IN THIS PAPER

The second quarter of 2022 was beset with hazards for long-term investors as inflation surged to a new four-decade high and central banks turned hawkish, rapidly raising interest rates in an effort to dampen soaring prices for food and fuel. Equity and bond markets plummeted, driving fears that the global economy—and the US in particular—might be headed for a major economic retrenchment, if not an outright recession.

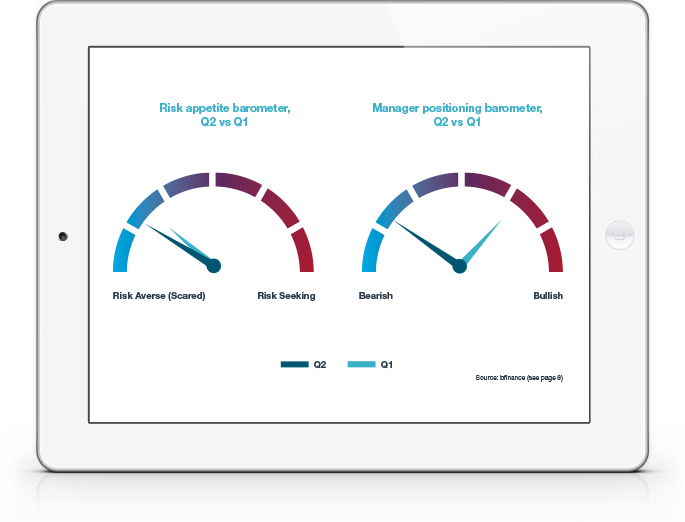

Against this backdrop, investors were challenged to rethink their vulnerability to equity market volatility, inflation risk and interest rate hikes; as a result, defensive positioning became a top priority for many. This retrenchment was reflected by the bfinance Risk Aversion Index, which moved deeper into bearish, risk-off territory, rising from 0.79 to 0.82 during Q2. Amongst the multi-asset managers tracked for the index, equity exposure dropped to less than 32% (three percentage points below the long-term average), and exposure to fixed income and other diversifiers rose to 68%.

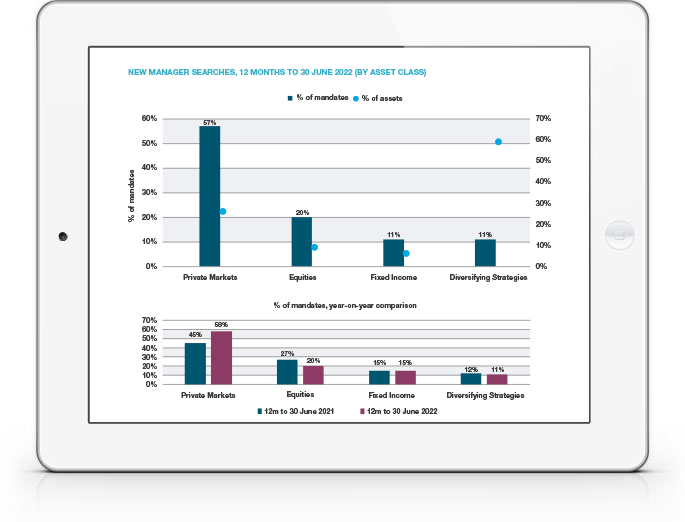

As geopolitical and macroeconomic pressures continued to multiply, investors with risk capital to deploy focused on Private Markets, which represented 68% of all new search activity for the 12 months ended 30 June 2022—an increase of 13 percentage points year over year. Investors demonstrated a keen appetite for Real Estate, which attracted 31% of all new searches, and Private Debt, which also drew attention as investors sought out new sources of portfolio diversification, income and inflation protection.

Equity searches fell in Q2 as investors grappled with ongoing market volatility: new searches accounted for only 20% of all search activity for the 12 months ended 30 June. Most of these searches, which focused on developed markets, were conducted by European investors; investors in North America, the UK and Ireland were the least active in this space. Fixed income searches remained unchanged year over year at 15% of all new activity, but the nature of these searches shifted towards emerging market debt and high yield/leveraged loans exposure.

Despite the turbulence in public markets, hedge funds and other liquid alternative strategies continued to provide investors with a significant source of portfolio diversification and returns. Macro & Trading strategies shone particularly brightly in Q2, returning +4.2% on average during the quarter—and bringing the group’s H1 2022 average to +14.2%. Although overall search activity for Diversifying Strategies remained virtually flat at 11% for the 12 months ending 30 June, we observed a rising percentage of overlay strategies being implemented by bfinance clients during this period, which resulted in this segment outstripping all others on a ‘proportion of assets’ basis.

WHY DOWNLOAD?

Each quarter, bfinance publishes information on investor activity, key market trends and manager performance. A quarterly snapshot of the key developments within equity, fixed income and alternative investments, including analysis of which asset manager groups performed well and which didn't.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)