IN THIS PAPER

Investors rethinking structures. Until recently, the supply of investment vehicles has largely been the territory of asset managers. Yet more investors are seeking to reduce costs, improve operational reporting and consolidate governance by launching Asset Owner Investment Vehicles (AOIVs).

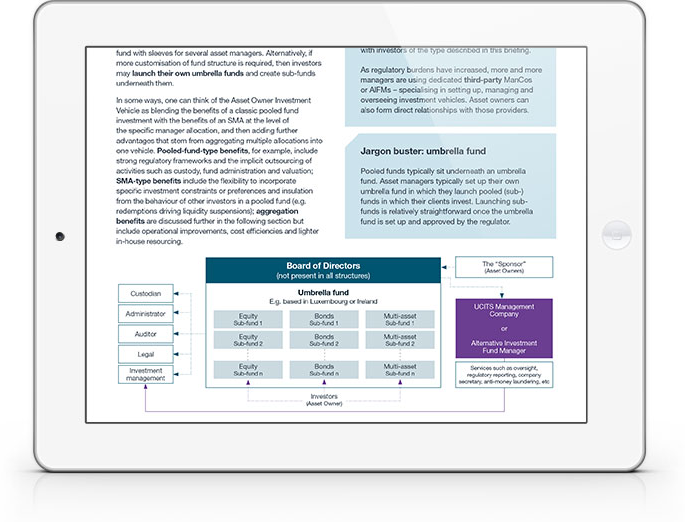

Definitions and models. They come in many forms and go by different names, but what are the key elements that AOIVs have in common? The core concept is one of aggregation: an asset owner, rather than investing in a large number of different entities, instead invests into only one – or at least only one entity covering the relevant proportion of the portfolio.

Key implementation considerations. Which types of investors could use these structures to improve efficiency and governance? What are the key factors involved in selecting a management company (ManCo)? How should investors approach a rapidly evolving market, where a wave of new third-party ManCo launches has now given way to a period of consolidation?

WHY DOWNLOAD?

Asset owners seeking to invest assets using fund managers typically place their money for each mandate into one of three types of structures: pooled funds, ‘funds-of-one’ or separately managed accounts (SMAs). These default approaches result in substantial administrative and operational fallout for the investor, such as aggregating reporting from multiple managers and paying significant costs when switching managers. As a result, more investors are turning to an alternative model: establishing a dedicated fund that can house a large proportion of their assets while outsourcing the investment management decisions to their various asset managers.

The earliest and most enthusiastic adopters have been investors who face specific local legal and regulatory challenges. For example, certain countries have taxation structures which make it hard for pension schemes to move assets around their portfolios without incurring tax burdens. More recently, even investors who do not encounter such innovation-demanding obstacles are also identifying the potential advantages of this type of structure.

This note seeks to provide a brief introduction to the world of Asset Owner Investment Vehicles, the available services and some of the key issues to watch out for. We hope that it will be of use to asset owners, whether they are already familiar with these models or not.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)