IN THIS PAPER

Exploring diverse opportunities in Asia Pacific: Assessing opportunities in private markets across the region requires a significant commitment, but it is time well spent given the region’s swift recovery from the worst of the Covid-19 crisis—and its continued economic strength as financial markets deepen and mature.

Staying flexible about possible solutions: As managers seek to differentiate themselves from their competitors by developing niche strategies, investors have an opportunity to consider regional or even country-specific products that complement their existing pan-Asia holdings.

Understanding implementation challenges: Investing in Asia Pacific may require an intensive research and due diligence, but asset owners stand to benefit from the potential for significant portfolio diversification and relative outperformance—assuming they’re able to identify and invest with the top quartile of managers.

WHY DOWNLOAD?

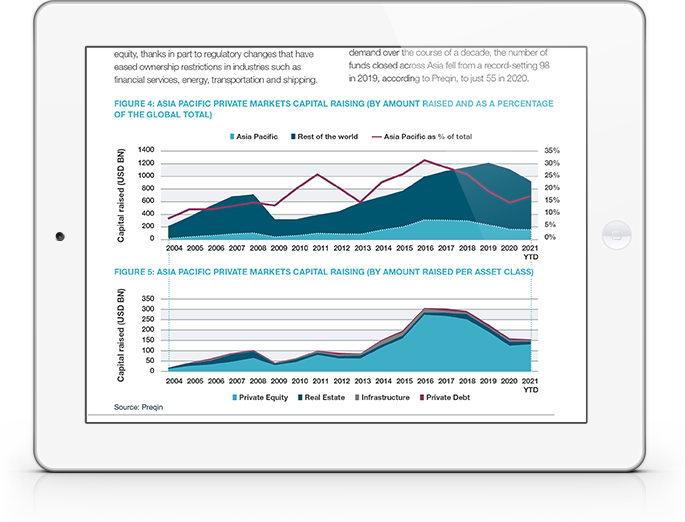

With performance dispersion in Asia Pacific’s private markets running high, manager selection remains one of the most important decisions that asset owners need to make. Choices are plentiful: an increasingly diverse, segmented landscape of fund offerings has emerged, driven by a changing fundraising landscape and a maturing talent pool. This paper—which includes two case studies of Asia private equity manager searches—aims to provide insight for asset owners seeking to make initial allocations to private markets in Asia Pacific or expand the breadth and depth of their existing allocations.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)