, enhancing the sustainability of ongoing spending. Furthermore, the analysis indicated that the real value of each capital pool is either stable or appreciating, thereby preserving purchasing power over time.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)