IN THIS PAPER

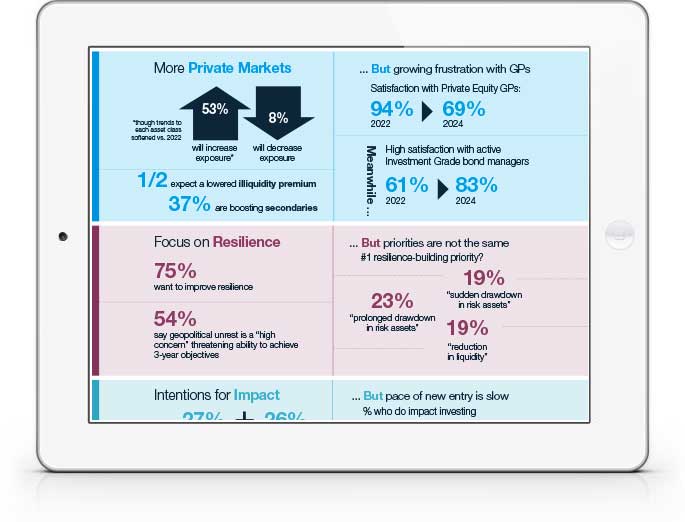

Growing frustration with GPs. Private equity satisfaction tumbled significantly in our latest Global Asset Owner Survey, with just 69% of investors claiming to be satisfied. In 2022, however, this figure stood at 94%.

Focus on resilience. Around three-quarters of investors said they want to improve their portfolio’s resilience, as 54% claim that geopolitical unrest is a “high concern” threatening their ability to achieve their three-year objectives.

The impact imperative. While 27% of investors are already active in the impact investing space, the pace of entry is slow, with this figure rising by just 2% in two years. However, a further 26% said they plan to start in the next twelve months, and almost a quarter of investors claimed they will increase their exposure to impact strategies.

WHY DOWNLOAD?

Investors continue to tackle turbulent market conditions as a result of the events that have taken place in recent years, with post-2022 recovery topping the agenda for many. Only 62% of investors say that their institutions’ investment performance met or exceeded long-term return objectives (or equivalent) through the rollercoaster of 2022-2023. In 2024, the figure is estimated to be 88%.

Looking ahead, it remains clear that portfolio resilience and ‘investing for impact’ are top priorities for investors, as geopolitical unrest, weak macroeconomic growth and inflation remain key concerns. We hope that these findings provide actionable food for thought, both for investors that are navigating through challenging terrain and for the asset managers and other providers who should serve the interests of the asset owner community.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)