- Canadian Pension Plan

- 2020

- Global equity, long-only and long/short

- CAD 2 billion

- Design a core multi-factor portfolio with an equity market neutral satellite portfolio

- Strategic Portfolio Design

Our specialist says:

Following the design process for the Multi-Factor and Market Neutral Equity portfolio, the engagement focused on setting the appropriate split between the two portfolios. The allocation split between Multi-Factor and Market Neutral Equity is essentially a trade-off between return-generation/growth like behaviour from long-only equity and the more defensive/consistent, but lower returning characteristics offered by Market Neutral Equity.

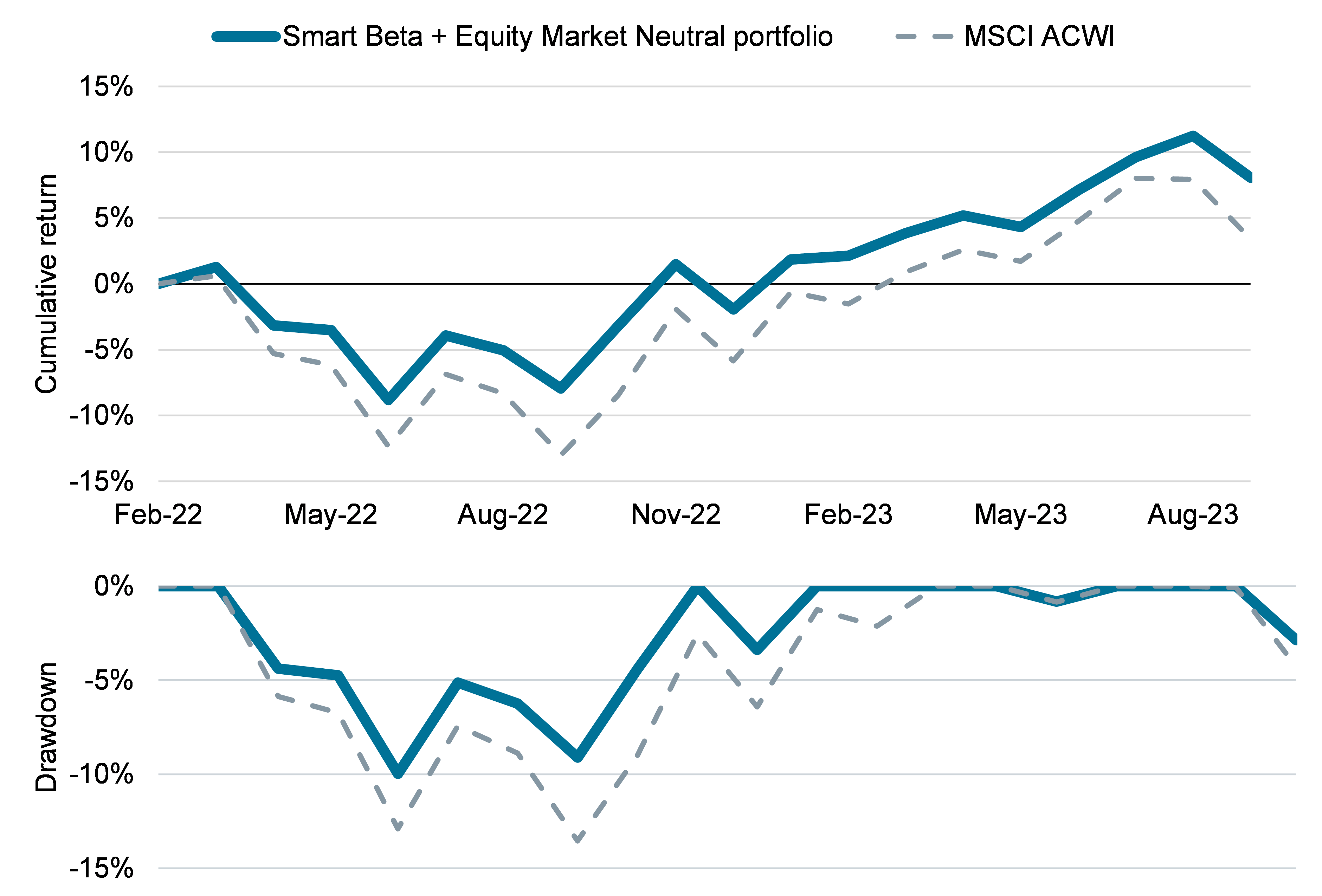

From there, the following stages of the client engagement were manager selection for the various elements. Today, bfinance provides monitoring services to client in which the initial design parameters are used to benchmark portfolio performance versus expectations. Since early 2022, the portfolio has outperformed the MSCI ACWI, with a lower volatility profile and improved drawdowns.

Client-Specific Concerns

The investor, a Canadian pension plan, engaged bfinance to reassess the design of their existing equity portfolio, with the aim to suggest fresh approaches that would be diversified across risk factors and geographies and provide a greater expected consistency to return generation. The objectives of the exercise included improvement of the portfolio’s drawdown and Value-at-Risk characteristics versus conventional global equity benchmarks, and versus the client’s existing equity portfolio. A core portfolio that is focused on harvesting style factor premia was explored including a determination of the factors to be chosen. Key questions were: how to best implement selected factors and what type of a satellite portfolio could demonstrably add manager alpha while complementing the core portfolio?

bfinance supported the client by considering the strategic options available, how best to combine those to meet its investment committee’s ‘philosophical preferences’ and stated investment objectives, and assess implementation options.

Outcome

- Setting the base case: Examining the existing portfolio and conventional global equity indices, risk budget parameters were set for portfolio design: volatility, Value-at-Risk, drawdown and scenario losses such as the October 2008 Lehman Bankruptcy, the Christmas Correction of 2018 and the March 2020 COVID-20 drawdown. Any proposed equity portfolio construct should display improved metrics versus the status quo or passive implementation.

- Implementing multi-factor as the core investment approach: In the realm of actively managed equity strategies, a multi-factor approach that harvests well documented factor premia was preferred, enabling robust return generation over the long-term. Specifically, the case was made for a multi-factor approach, instead of a single-factor approach. Factors perform differently across the market cycle and are hard to time, favouring a diversified approach. Low Volatility and Quality are more defensive factors, while Value, Momentum and Size are more cyclical factors.

- Diversifying within multi-factor: Two prevalent types of multi-factor strategies were considered: Beta = 1 strategies, which aim to maximise the expected returns while taking a similar risk profile to the market, and Beta < 1 strategies, which aim to minimise the risk while achieving a similar return to the index. Analysis showed that an allocation to 4 managers with differentiated multi-factor models brings further portfolio diversification benefit and improves the risk and return profile, ultimately aligning the core portfolio with the client’s risk/return objectives.

- Augment with Market Neutral Equity as the satellite: A smaller satellite portfolio of market neutral hedge fund strategies improves overall portfolio risk characteristics by adding minimally correlated, potentially ‘all-weather’ source of returns, augmenting the portfolio’s risk/return profile to be aligned with the client’s stated investment objectives.

- Offering substantial diversification benefits within Market Neutral Equity: There is clear scope for strategy as well as manager diversification within Market Neutral Equity strategies by considering allocations to strategies such as Statistical Arbitrage, Quantitative, Fundamental, Pairs Trading and Event Driven. Based on bfinance manager composite data, the average long-term pairwise correlation of Low Net/Market Neutral Equity hedge funds is 0.15. Portfolio level risk-adjusted return figures can be improved by allocating to multiple managers / strategies over a single allocation in order to benefit from effects of diversification; a portfolio of 5 long/short equity managers was found to be optimal at this stage.

Indices are not investible and do not represent performance; it is not possible to invest directly in an index.

English (Global)

English (Global)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)