IN THIS PAPER

Measuring intent versus reality

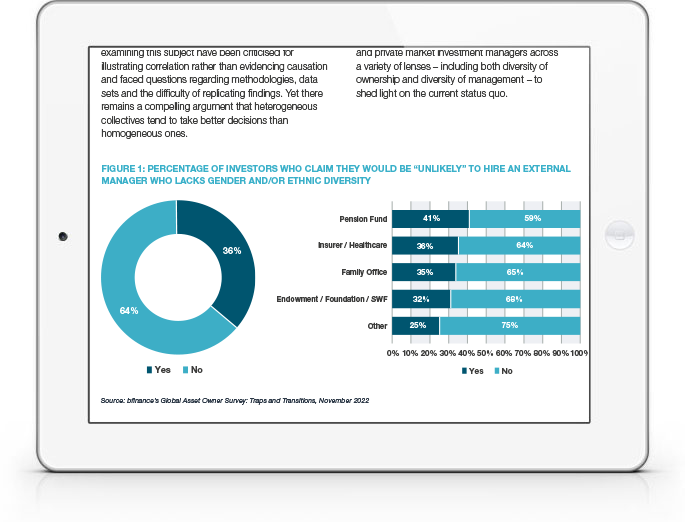

Diversity: a manager selection priority? Various bfinance asset owner surveys over the years have suggested that a sizeable minority of investors, across all segments, expect diversity from the firms on their external asset management roster. However, intentions and actions are not always aligned.

Public and private market snapshots: bfinance data reveals that private market managers are more likely than public market managers to have DEI considerations addressed at policy level. Yet there are additional factors at play, with UK-based asset managers significantly more likely to have a DEI policy in place than their global peers.

In search of best practice: Looking beyond firm-level questions and focusing on strategy-level activity, investors can consider the specific investment team’s composition, or even go further and scrutinise how DEI considerations are addressed in portfolio holdings themselves: does the manager assess the diversity of the firms in which they invest, and is this subject addressed through stewardship efforts?

WHY DOWNLOAD?

This small but growing market has much to offer

As asset owners place greater emphasis on diversity and inclusion in investment management, this intent does not always translate seamlessly into manager selection practices. Throughout the 2020s, a substantial minority of investors in bfinance Asset Owner Surveys (30-40%) have expressed reluctance to appoint external managers lacking gender or ethnic diversity. Yet, when principles meet practice, this priority can wane—particularly across certain asset classes and sectors.

This report investigates the extent to which diversity is prioritised in real-world manager selection. Numerous studies indicate that diversity within teams can offer benefits such as reduced groupthink and improved risk management, although research remains contentious regarding causation. Meanwhile, investment managers recognise that strong DEI initiatives can enhance recruitment, retention, and alignment with client values.

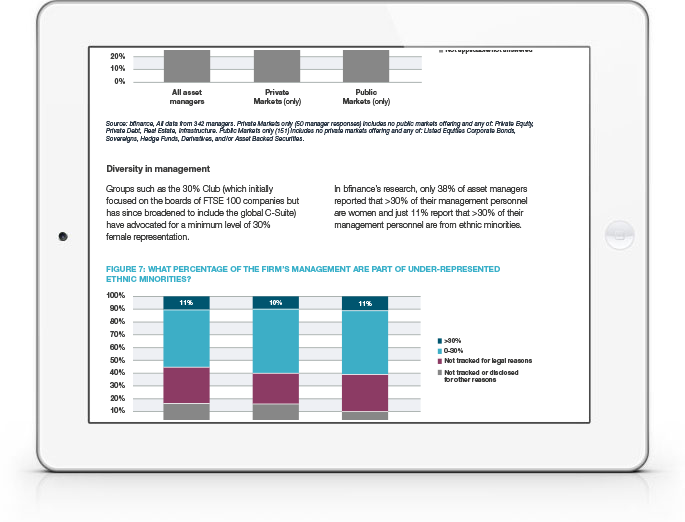

Despite signs of progress, such as greater transparency on gender pay gaps, disparities in diversity—especially at the leadership level—persist. Broader measures of diversity, including socioeconomic background and educational profile, could offer a more nuanced perspective on team dynamics. The following sections examine current diversity data across public and private market fund managers, providing insights into both ownership and management structures to capture the industry’s ongoing efforts and enduring challenges.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)