Delivering savings for investors

Asset owners need clear, robust insights on fees in order to support a range of important objectives. These may include identifying potential savings, renegotiating management fees with providers, demonstrating overall 'value for money' and even strategic reorientation.

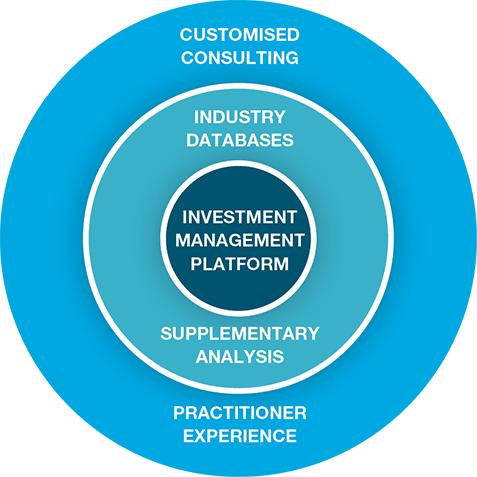

Since 2012, bfinance has been delivering outcome-oriented fee benchmarking to clients, leveraging the firm’s extensive proprietary data gathered through manager research and selection. In-depth evaluation of asset manager fees, value-for-money assessments and Transaction Cost Analysis provide opportunities to generate significant savings.

What’s different about bfinance fee reviews?

Managers’ fees are compared against relevant peer groups, rather than generic sector lists, based on the investor-specific criteria and objectives. Performance decomposition provides an additional lens to assess ‘value for money’.

bfinance’s Proprietary Investment Management Platform (40,000+ fee data points, 4000+ managers, 240+ sub asset classes) gives investors the data advantage. We use fees obtained from managers through a competitive tender process for live mandates for comparison, not generic survey data.

Senior asset class specialists bring sector-specific insight and extensive experience with fee negotiation in their markets. Transaction Cost Analysis (TCA) provides an additional lens to understand value for money.

Latest case studies

Fund Fee Review

The superannuation fund wanted to review the management fees they were paying for investment...

Portfolio Solutions – Fee Review, Public Markets

The client, an Australian pension scheme, was under mounting pressure from the Australian...

Fee Benchmarking and Strategic Support

This UK pension scheme was seeking to benchmark the fees being paid to more than a dozen managers...

Portfolio Solutions – Fee Review

This Australian asset owner engaged bfinance to provide a value-for-money assessment on a large,...

Latest insights from the team

What our clients say

They are as near to perfection as they can be. If you ask them to do something, they do it quickly. I find them very helpful.

The reports I read are outstanding in terms of richness of information. The information is exactly what is needed to make an informed decision.

Working with bfinance gives us an advantage that we wouldn’t have had with a traditional consultant.

Key service features

Data

- Access to live manager fee proposal data

- Database of comparable funds

- Comparisons vs tailored manager peer groups

Insight

- Asset class experts on managers and peers

- Performance breakdown into underlying factors

- Fee tiering and market analysis

Negotiation

- Tried and tested process of manager engagement and project management

- Proven track record of securing improved fees

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)