IN THIS PAPER

Portfolio design approaches: Investors may use this sector to reduce/remove China exposure or complement a dedicated China allocation.

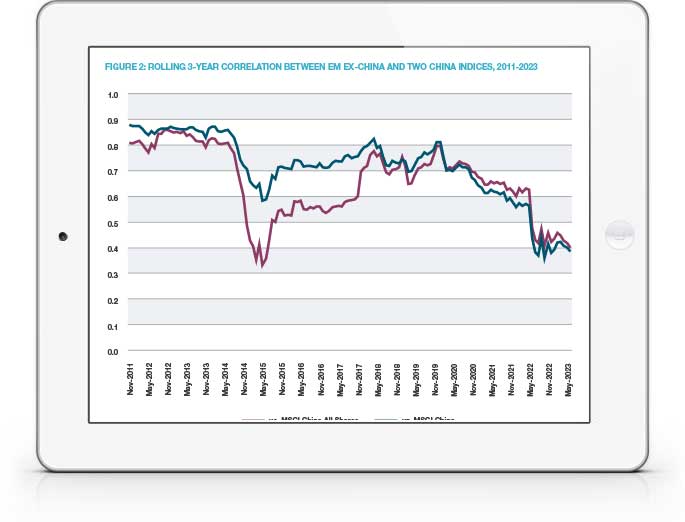

Attractions of this relatively new sector include fundamental headwinds/tailwinds, the reduced correlation (‘decoupling’) of China and emerging market indices and the specific merits of ex-China strategies from an alpha generation perspective.

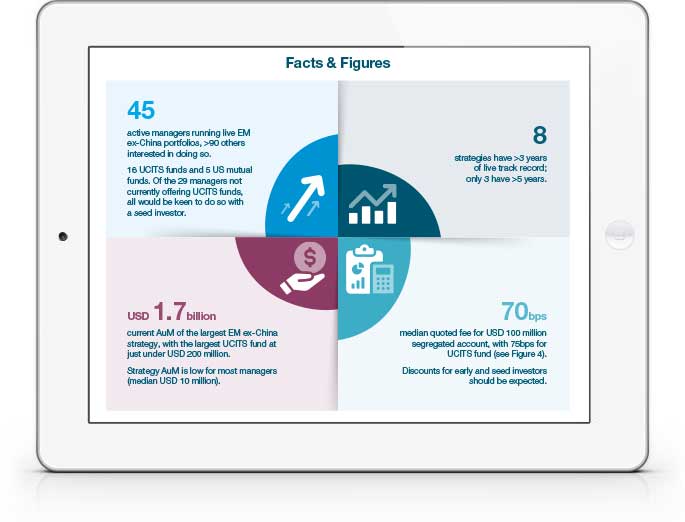

Mapping the manager landscape: A closer look at strategies, vehicle types, track records, AuM, investment process and fees, where significant early bird discounts are available.

What should investors look for? Active managers need deep research capabilities to build robust portfolios without China stocks. The final section of the report shows managers’ sector and country positioning.

WHY DOWNLOAD?

GEM ex-China equity is becoming recognised as a distinct segment within the active equity management landscape. Now, a wide-ranging bfinance RFI has identified nearly 50 managers running live GEM ex-China portfolios — considerably more than can be found in major industry databases. Meanwhile, nearly 100 additional asset managers are either actively considering a launch or would be open to constructing an ex-China portfolio.

Journalists and commentators tend to ascribe the rise of China-free emerging market strategies to negative sentiment towards the country, due to any combination of recent weak performance, escalating geopolitical tensions, relatively muted macroeconomic data and high-profile state interventions. Yet the emergence of a credible group of strategies in this space is of interest and value to investors irrespective of sentiment towards China.

Developing a credible GEM ex-China strategy is not straightforward, however. Success requires more than simply eliminating Chinese-listed stocks from a GEM portfolio. Investors should seek managers with strong coverage of smaller markets and stocks for robust, well-diversified portfolios without undesirable skews.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)