- US Wealth Manager

- Q2 2022

- Fixed income, majority US

- < USD 10 million

- 3-5% p.a. nominal return target

- Strategic Portfolio Design

Our specialist says:

This approach not only models asset classes but specific fixed income portfolios like ETFs: the forward-looking scenarios presented therefore reflect the client’s potential portfolio, rather than a conceptual strategic asset allocation. Each replicated ETFs was modelled using three parameters—a rate term structure, spread term structure and excess return series—while characteristics such as maturities and ratings were matched with corresponding ETFs available in the market.

Client-Specific Concerns

This US wealth manager sought to update its relatively conservative fixed income portfolio in order to meet the investment target of 3-5% per annum nominal returns—a topic that has become particularly pressing for their team in a climate of inflation and rising interest rates.

There was a strong focus on maintaining the (short) duration profile to minimise the impact of rate hikes. It was also crucial to reflect the underlying clients’ need for capital preservation in this asset class—making metrics such as VaR more relevant than volatility. In addition, the portfolio had to be fully implemented via ETFs available in the US market.

In redesigning the approach, the investor was keen to look at a wide range of US fixed income instruments including US Treasuries, corporate bonds (investment grade and high yield), ILBs and high yield municipal bonds, potentially complemented by some emerging market debt exposure. The existing portfolio had exposure to all of these sectors. They were also willing (in theory) to consider further credit types suggested by the bfinance team.

Outcome

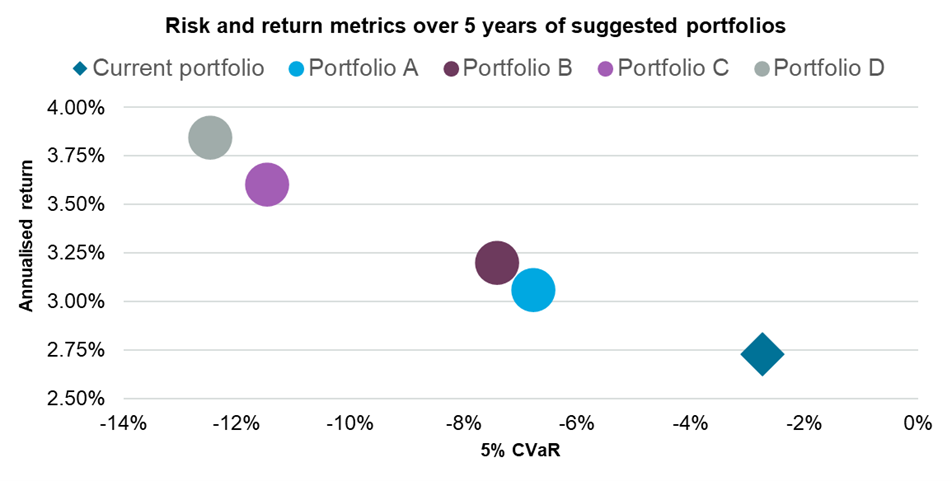

- Building understanding. Researchers helped the investor to navigate through the different building blocks in credit portfolio design and key risk levers such as maturity, credit risk, and seniority. After modelling the current portfolio and simulating thousands of scenarios, the team carried out an optimisation process—adjusting weightings and constituents, constrained by the investor’s requirements and preferences. Carrying out that optimisation process step-by-step enabled the client to develop a clear sense of how the various components and allocations were driving aspects of risk and return.

- Broadening the opportunity set. Additional credit sectors were included for consideration during the optimisation exercise at bfinance’s recommendation—namely convertible bonds and US leveraged loans—thanks to their ability to perform well when interest rates rise.

- Providing clear choices. Through the optimisation, the team developed four candidate portfolios for the client’s consideration. While all were well diversified across credit types with exposure to fixed and floating rate debt, risk profiles varied from ‘medium’ to ‘medium-high’. This enabled the investor’s team—who had developed a robust understanding of the various choices through the process—to reach an informed decision.

- Focusing on rising rates with yield curve scenario analysis. This investor was particularly concerned about the impact of rising rates on their current portfolio. To assess likely performance during different interest rate environments, bfinance filtered for specific yield curve scenarios among the full set of 2,000 scenarios generated by the model. These include parallel shifts, steepening and inverted yield curves. Although a parallel upward shift would produce the worst scenario for the candidate portfolios, the loss is limited due to short duration positioning.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)