IN THIS PAPER

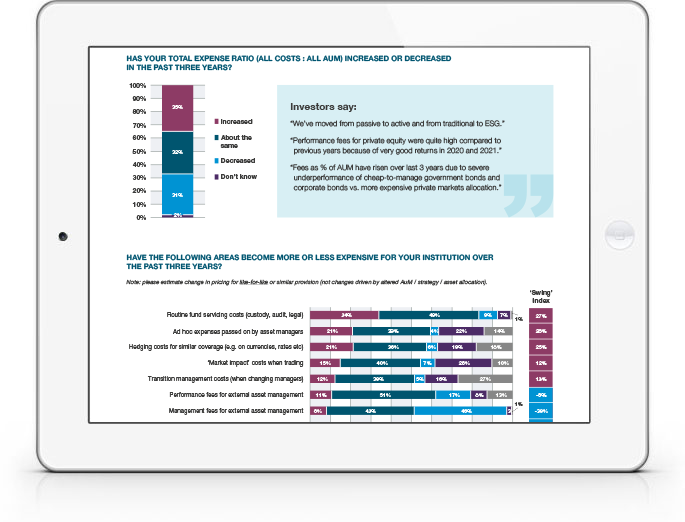

Are like-for-like expenses rising or falling? Some 34% of investors say that fund servicing costs have increased in the past three years (10% decrease), while nearly one in four say that ad hoc expenses from their asset managers have risen (4% decrease). Although 46% say management fees have declined, many pointed to pressure points including ESG reporting. [See pages 2-3]

Are costs (a) transparent and (b) comparable? Nearly half of investors are dissatisfied with the level of “comparability” of manager performance fees, market impact costs and ad hoc expenses; 37% are dissatisfied with the comparability of management fees. Significant “don’t know” responses indicate a potential need for improved clarity and communication on this subject. [See page 4]

Asset class-specific challenges: 65% of investors are broadly satisfied with both the transparency and comparability of costs in fixed income, versus just 16% in private markets and 18% in liquid alternatives. [See page 5]

WHY DOWNLOAD?

For over a decade following the ‘GFC’, investors benefited from cost-compressing factors including low interest rates, downward pressure on asset management fees in several asset classes and improved (albeit still very imperfect) cost transparency facilitated by regulation, industry initiatives and more. Such savings helped—in part—to offset the cost of a widespread shift towards non-traditional investment strategies.

Now, as shown in this investor survey, the dynamics are changing and significant cost-additive pressures have emerged. While asset managers often find it hard to implement material increases in flat fees for institutional clients, rises can take many forms, including additional (non-fee) costs and more performance-based fee structures. Some other providers, such as those involved in custody and audit, can find it somewhat more straightforward to implement price hikes.

Even where underlying costs should be falling, such as trading with improved automation, those savings are not always being passed on to clients and other transaction-related expenses— such as ‘market impact’ cost—remain often-unseen. Indeed, the findings of this poll show that challenges of non-transparency and non-comparability remain widespread across many cost components and asset classes.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)