IN THIS PAPER

Real estate manager performance dispersion at a glance. Although US real estate fund managers have outperformed international counterparts, dispersion was higher in this market, while Europe and Asia show tighter ‘clustering’ of fund returns. The effects of sector exposures, fund sizes and the timing/volume of flows varied across regions: large size, for example, only appears to have detracted from returns in the US (home of the ‘mega fund’).

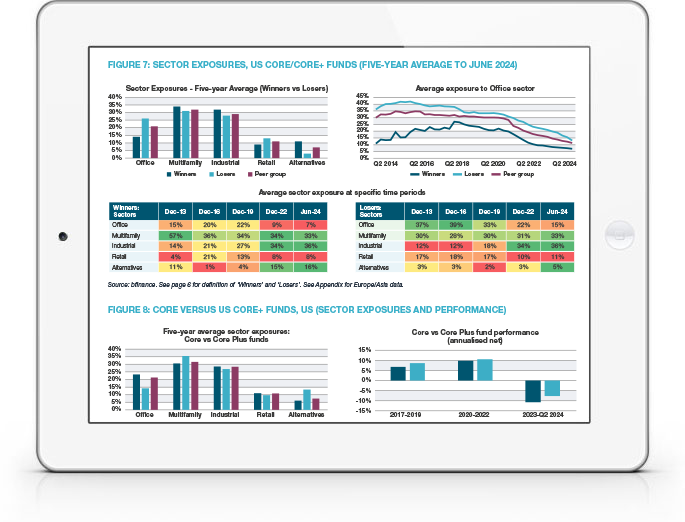

Sector positioning overtook property-specific selection as the key driver of relative returns. An analysis of ‘winners’ and ‘losers’ provides evidence that asset managers have generated alpha through tactical shifts in exposures to sectors and regions, such as 2018-19 reductions in ‘office’ and cuts to German positions in 2021- 2022. Yet the prevalence of open-end funds means that successful repositioning is somewhat dependent on flows of investor capital.

Lessons for portfolio positioning, strategy choice and manager selection: Investors can draw on new lessons when evaluating various real estate strategies and considering whether to reposition or adjust the approach to manager selection. Access to ‘alternative’ or ‘next generation’ real estate—via generalist private funds, specialist private funds or REITs—is a key topic of current discussion.

WHY DOWNLOAD?

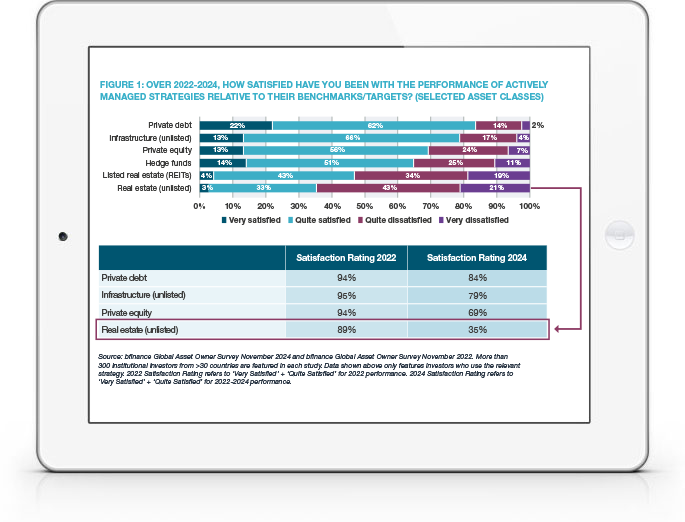

A challenging period for real estate investment has produced very low levels of investor satisfaction with their fund managers. The latest biennial bfinance Global Asset Owner Survey illustrates a dramatic shift of sentiment, with nearly two thirds now reporting being “dissatisfied” with the performance of their unlisted real estate managers relative to their benchmarks or targets – up from just 11% in late 2022.

In this report, we examine managers’ results in unlisted core/core+ real estate, focusing on the factors driving dispersion between higher and lower performers. Sector exposures, geographies, fund size, fundraising timelines, use of leverage and other potential drivers are all considered. While the degree of exposure to the office sector was a key differentiator, particularly in the US, other factors— such as size and the timing of fundraising—were highly influential as well.

A phase of weak returns can provoke questions around strategy, portfolio positioning and manager selection. Investors may wonder: should exposure to various real estate strategies be re-evaluated? Is it worth introducing allocations to specialist strategies in ‘next generation’ or ‘alternative’ real estate? What factors should be given greater consideration during manager appointments? We hope that this report provides food for thought for investors who are evaluating real estate portfolio strategy now.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)