bfinance insight from:

Peter Hobbs

Managing Director, Head of Private Markets

The property market correction of 2023-24 marks the fourth significant dislocation in this asset class since 1970. Each prior instance—the early 1970s, the oversupply of the 1980s/early 1990s and the ‘GFC’—ultimately provided exceptional opportunities for investment in recovering markets. Yet a promising vintage does not guarantee strong performance: periods of ‘recovery’ also present particular pitfalls.

Real estate managers have urged investors to increase their exposure, emphasising the chance to “acquire assets at attractive prices” in today’s “fragmented market”1. While fundraising has remained sluggish—with capital raising for closed-end real estate funds in 2023 at its lowest level since 2011 and the US$66 billion raised in Q1-Q2 2024 representing the lowest first half for a decade (Preqin)—we are now seeing more and more activity from asset owners who are considering when and how to increase exposures with opportunities in mind.

Recovery and red flags

Investors should keep a watchful eye on potential pitfalls in a resurgent market. The challenges vary across different sectors, strategy types and regions. Moreover, even within each area, some asset managers will be more vulnerable than their peers. Corporate and team-level risks increase during periods of stress: decreased profitability has driven cost-cutting and re-prioritisation, which in turn affects the resilience and integrity of platforms. Even the best investment team with an excellent strategy can be affected.

Below we consider four key strategy groups and three key issues to watch out for in each area as investors seek to exploit the evident opportunities.

Core Real Estate

- How resilient is the strategy to a weak fundraising climate? Capital raising challenges may continue over the medium term and investors should consider the implications for the viability of commingled funds. Not all managers and strategies are equally likely to experience fundraising disappointment or be similarly vulnerable to the implications of smaller raises if they occur. Structural factors may continue to inhibit fundraising (corporate pension plan derisking is still underway in certain countries, for example), notwithstanding the industry’s sometimes-troubled efforts to bring more retail/wealth investors into the asset class.

- Are there ongoing redemptions? Investors may still encounter sizeable redemption queues in open-ended funds, raising questions about how new capital would be deployed alongside the need to provide liquidity to outgoing LPs. Funds without ongoing redemption pressure should also be scrutinised on how they managed liquidity for investors through 2022-24, both in terms of redemption payment mechanics and overall strategy.

- What are the benefits of diversification versus sector concentration? While it may be tempting to favour managers with stronger exposure to sectors that proved more resilient in the latest drawdown, such as ‘next generation’ real estate (self storage, data centres, medical offices, et cetera), investors should weigh this against the long-term merits of diversification. Some of these next-generation sectors remain relatively expensive, such as self-storage, or are exposed to high levels of new supply.

Value-add Real Estate

- What about assets already in the fund (and in prior funds run by the same manager)? It can take two-to-four years to go through a capital raising and investment period. Funds currently in their later stages of capital raising likely did their initial raise in 2022/23 and started deploying at that time (when valuations were higher). Investors should carefully consider the performance profile of any assets already acquired and the amount of dry powder remaining. Managers’ earlier funds may also require significant attention, particularly if they are dealing with delays and write-downs associated with the current downturn. Will key personnel be distracted by the workload of managing legacy exposures?

- What impact may higher costs and the ESG issues have on the strategy? Inflation has led to higher development costs. Investors should pay particular attention to ESG considerations: climate-related requirements are increasing, and refurbishment costs remain elevated. Does the manager have substantial experience in this area, and can they manage the associated risks effectively?

- How is the manager developing their operating partner relationships? As managers become more involved in ‘next generation’ real estate sectors, projects become more complex than traditional property. Relationships with operating partners are changing and managers must have the expertise to keep pace.

Real Estate Debt

- Is the manager/strategy resilient in a weak fundraising climate? There has been some disappointment here, with Preqin data showing that real estate debt capital raising in 2023 was less than $5 billion. Some funds may fail to reach ‘critical mass’ for executing their strategy with appropriate diversification. A decline in interest rates may further affect the attractiveness of this asset class.

- How will changing competitive conditions affect the strategy? The return of banks to real estate debt lending, which had been stymied, may drive yield compression in this sector. Asset managers might need to focus on more complex origination (mezzanine, A/B notes, distress, etc.) rather than banking-friendly parts of the market. Dynamics will differ between North America and Europe (the latter being more nascent).

- Will corporate instability be a problem? As mentioned earlier, corporate and team stability is crucial during dislocation and recovery periods. The real estate debt asset class has undergone a particularly high level of corporate activity over the past five years: many managers have built debt capabilities through acquiring boutique operators and integrating them with their equity businesses or broader credit platforms. This made sense long-term but may be re-evaluated under immediate pressures.

REITs

- Does the manager have appropriate scale, especially amid a ‘trend to passive’? REIT platforms face added pressure from the trend towards passive investing. Despite evidence of alpha generation by active managers, passive REIT strategies have grown steadily. This trend, coupled with weak performance since 2020, has made it challenging for asset managers to grow and appropriately resource their REIT platforms. Investors should focus on scale and robustness.

- How should we assess managers with low performance persistence? While active REIT managers show strong alpha generation as a group, there is little persistence among top performers. Investors should be cautious about favouring managers with strong recent numbers and closely examine the risks associated with particular performance levels through metrics such as tracking error, upside/downside capture, information ratio, and batting average.

- Are new ESG/climate products viable? The REIT sector has seen significant product development focused on ESG, climate, and ‘net zero’. Investors should scrutinise these carefully, as they can narrow the investment universe and carved-out ‘track records’ may not be representative.

Learning from the past

Each major real estate downturn follows a similar pattern: weak performance (down 20-30% in most markets), plummeting transaction activity (50% down on the prior year in 2023), high levels of redemption activity (many open-end funds with 20%+ redemption levels), and fundraising challenges.

However, not all crises or recoveries are identical. The 2023-24 correction has its unique characteristics. For example, it was narrowly preceded by a significant pandemic-driven slump. Today’s interest rate and inflation environments differ markedly from those post-2009. The current correction shows significantly greater variation in performance across different property sectors compared to 2007-09: offices are particularly out of favour, whereas sectors like Medical Offices and Data Centres are thriving. Additionally, this cycle has a greater focus on ESG considerations, especially climate risk mitigation, which brings both costs and ‘stranded asset’ risks.

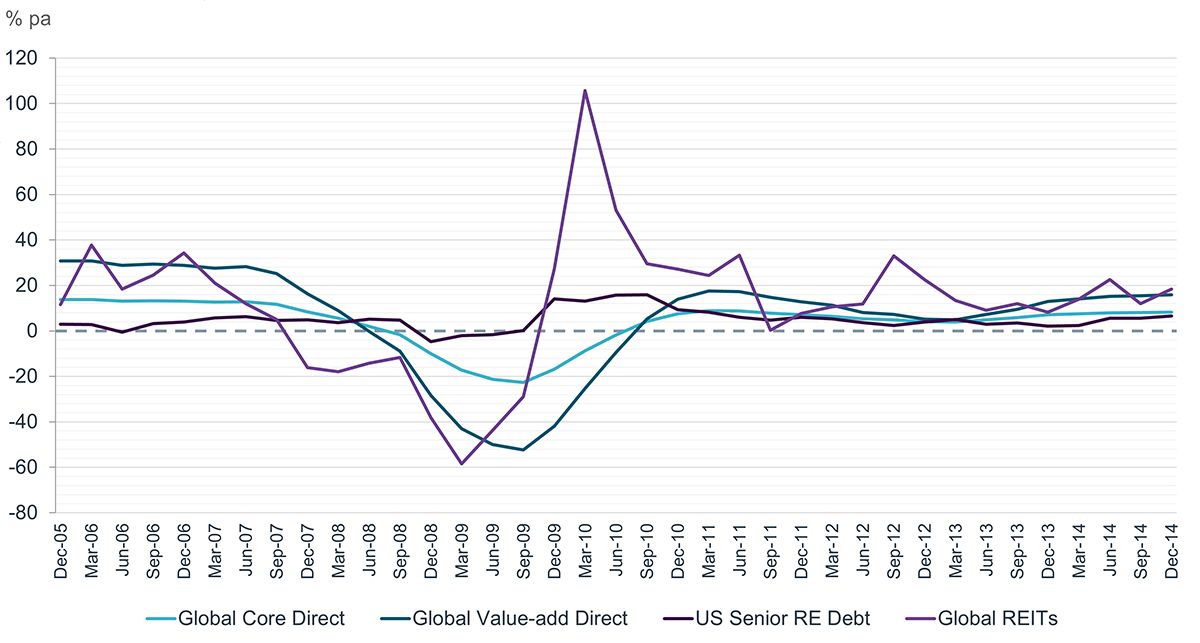

Despite these differences, real estate cycles do show some similar patterns. It is worth examining the most recent (GFC) downturn to gain insights into how the market might move through the later stages of the current cycle. The chart and table below illustrate the performance of the four major real estate strategy types during the Global Financial Crisis of 2007-09: Core Direct, Value-add Direct, REITs, and Real Estate Debt.

Figure 1: Performance of real estate asset classes during the ‘GFC’

Source: bfinance. Estimated returns based on various sources, adjusted to reflect typical base management fees in this asset class. Global Direct data derived from ANREV/INREV/NCREIF Fund Series, with 'Core' based on GREFI (Global Real Estate Open End Fund Index) and 'Value-add' derived from Core series adjusted for typical leverage levels. US Senior Debt data derived from Giliberto Levy Commercial Mortgage Performance Index Series. Global REITs data from EPRA/FTSE/NAREIT index. These return series do not reflect real-life net of fee performance for investors and are not indicative of future performance.

This showcases a pattern of high volatility in REITs, resilience in Debt, and Value-add outperforming or underperforming Core at different points in the cycle. The chart also illustrates the large Direct and REIT drawdowns during the GFC and the strong bounce back afterwards, with the REIT market moving ahead of the direct market (posting positive performance a full three quarters ahead of the direct market).

The current cycle presents a similar picture in many respects. Real estate debt is delivering healthy yields; even though 2024 base rates are higher than those of 2008, margins remain broadly attractive. REITs, which have endured very poor recent results, may benefit more quickly from potential rate reductions, while the recovery in Core may be later and slower, likely beginning gradually in 2025 and beyond.

Beyond strategy: choosing the right implementation approach

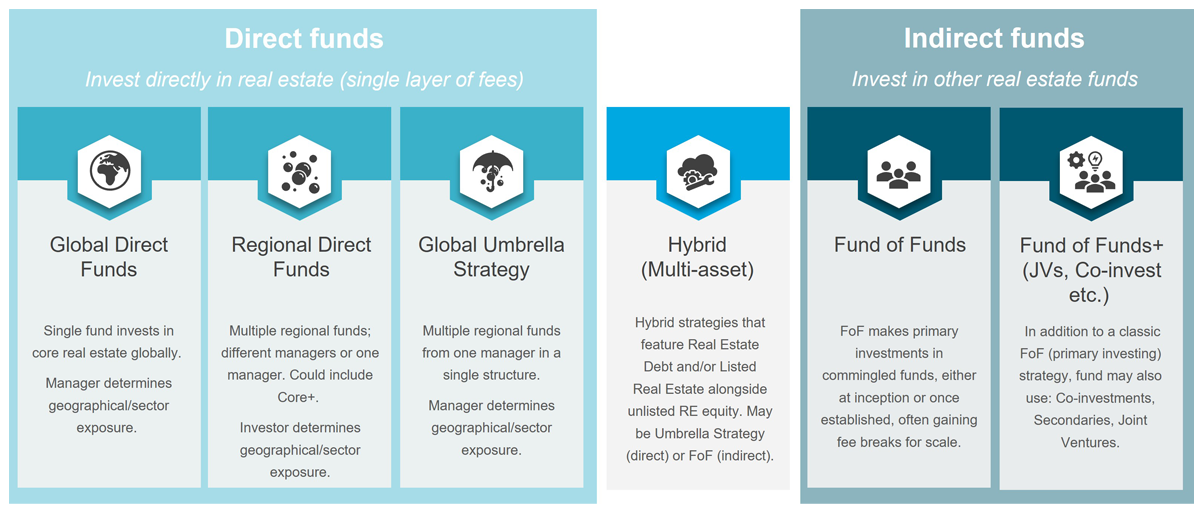

At this critical stage of the cycle, in addition to considering strategy-oriented points, investors may wish to re-evaluate the types of vehicles being used. Are current conditions more suitable for a separately managed account versus a commingled fund? Does the outsourcing element of fund-of-fund investment hold greater appeal compared to single manager funds? Are secondary strategies more appealing now?

There is a vast array of choices available to investors. The snapshot below illustrates the variety available in Global Core real estate commingled funds.

Figure 2: Global Core Real Estate: Implementation Options

Source: bfinance

Conclusion

If history repeats itself, now may be an opportune time for investors to raise exposure to the real estate market. However, not all strategies and managers perform well during a good vintage. Investors must tread carefully when navigating a recovering market and conduct rigorous due diligence when assessing investment managers.

1Patrizia: Real estate market dislocation looms but opportunities remain for investors, 14th February 2023

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)