- Saudi Arabian Endowment Fund

- 2021

- Multi-asset

- SAR 8.0 billion

- Global

- Maintain real value after distributions

- Strategic Asset Allocation

Our specialist says:

Our goal, from the outset, was to work closely with the client in exploring, clarifying and testing a new investment policy statement to help build a strong foundation for all of the consultative and modelling work that followed. Having agreed the defining terms of the new policy statement—and working from first principles—we then took an iterative approach to developing a detailed strategic asset allocation solution that met the client’s specific requirements. The final stage of work, which involved marrying this vision of a redesigned Shariah-compliant investment portfolio with an achievable deployment plan, gave the client a practical road map to use in carrying out that transformation.

Engagement at a glance

A Saudi Arabian endowment sought to revamp its investment policy statement to reflect its evolving financial goals—and then develop a Shariah-compliant strategic asset allocation (SAA), accompanied by a multi-year deployment plan, to initiate the portfolio implementation process.

Indices are not investible and do not represent performance; it is not possible to invest directly in an index.

Client-Specific Concerns

The investor was particularly concerned with adhering to Shariah law and sought to structure the investment policy statement and SAA with sufficient flexibility to allow the internal management team to take advantage of investment opportunities within a defined financial framework. The team sought to keep the portfolio predominantly invested within local markets without accumulating disadvantageous asset exposures or risk overweights due to its geographic focus.

Indices are not investible and do not represent performance; it is not possible to invest directly in an index.

Outcome

- Defining the terms of transformation:As part of its preparatory work with the client, bfinance assessed the existing set-up and governance of the endowment and assisted its management team in defining the fund’s investment objectives and desired constraints; this process led to the clarification and finalisation of a new investment policy statement.

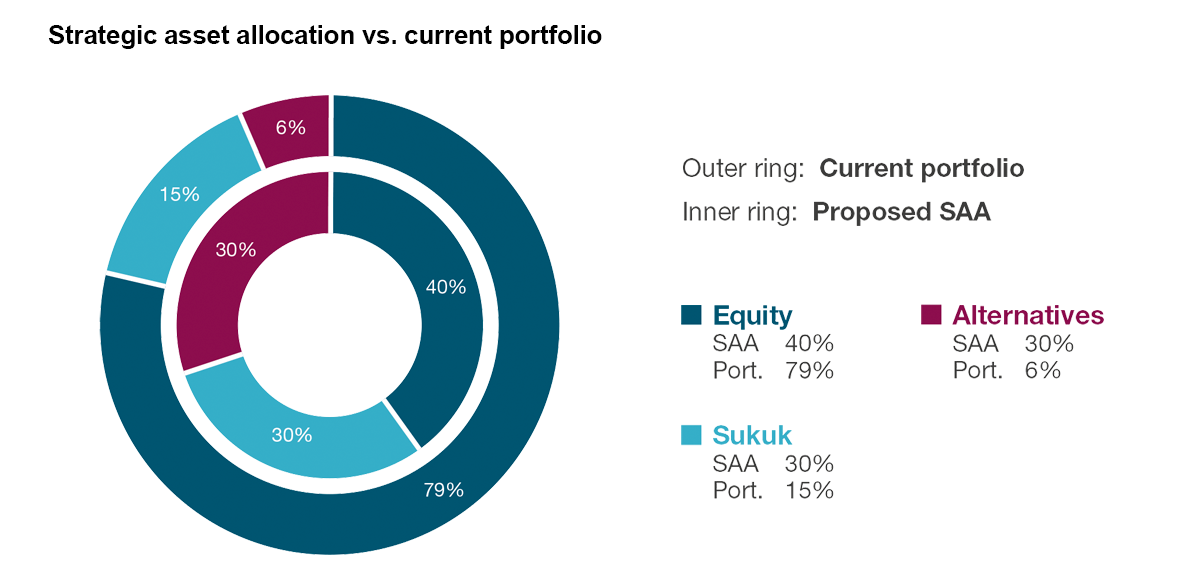

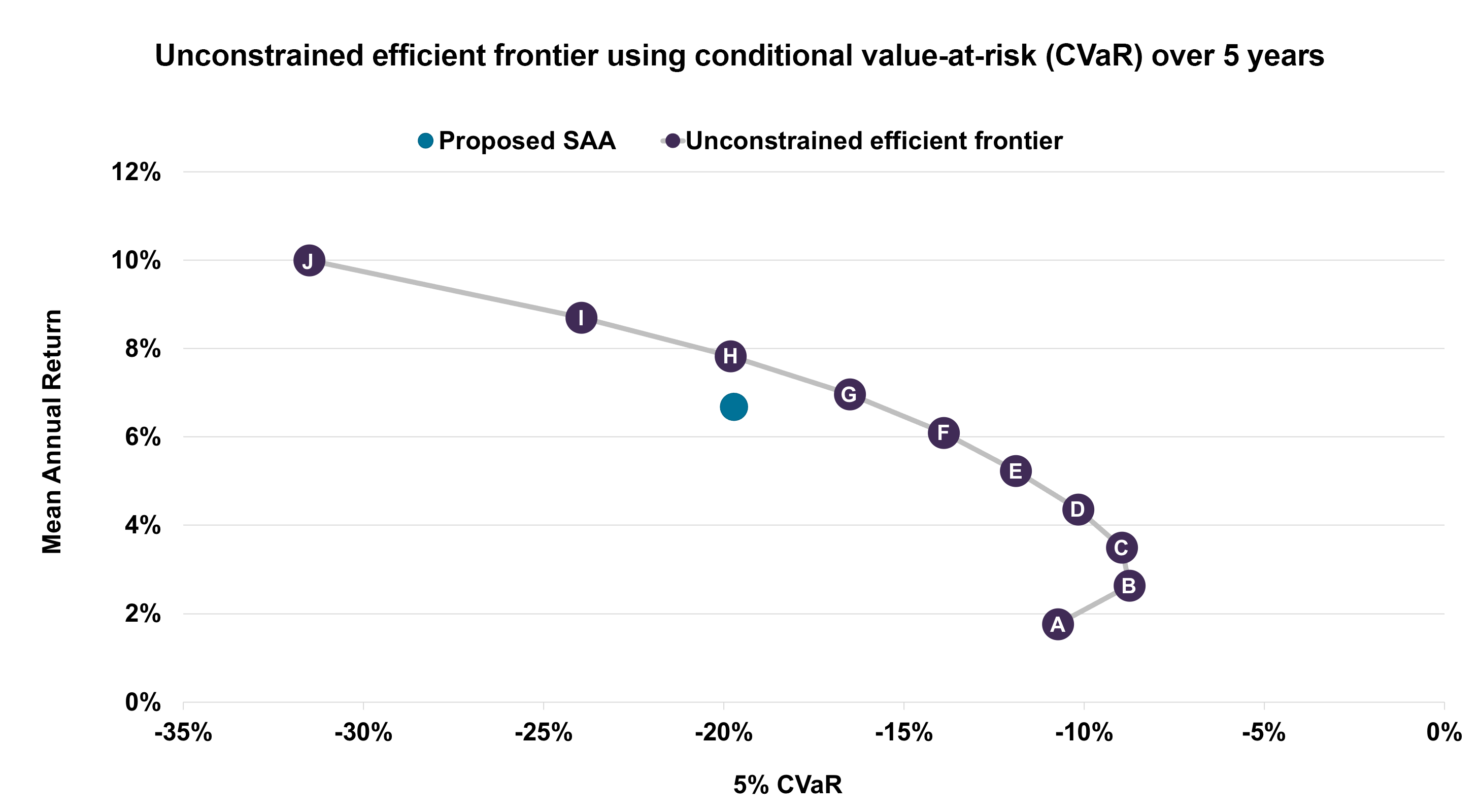

- Mapping the range of available opportunities:bfinance worked closely with the endowment’s team to review the asset classes available under a Shariah investment framework and tested different ways of investing across them to achieve the desired regional focus while maximising returns and preserving capital. With the aid of market-leading software modelling, the final SAA emerged from this iterative process with sub-asset classes identified and suitable allocations defined.

- Stress-testing the proposed SAA:The portfolio redesign was tested and refined by considering the requirements of deploying fresh capital into new sub-asset classes alongside the legacy portfolio holdings; further adjustments were made in consideration of extraneous factors such as changes in contributions to the endowment and the effect of inflation.

- Optimising implementation: bfinance devised a real-time deployment plan in collaboration with the client; the plan set out quarter-by-quarter investment priorities and demarcated a clear path for full implementation—and realisation—of the new SAA.

English (Global)

English (Global)  Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)