IN THIS PAPER

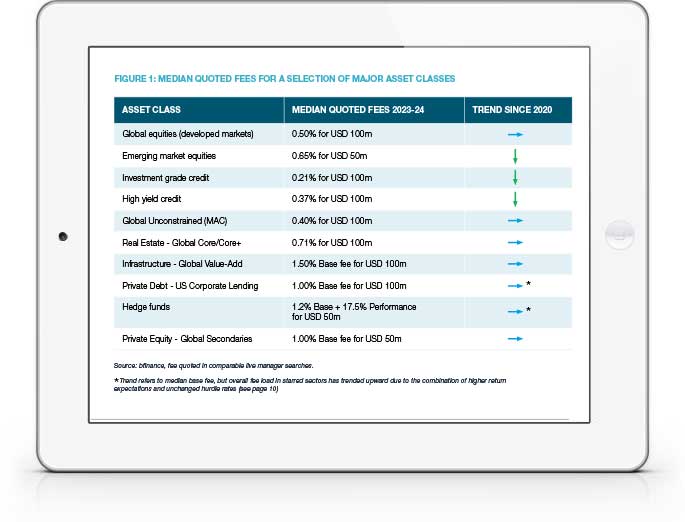

Fees in 2024: a high-level snapshot. Competitive conditions have evolved. In public markets, falling fees are no longer as widespread as they were in the 2010s. In private markets, where fee levels had broadly proved more stubborn, lower-than-expected fundraising may now support a migration to more investor-friendly terms.

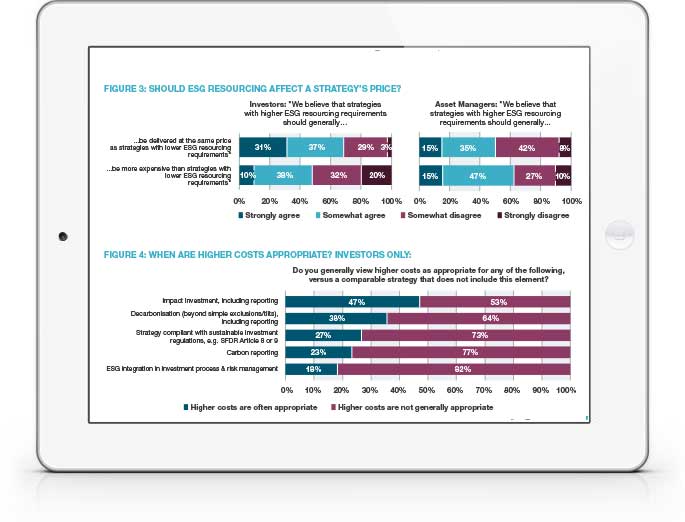

Escalating ESG expenses: Most asset owners believe that ESG resourcing should not affect a strategy’s overall price, but only half of asset managers agree. 9/10 asset managers say their ESG-related spending has “increased materially” in the past three years. Fairness revisited: how should the burden of these costs be shared between investors of various profiles and managers?

Hurdle rate headache: Hurdle rates across Hedge Fund and Private Market sectors have largely remained unchanged, even as higher-for-longer risk-free rates have prevailed. While there are signs of change, particularly within Separately Managed Accounts, these have not yet translated into a significant measurable shift in average pooled fund terms. Expected returns are on the rise in several alternative asset classes, producing an increased delta between performance and the hurdle rate; this translates into greater fee leakage, even where the investor may still receive a better net return overall. Is it fair that asset managers receive a larger proportion of overall returns in an altered environment? In 2024, bfinance and others—including a consortium led by the Teacher Retirement System of Texas—have publicly called on Hedge Funds to institute cashbased hurdles.

WHY DOWNLOAD?

As macroeconomic conditions and market circumstances change, investment fees and costs can be re-evaluated productively. Periods of transition can affect alignment of interest between asset managers and asset owners. It can take time and effort to restore a fair division of costs (and thus net returns) between parties.

This edition of the bfinance Investment Management Fees series focuses on three key themes that may merit careful examination in the current climate, in addition to providing high-level fee data for a broad range of asset classes.

The report also contains the first published results of the bfinance 2024 ESG Costs in Asset Management survey, featuring data from 659 senior Asset Owners and Asset Managers representing well over US$50 trillion in assets.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)