IN THIS PAPER

Asset managers are positioning themselves more aggressively as the bfinance Manager positioning barometer confidently moves into bullish territory, despite the Risk appetite barometer retreating in the quarter.

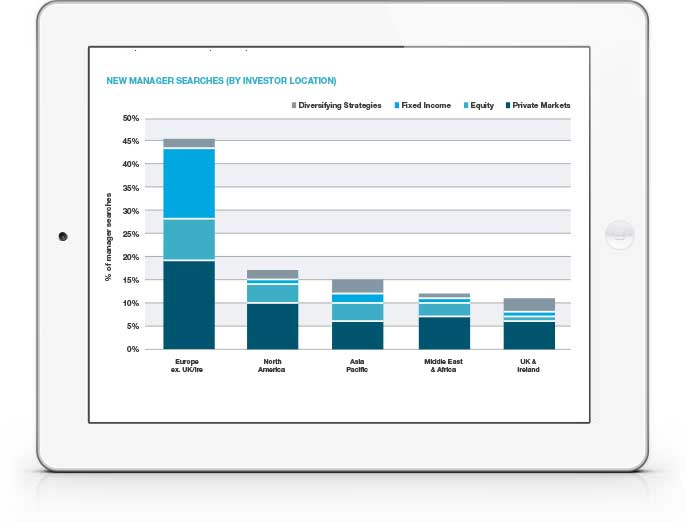

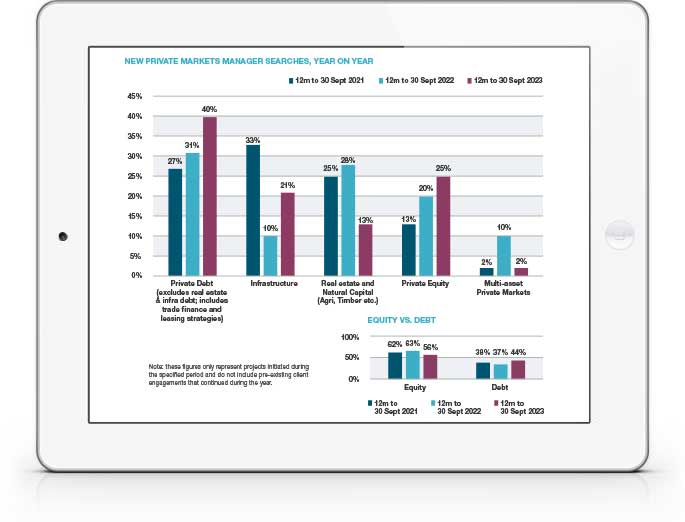

Among bfinance clients, private market asset classes dominated new manager search activity, accounting for 48% of all searches. Though, it is worth noting that this figure fell significantly from 61% in the previous 12-month period. There was a sharp slowdown in overall industry fundraising. The weak Q3 level follows low capital raising in Q1 and Q2 suggesting that 2023 will be the lowest level for at least five years. Private Debt continues to be the main private market asset class that has performed relatively well, benefitting from the higher yields available to lenders, while real estate continued to struggle in what remains a challenging environment.

Looking at diversifying strategies, hedge funds bounced back after a rather challenging period, accounting for 45% of all new diversifying strategies manager searches in the last 12 months, up from 36% in the previous year. Investors targeting the space are a mix of those looking to add to their already existing exposures and those looking for improved returns.

Developed market demand bounced back in the latest quarter, accounting for 21% of all searches in the last year and rising from 14% in the previous period. Developed market managers were in favour with demand up 14% and emerging market manager appetite dipping by 12%. In global developed markets, Q3 offered a period of respite for those active managers not focused on high growth companies.

WHY DOWNLOAD?

Each quarter, bfinance publishes information on investor activity, key market trends and manager performance. A quarterly snapshot of the key developments within equity, fixed income and alternative investments, including analysis of which asset manager groups performed well and which didn't.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)