IN THIS PAPER

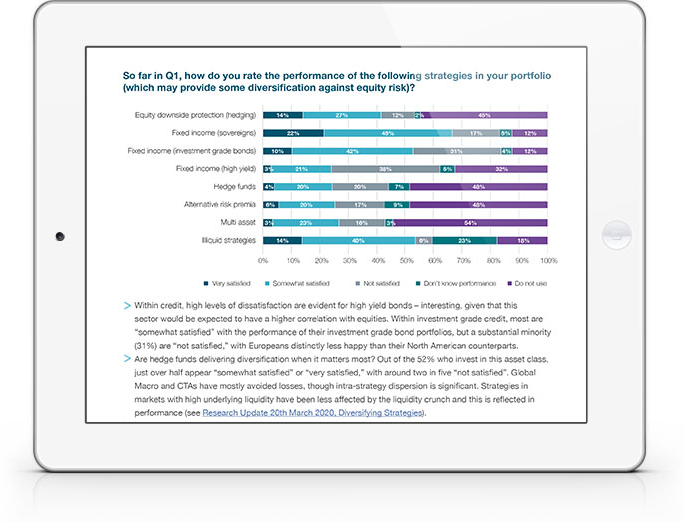

Is diversification delivering? Although the majority of investors are “somewhat” or “very” satisfied with the performance of strategies which should provide some diversification against equity downturns, such as investment grade credit and hedge funds, a significant minority (30-40%) reported being “not satisfied” with results so far.

Were investors protected? Just over half of respondents had some sort of equity downside protection (hedging) in place, and the majority (75%) of those were either “very” or “somewhat” satisfied with how those hedges had delivered.

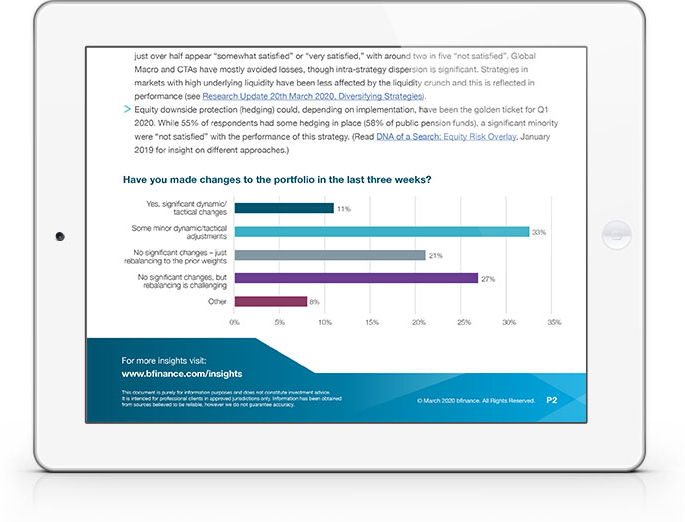

A minority have implemented changes to asset allocation. One in ten investors have made “major dynamic or tactical changes,” one third “minor” changes. The rest are seeking to maintain asset allocation, but many of these are finding rebalancing “challenging.” Going forwards, “liquidity risk” is the major concern – outstripping even downside risk.

Most investors are satisfied with their allocations to private markets, although performance remains the big “known unknown” in portfolios.

WHY DOWNLOAD?

Investors around the world are divided in their reactions to the twin-headed crisis of coronavirus and the oil supply war. While some are evidently satisfied that strategies intended to provide some diversification and protection have done their job amid the market rout, others report disappointment and frustration.

Their views for the mid-term outlook are also split, with “optimists” expecting a faster and more robust recovery evenly balanced against “pessimists” anticipating prolonged recession.

This mini-survey is a precursor to the firm’s biennial Asset Owner Survey, due to be launched later in 2020. Investors: please do contact bfinance if you would like to suggest questions for inclusion in that study.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)