IN THIS PAPER

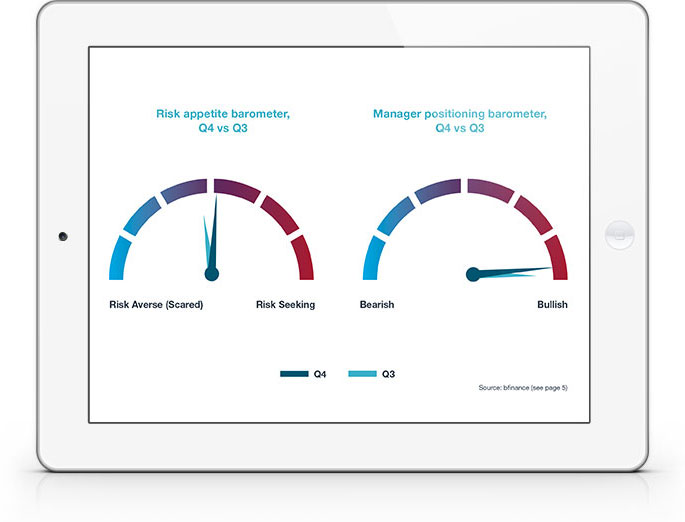

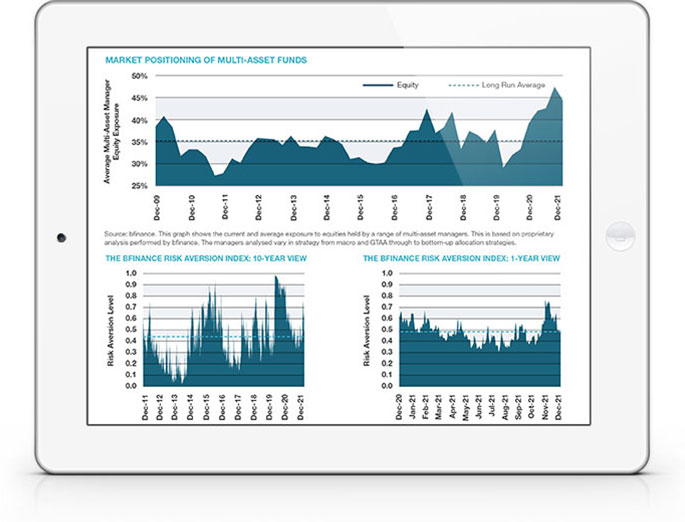

Even as global supply chains stalled, inflationary pressures increased and new coronavirus variants swept the globe, equity markets ended 2021 with a flourish, attaining double-digit gains for the third year in a row. Multi-asset managers, however, took stock of the potential for greater macroeconomic disruption and incrementally reduced their equity exposure in favour of bonds and other diversifiers.

Investors have been caught between the need to reap the benefits of strong global equity performance and the imperative to mitigate the risk of heightened market volatility as central banks begin to taper their asset purchase programs—which were implemented at the peak of the COVID-19 pandemic in 2020— and raise interest rates. In response, investors are now hunting actively for strategies likely to provide some resilience and new sources of income: the number of searches conducted for bfinance clients continued its strong upward trajectory in Q4, rising by 31% year over year for the 12 months ended 31 December 2021.

Investors’ interest in Private Markets continued unabated in throughout 2021 and represented nearly half—49%—of all new manager searches across the firm during the year. Given their growing unease about the impact of rising inflation, investors have been focusing on strategies that offer income plus inflation protection and have been directing resources to Private Debt (including trade financing and leasing strategies), Infrastructure and Real Estate. Collectively, these three asset classes accounted for 84% of all bfinance search activity in Private Markets in 2021.

The strong performance of global stock markets in 2021 has continued to attract investors—many of whom appear focused on diversifying their existing exposures. As a percentage of overall search activity, Equity accounted for 24% of all searches for the 12 months to 31 December 2021—with 41% of those searches focused on broad global equity mandates— but we also observed a significant uptick in emerging and regional equity mandates.

Investors in Fixed Income strategies have been subject to intense pressure to diversify their sources of yield, leading to a surge of search activity for emerging market (EM) debt, which accounted for 29% of all asset-class specific searches for the 12 months ended 31 December 2021. Searches for high yield, leveraged loans and multi-sector fixed income have also remained robust.

The hedge fund industry has experienced something of a renaissance over the past year as equity market volatility has risen and asset owners have sought refuge. Searches in Q4 were predominantly focused on multi-strategy funds and market-independent strategies (with a focus on equity market neutral strategies for asset owners in Europe and North America). Looking forward to Q1 2022, we expect demand for hedge funds and liquid alternatives to remain quite buoyant.

WHY DOWNLOAD?

Each quarter, bfinance publishes information on investor activity, key market trends and manager performance. A quarterly snapshot of the key developments within equity, fixed income and alternative investments, including analysis of which asset manager groups performed well and which didn't.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)