Infographic

IN THIS PAPER

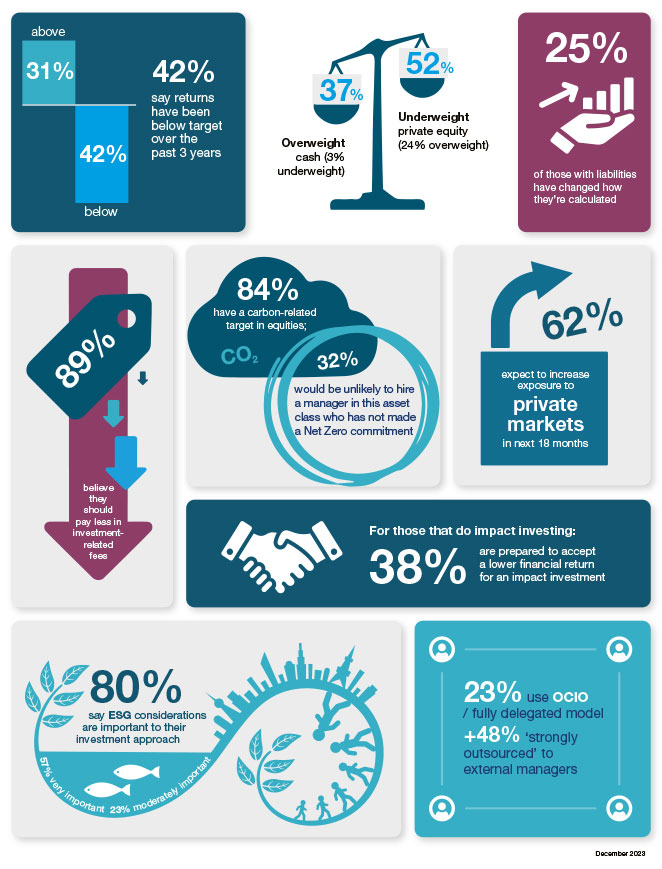

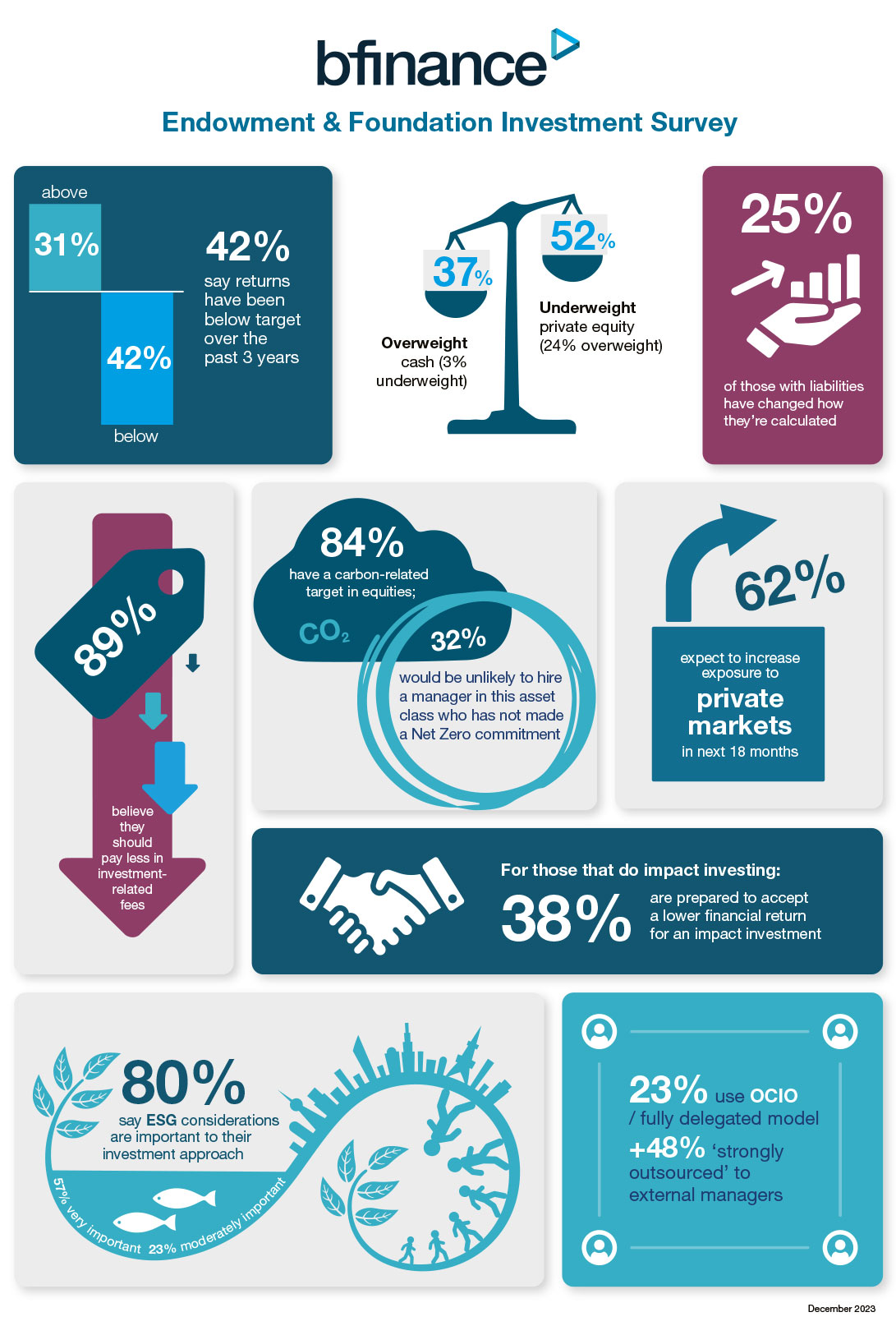

Investment challenges. Inflation bites as 42% indicate that their returns have fallen short of (mostly CPI-linked) targets over the past three years. A quarter of investors have recently changed how liabilities/spending commitments are calculated as they seek to refine and update their approaches. A slowdown in private market investment activity has left 52% of respondents underweight private equity (and 37% overweight cash), but most expect illiquid investment exposure to increase in the next 18 months.

Investment operating model. The ‘OCIO’ trend is strongly in evidence, while an additional 48% describe their model as ‘strongly outsourced’ (heavy use of external asset managers). But 90% of the group believe they “should be paying less” in investment related fees and only 10% strongly agree that the current approach to benchmarking external managers’ fees/costs is satisfactory. Investors expressed frustration with active manager performance in multi asset (63% of users dissatisfied) and equities (>40% of users dissatisfied).

'Investing for good.' A very strong 80% of investors in the study describe ESG considerations as being important to their investment strategy and implementation (57% “very important”). Yet a closer look at practices, asset classes and external manager selection criteria reveals a more nuanced story. While 80% have a carbon-related target for equity portfolios, only 50% would be “unlikely to hire” an external equity manager who cannot report on carbon/GHG data. The popularity of impact investing—particularly in private markets—is revealed.

WHY DOWNLOAD?

Endowments, foundations and charitable organisations have long been recognised for their remarkable capacity to drive innovation. Yet the post-pandemic era of high inflation and market volatility has brought new pressures for the ‘non-profit’ asset owner community.

With fewer regulatory boundaries and (often) less constraining liability profiles than many pension funds and insurers, endowments and foundations have repeatedly led the way on key industry trends. Illiquid investment by US and Canadian university endowments represents perhaps one of the most well-noted examples of this effect. More recently, non-profit asset owners have taken the lead in areas such as impact and climate investing. Yet the post-pandemic era has brought particular challenges. Most endowments and foundations have return targets linked with inflation metrics (see page 5), which have surged. Meanwhile, higher interest rates have not benefitted this community as strongly as they have favoured many other asset owners: for defined benefit pension schemes, for example, higher ‘discount rates’ have resulted in many schemes becoming far more well-funded.

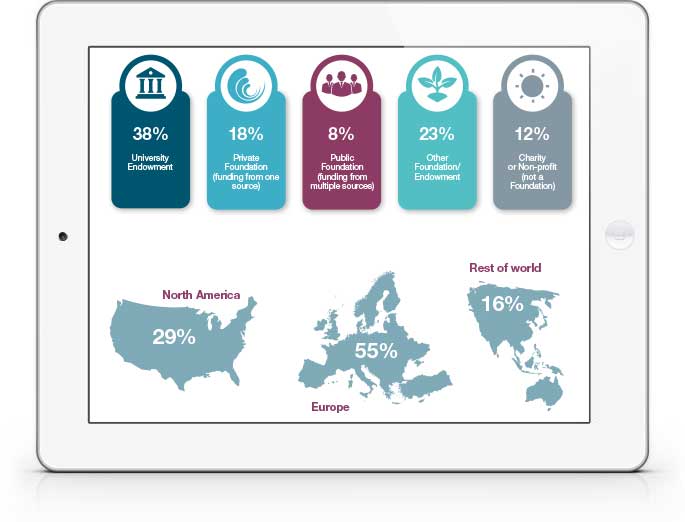

In October 2023, sixty-one senior endowment, foundation and charity personnel from sixteen countries shared insights and data for this inaugural report. Though non-profit asset owners represent a substantial cohort within bfinance’s long-standing Asset Owner Survey series, this study was intended to address notable sector-specific considerations.

We hope that this report proves helpful to non-profit asset owners and the ecosystem of managers and service providers that support them. If you would like to find out more about participating in bfinance Asset Owner Research, please contact the team directly at

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)