- German Endowment

- 2021

- Strategic Portfolio Design, Real Estate and Infrastructure

- EUR 60million

- Global

- N/A

- Portfolio Solutions

- Strategic Portfolio Design

Our specialist says:

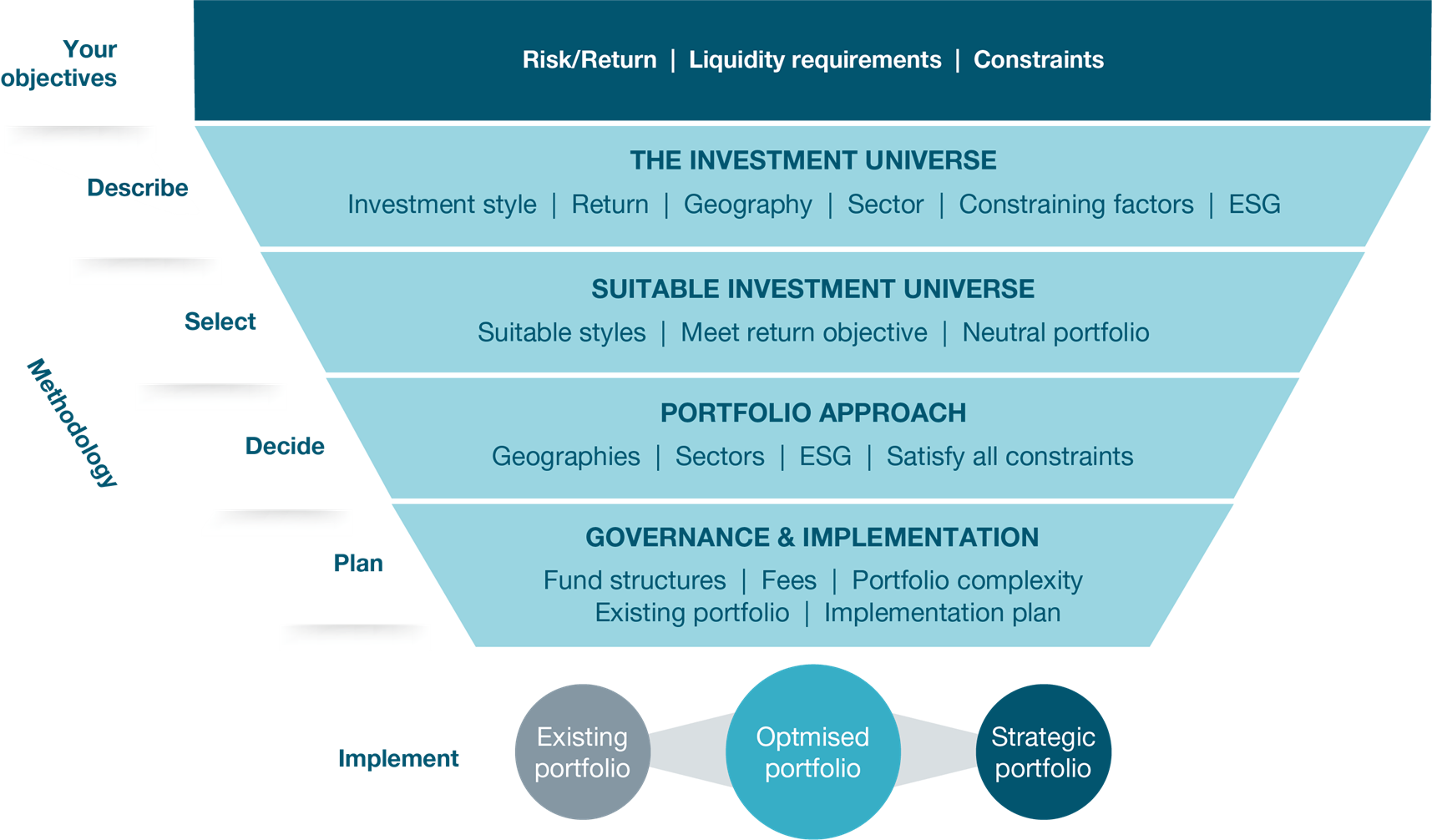

Portfolio design does not simply dictate the strategic weights that ought to be assigned to different strategies, sectors and regions; the process involves supporting the client and asking key questions. In this particular case, we sought to answer the following questions: Which strategies within real estate and infrastructure are suitable for this investor—and how should we determine suitability? What resources would this client require to set (or maintain) the geographic profile of the investment portfolio? If we were to help the client in-source that decision-making, would the client actually be able to implement that focus with existing funds in the market? By carefully weighing variables, we can provide certainty to the client that—whatever portfolio we design—it can be readily implemented in the market.

This German endowment fund engaged bfinance to review its current real estate and infrastructure holdings and set out a new strategic direction for the portfolio—one that would complement its existing holdings and grow with the addition of EUR60 million in additional investment.

Client-Specific Concerns

Having recently conducted a strategic asset allocation review of its overall portfolio, this German investor decided to increase its holdings in real estate and infrastructure with the caveat that its team would seek external support to define the parameters of the new investment initiative. As the team looked to expand its enhanced real estate and infrastructure sub-portfolio, the client was particularly focused on maintaining a conservative Core/Core-plus risk profile with an emphasis on total return over a 20-year investment period. The organization also wanted to maintain its overweight in European assets despite the global remit of its existing portfolio and—whenever possible—make allocations to real estate and infrastructure strategies that met its environmental, social and governance (ESG) criteria.

Outcome

- Reconceptualising the investment approach: bfinance supported the client’s investment team in reviewing the endowment fund’s existing real estate and infrastructure portfolio, analysing its strategic approach and devising a new investment plan for the years ahead.

- Accommodating future asset growth: working collaboratively with the client’s own team, bfinance helped determine which internal requirements would impact the design of the expanded real estate and investment portfolio; what effects those requirements might have on future returns; and how to ensure that the investment team could implement the new design without encountering unexpected challenges in the market.

- Analysing and incorporating ESG criteria: all the managers retained for the final round demonstrated strong ESG capabilities, including the ability to adhere to the client’s exclusion list and offer a clearly defined carbon footprint reduction plan. As part of that analysis, bfinance also looked at the manager’s ability to measure and report on greenhouse gas emissions and indirect emissions as well as future plans to become carbon neutral by 2050.

Strategic portfolio design for private markets: real estate and infrastructure

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)