IN THIS PAPER

Investors' needs and available strategies. There are now more than 120 active listed equity strategies that explicitly address carbon or climate change considerations, as well as passive strategies. The universe is considered through the lens of three potential investor objectives: carbon reduction, managing climate risk and delivering impact.

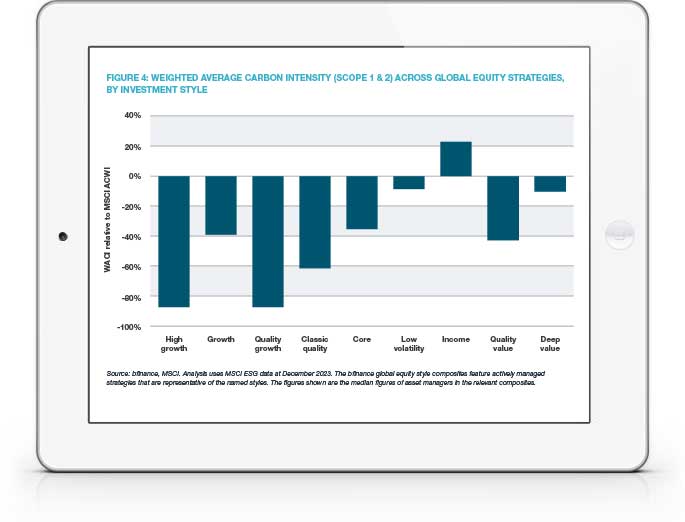

Carbon-cutting pitfalls. Many investors are now seeking to implement strategies for reducing portfolio carbon emissions. Yet carbon cutting can produce unintended adverse consequences. A closer look at three challenges is accompanied by an analysis of equity portfolio data across different style cohorts.

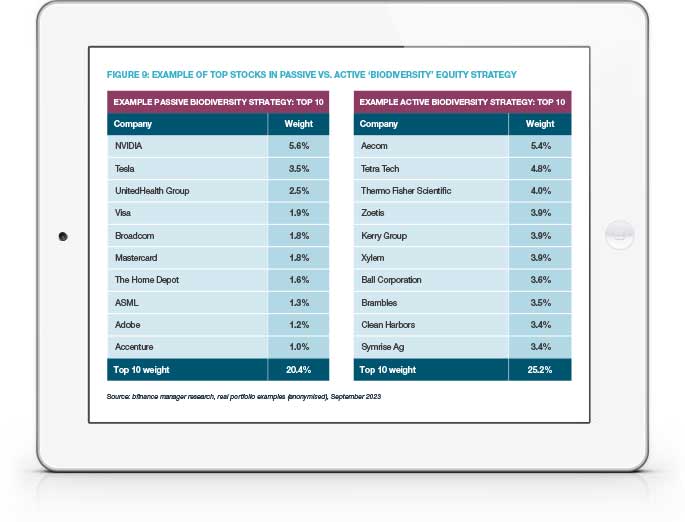

Understanding biodiversity in equities. Investors are seeking to gain an understanding of how to assess biodiversity across equity portfolios. It remains difficult to price in the relevant risks but approaches are evolving. We note 10-15 active and passive strategies with an explicit (labelled) focus on this subject.

WHY DOWNLOAD?

As early as 2021, bfinance estimated that 56% of asset owners were already measuring carbon emissions for their equity holdings and, if we look at manager selection activity, one third of all new equity mandates from bfinance clients in 2023 explicitly involved fossil fuel exclusion, carbon footprint reduction or consideration of Net Zero alignment.

Equity managers have moved with alacrity in response to client demands, keen to shore up their competitiveness. Research from bfinance reveals a fast-growing contingent of dedicated funds. There are now more than 120 active listed equity strategies explicitly focused on carbon or climate change, over one third of which take an ‘impact’ approach.

The improving availability and variety of strategies undoubtedly benefits investors. Yet tackling climate or environmental considerations within investment portfolios is a complex and nuanced subject. This report seeks to provide clarity on products, practices and pitfalls in today’s investment landscape.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)